-

BankMobile became profitable thanks to its high-volume, low-cost acquisition of student customers. The new CEO's challenge will be holding on to them after they graduate.

March 19 -

The serial entrepreneur has created a challenger bank called One for middle-income people with complicated financial lives.

March 17 -

The U.S. challenger bank and the startup STC Pay aim to create a special blend of banking services for millions of tech-savvy, cash-averse consumers in Saudi Arabia.

March 13 -

The all-digital bank is hoping to win over consumers with above-average savings rates and more detailed analysis of their spending habits.

March 8 -

Some institutions have taken steps to ensure their websites meet accessibility standards, but experts say many credit unions could still be doing more.

March 2 -

-

Observers speculate that Intuit simply wants to enhance revenue and protect its tax software business, but the CEOs of each company say the deal would also give consumers more control of their overall finances.

February 24 -

Intuit has agreed to buy Credit Karma for $7.1 billion. The move is seen as a way for Intuit to get access to more consumer behavior data, generate new sources of income and potentially protect a key business.

February 24 -

Consumer advocates and policymakers are railing against use of the technology by government, universities and others. Banks using it for authentication need to tread cautiously, experts say.

February 18 -

"To wake up one day and assume everyone in America is going to be above average at math and above average rational is crazy," says Ethan Bloch, whose app is designed to help people achieve financial health.

-

It was Varo's second try with the Federal Deposit Insurance Corp., but it has now moved within a few steps of obtaining what has eluded fintech firms of late: a green light from banking regulators.

February 10 -

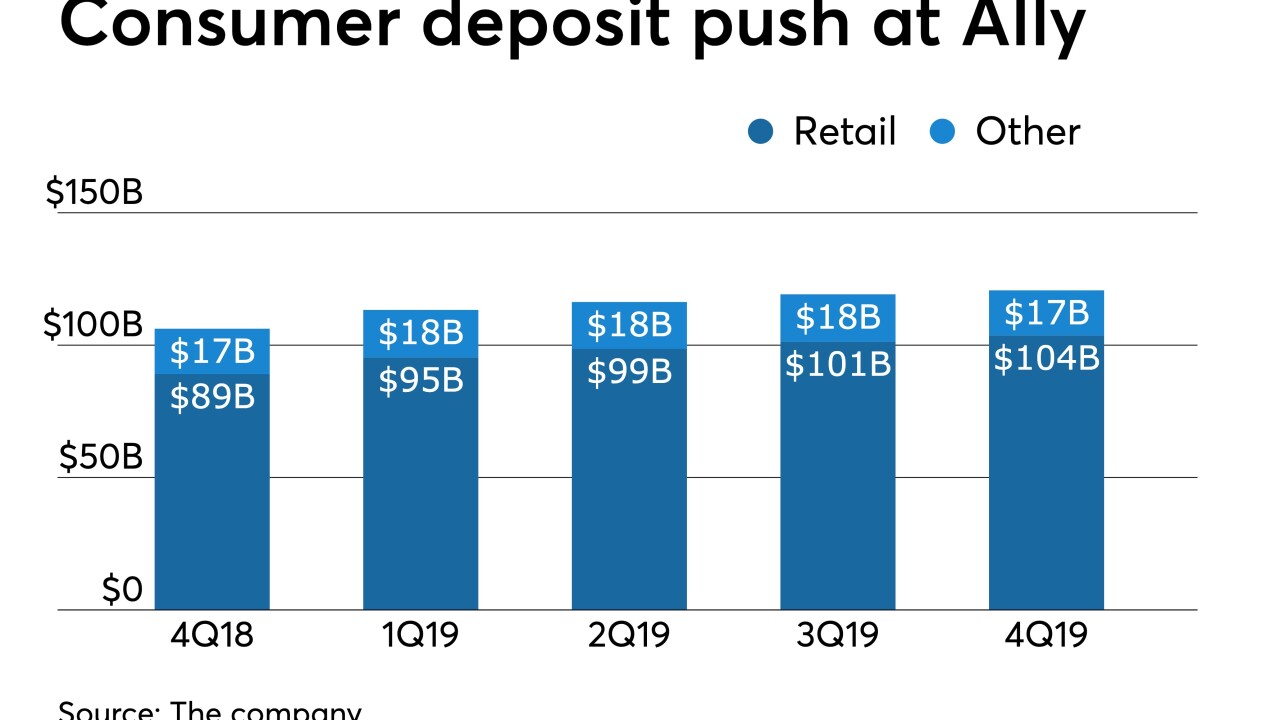

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

A new app will allow small-business clients to quickly apply for credit while expanded offerings for homeowners associations will help CIT build up its base of low-cost deposits.

January 31 -

The startup has added more sophisticated invoicing features, sleeker onboarding and a more detailed dashboard.

January 28 -

Seeking a way to boost Spain's fintech sector, CaixaBank is partnering with global startup Plug and Play to promote collaboration for new banking, payments and insurance services.

January 28 -

Rellevate, a startup founded by former Western Union executive Stewart Stockdale, is forming a digital bank designed for people who make $10 to $25 per hour and live paycheck to paycheck.

January 28 -

Rellevate, founded by Stewart Stockdale, will offer pay advances, fast bill pay payment and international remittances for consumers who live paycheck to paycheck.

January 27 -

The German challenger bank says it has quickly attracted Americans from every state and various demographic groups to its mobile banking app.

January 27 -

The investment bank's new CashPlus Account comes with a mobile banking app, a debit card, online bill payment and other banklike features.

January 23 -

The financial wellness fintech focused initially on building an app that helped people understand their financial picture, CEO Jon Schlossberg says.

January 23