-

Nearly 70% of U.S. adults between the ages of 26 and 40 said their earnings had been negatively affected by the outbreak, about 10 percentage points higher than other age groups.

April 30 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

The lenders are bracing for spikes in delinquencies or defaults on loans to a sector heavily punished by social distancing measures.

April 29 -

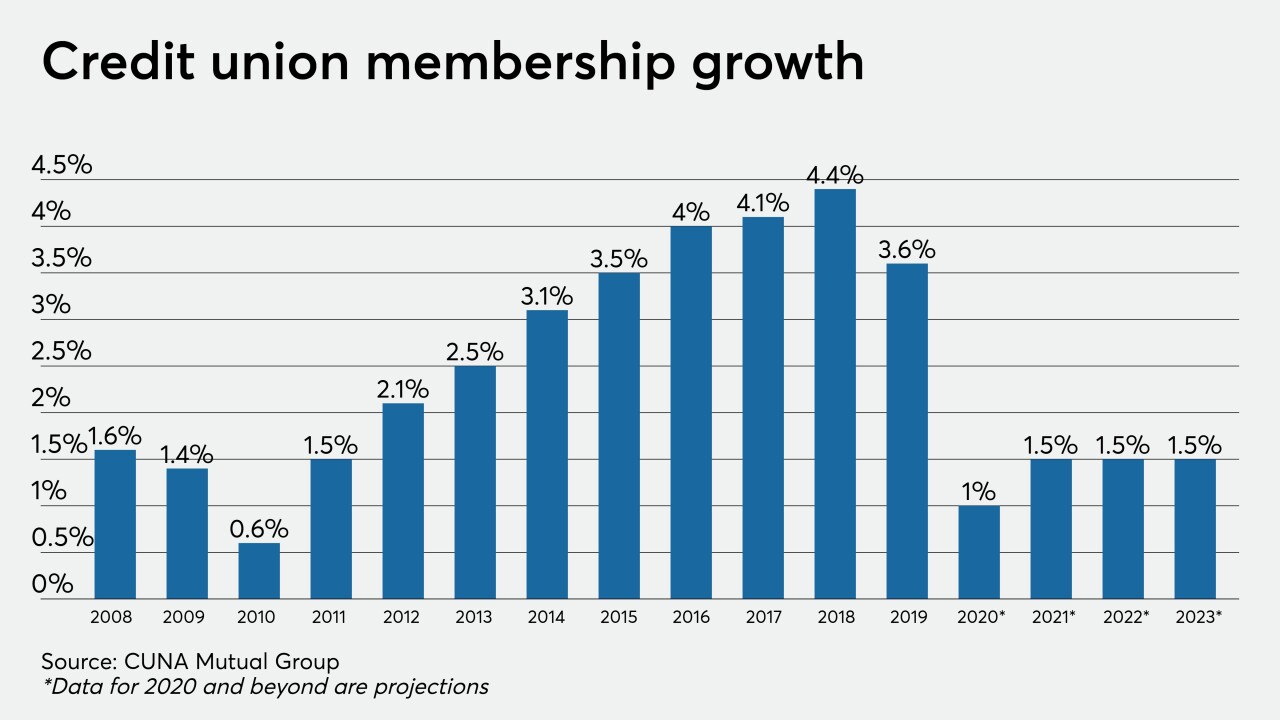

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

The FHFA's director said the announcement is meant to “combat ongoing misinformation” about efforts to let homeowners skip mortgage payments due to the coronavirus pandemic.

April 27 -

Lenders and small businesses are hoping this round goes more smoothly than the chaotic first one (and if it doesn't, Joe Biden warns, many mom-and-pop shops are done for); originators are adding staff, cutting marketing to handle massive uptick in refinance applications.

April 27 -

The bureau said it began developing the standards before the coronavirus pandemic. But more transfers may occur as some servicers struggle to meet their obligations during the economic downturn.

April 24 -

The former CEO at The Federal Savings Bank, who faces a bribery charge in connection with loans to President Trump's onetime campaign chief, is seeking to keep evidence from his phone out of the upcoming trial.

April 24 -

The Treasury secretary said recent government moves will help the firms get through the risk of millions of borrowers missing their loan payments.

April 24