-

The move figures to generate more low-cost funding for the firm’s consumer lending businesses without sacrificing substantial revenue.

June 17 -

Credit unions collect more in fee income than their banking counterparts. That could become problematic as the political winds and consumer preferences shift.

June 6 -

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

May 17 -

"Institutional support" spurs cryptocurrency price gains; the regulation limits what banks can charge for going negative on accounts.

May 15 -

Digit's savings app, relying on JPMorgan Chase's new real-time payments service, will offer customers an instant withdrawals feature that uses savings as a cushion against checking overdraws.

May 14 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 14 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 13 -

The settlement comes as Navy makes history by becoming the world’s first credit union to exceed $100 billion in assets.

April 22 -

Wells Fargo said holders of its student cards will see their costs decline by about half as its expands benefits after drawing scrutiny earlier this year for high fees on college campuses.

April 4 -

Two trends — competition from challenger banks and the emergence of real-time payments — threaten to eat away at the fees banks collect on overdrafts and bounced checks.

January 6 -

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

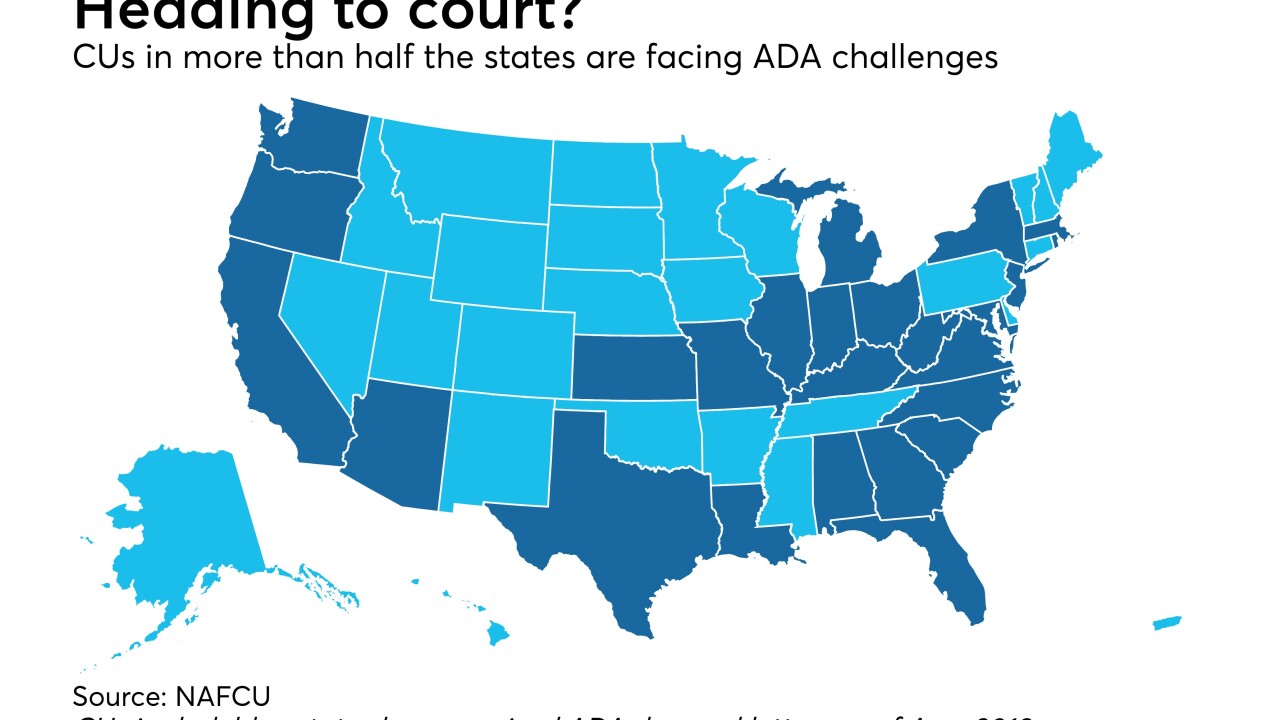

The industry spent a good portion of 2018 fighting ADA and overdraft lawsuits, and experts say despite some progress, next year could hold more of the same.

December 20 -

A number of credit unions have been hit with lawsuits that claim they have charged members overdraft fees despite there being sufficient funds in checking accounts.

December 11 -

A judge dismissed two of the six counts against the Mass.-based credit union, meaning DFCU will join several other CUs nationwide facing similar suits.

November 12 -

Payday lenders scored a victory when the bureau committed to proposing changes next year, but they expressed disappointment that the revamp will not address a key payment-processing provision.

October 30 -

In a letter Monday to Federal Reserve Board Chairman Jerome Powell, the four House Democrats argued that the nation’s aging payments system is contributing to economic inequality.

October 30 -

A high-profile media story is painting the industry in a negative light and should be cause for some CUs to re-examine their profit model.

October 15 Archer+Rosenthal

Archer+Rosenthal -

For more than a year, the central bank has been under pressure to speed the development of a real-time payment system. But it faces tough questions about what its own role should be.

October 3 -

Apple Federal Credit Union and Envision CU are the latest to be targeted in a growing trend as plaintiffs go after credit unions alleging deceptive overdraft practices.

September 14 -

Readers weigh in on bank overdraft policies, react to megabank capital standards, respond to Sen. Heidi Heitkamp's tough re-election bid and more.

August 30