-

The Tennessee company reported 6% growth in loans, which included strong C&I and CRE grains. However, revenue shrank thanks partly to a steep falloff in fixed-income fees.

October 14 -

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18 -

The Cincinnati company has agreed to acquire Epic Insurance Solutions in Louisville, Ky., as it continues to build out its fee-based lines of business.

September 15 -

Revenue from overdrafts keeps rising, according to new FDIC data, even though the controversial product still has a bull’s-eye on its back. Clearer disclosures and higher consumer confidence are the big reasons.

September 8 -

With the deadline for a federal-debt-limit renewal nearly a month away, bankers are dreading the prospect of higher funding costs, strained liquidity, weaker commercial loan demand and other ramifications if Washington does not act.

August 24 -

People’s United recently won the deposit business of the states of Massachusetts and Vermont, punctuating a multiyear plan to expand in government banking. But it’s a hard niche to succeed in, and, as other banks can attest, it can invite controversy.

August 15 -

Clearing services, assets under custody and administration and other parts of the trust bank's operations rose in the second quarter, all good news as it shifts leadership from Gerald Hassell to former Visa CEO Charlie Scharf.

July 20 -

The regional bank reported an 8% gain in fee income and trimmed costs amid 1% loan growth.

July 20 -

Declines in commercial products and mortgage banking fees at the Minneapolis company offset some of the benefits of higher interest rates.

July 19 -

Loan and fee income rose at the Los Angeles bank, which also jettisoned nearly $160 million of health care cash-flow loans.

July 18 -

The Dallas company is in the middle of a dramatic turnaround after scaling back on energy loans and slashing expenses. Still, followers of the company seek assurances that the discipline will endure.

July 18 -

Trust income, bank card fees and deposit service fees led to double-digit earnings growth at Commerce Bancshares.

July 13 -

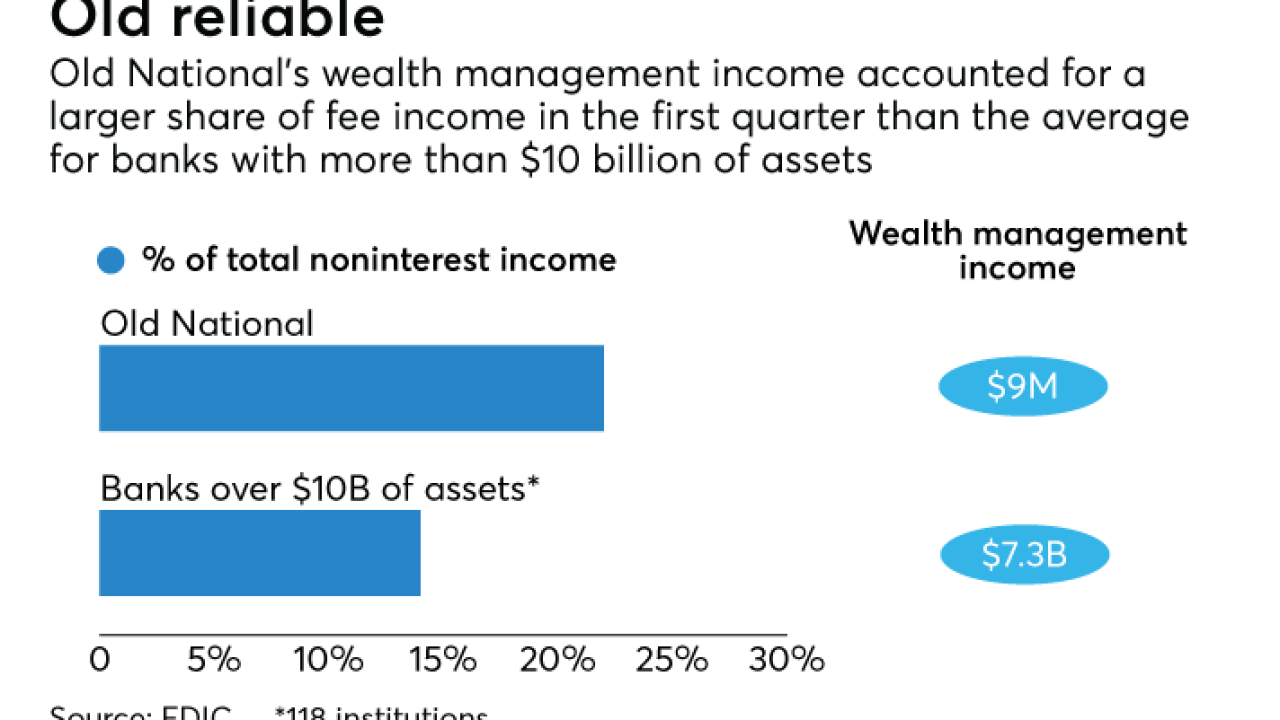

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

July 3 -

Before smartphones and digital wallets, a Georgia bank in the '90s partnered with a calling card provider to expand customer relationships and drive noninterest income.

June 26

-

On March 31, 2017. Dollars in thousands

June 19 -

Canada's big banks are pursuing wholesale banking, capital markets and select M&A opportunities across the border to hedge against a slowing mortgage market and other economic concerns on the home front.

May 26 -

The recent earnings season shined a light on community bankers’ tactical moves. Here’s a look at what some institutions are planning in coming months.

May 10 -

Double-digit gains in assets under management and administration and higher interest rates more than offset rising expenses.

April 25 -

First-quarter earnings at the Providence, R.I., company jumped 45% thanks partly to improvements in its net interest margin, 7% loan growth and stronger card and other noninterest income.

April 20 -

The Minneapolis company reported higher quarterly earnings thanks to strong performance in credit cards, investment management and other fee-based business lines.

April 19