M&A

M&A

-

The deal will help the bank serve small-business customers that are shifting to digital payments.

August 12 -

Three credit unions have announced deals to acquire community banks in the past week. The latest is the Wisconsin-based Royal, which is buying the $441 million-asset Lake Area Bank.

August 12 -

The combination of Orion Federal Credit Union and Financial Federal Bank is the seventh credit union-bank merger announced this year.

August 11 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

August 10 -

The combination of American Express and its fintech subsidiary Kabbage is starting to bear fruit at an opportune time, as credit card companies increasingly expand their range of products to boost revenue.

August 10 -

Ann Arbor Bancorp had agreed to buy FNBH in February 2020 but backed off four months later amid economic uncertainty. The two sides have reunited, though the price tag rose.

August 9 -

The $1.5 billion-asset SAFE FCU in Sumter, South Carolina, is combining with the $3 million-asset Sumter City Credit Union.

August 9 -

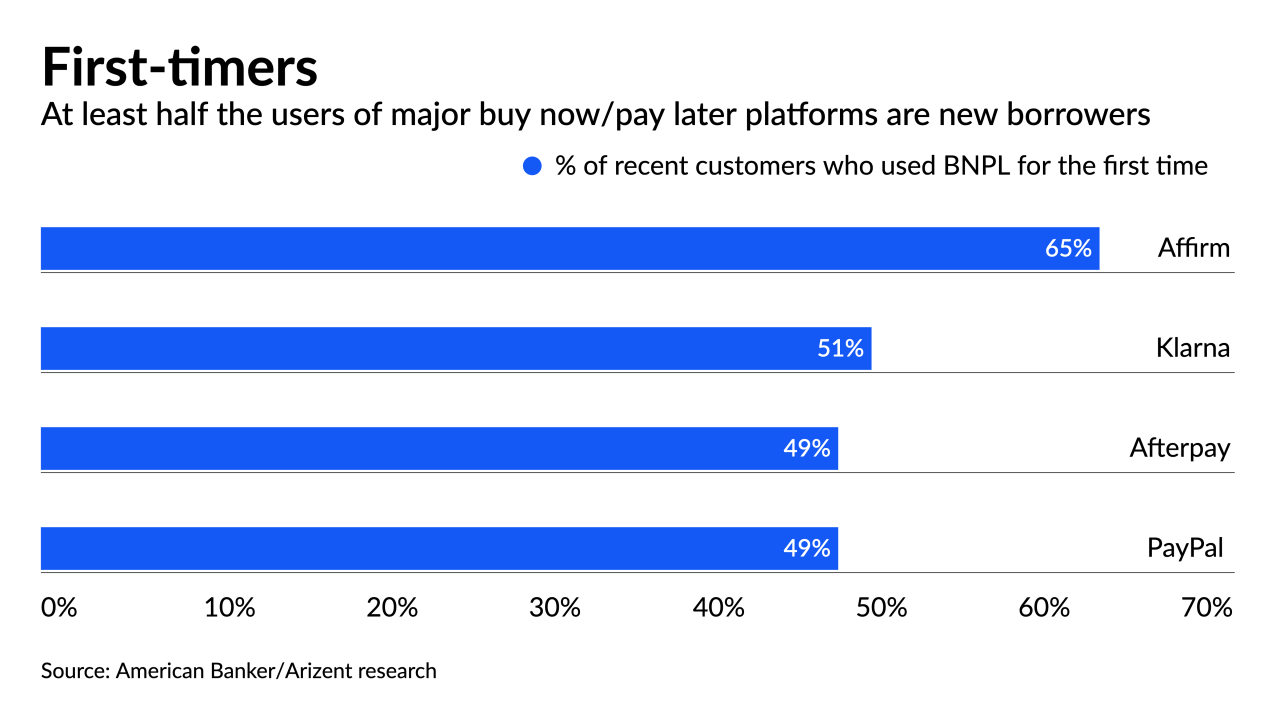

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

The deal would mark a first step in Chief Executive Jane Fraser’s plan to exit 13 retail markets across the Asia-Pacific region, Europe and the Middle East.

August 9 -

Chabot Federal Credit Union is combining with University Credit Union, which was founded on the UCLA campus.

August 6 -

Alabama Credit Union's agreement to buy Security Federal Savings Bank, a small commercial lender, renews lingering questions about whether small banks are prey for tax-advantaged credit unions.

August 5 -

The Rhode Island company has been snapping up banks and nonbanks alike. It says that buying Willamette Management Associates in Oregon will augment its 2017 purchase of Western Reserve Partners.

August 5 -

First United Bank in Oklahoma bought a minority stake in Exencial Wealth Advisors instead of acquiring it outright to give the owners an incentive to stick around and help build the business — and to make it easier for the bank to bail if things don't work out.

August 5 -

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

August 3 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

August 2 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Mutual banks tend to combine only with fellow mutuals. Spencer Savings' deal to acquire a stock-traded rival shows how the pressure to expand is forcing some buyers to get creative.

July 30 -

Two upstate New York credit unions are combining to create an $8 billion-asset institution, continuing a trend of bigger deals driven by a need to match the scale and technological capability of rival banks.

July 29 -

Flagstar’s main business is lending to nonbank mortgage lenders, and New York Community Bancorp CEO Thomas Cangemi has a plan for tapping those borrowers to drive loan and deposit growth.

July 28