M&A

M&A

-

Deutsche Bank must be ready for possible acquisitions once consolidation in European banking accelerates, CEO Christian Sewing said, the clearest hint yet that he’s considering deals again halfway through his four-year turnaround program.

May 19 -

American State would be the largest bank buyout for Equity, which has acquired 17 banks since 2003.

May 17 -

Ride-hailing and payments giant Gojek agreed to combine with e-commerce pioneer PT Tokopedia to create the largest internet company in Indonesia, before seeking a stock-market debut at home and in the U.S.

May 17 -

The purchase is one of several moves the payment company has made to improve its identity expertise.

May 14 -

In letters to regulators and lawmakers, bankers and their trade groups argued that deals like Vystar Credit Union's proposed acquisition of a small Georgia bank could result in less community development lending and declines in federal tax receipts.

May 14 -

The deal should allow the prepaid card issuer to expand its footprint in a business it entered seven years ago.

May 14 -

The company partners with merchants to use their fulfillment systems to allow consumers to send back unwanted merchandise.

May 13 -

FinTrust Capital Partners in South Carolina has $2 billion of assets under management.

May 13 -

Princeton Portfolio Strategies Group would become the sixth asset management business that the New Jersey banking company has bought since 2014.

May 13 -

The bank tech firm needs licenses and partners in multiple nations — a monumental task that promises to take years.

May 13 -

The company, which operates private-label and cobranded credit card and loyalty programs, plans to spin off its loyalty operations this year to improve ADS' financial performance.

May 12 -

The Denver company, which has branches in El Paso, will gain more locations in cities such as Dallas and Austin with the pending purchase.

May 12 -

Both credit unions are based in Pittsfield, Massachusetts.

May 11 -

After more than 100 years of mostly in-person operations, the subprime installment lender is seeking to adapt to changing consumer preferences — launching an online loan platform just before the pandemic and recently striking a deal to acquire a financial wellness app.

May 10 -

American Express is trying to differentiate itself from other card networks by making loans through its bank and incorporating accounts payable services and lending technology it inherited with its acquisitions of Acompay and Kabbage.

May 10 -

American Express is trying to differentiate itself from other card networks by making loans through its bank and incorporating accounts payable services and lending technology it inherited with its acquisitions of Acompay and Kabbage.

May 10 -

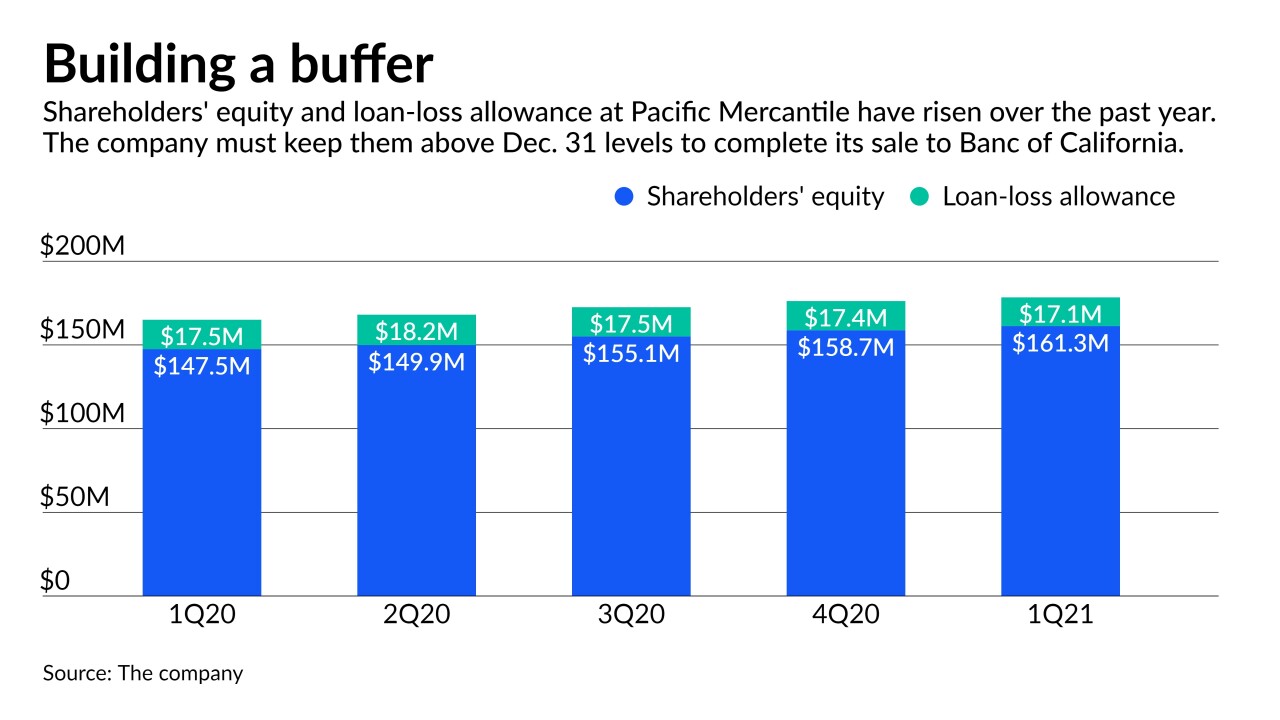

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

National Australia Bank and Australia & New Zealand Banking Group, the country’s third- and fourth-largest lenders by value, are in talks with Citigroup over the assets, according to people familiar with the matter.

May 5 -

The Arkansas company will gain branches around Nashville as part of the acquisition.

May 5 -

The company agreed to pay $104 million for a one-branch bank with $391 million of assets.

May 5