-

Australia is the latest country to enable Faster Payments with the February 2018 launch of the New Payments Platform. It's 10 years behind the U.K.'s version, but benefits from a decade of experience and observation.

May 1 -

The rise of digital options is evolving payments from infrequent large transactions to a constantly flow of smaller payments, and companies that don't adjust risk being left behind, according to Luis Valdich, managing director of venture investing at Citi Ventures.

April 30

-

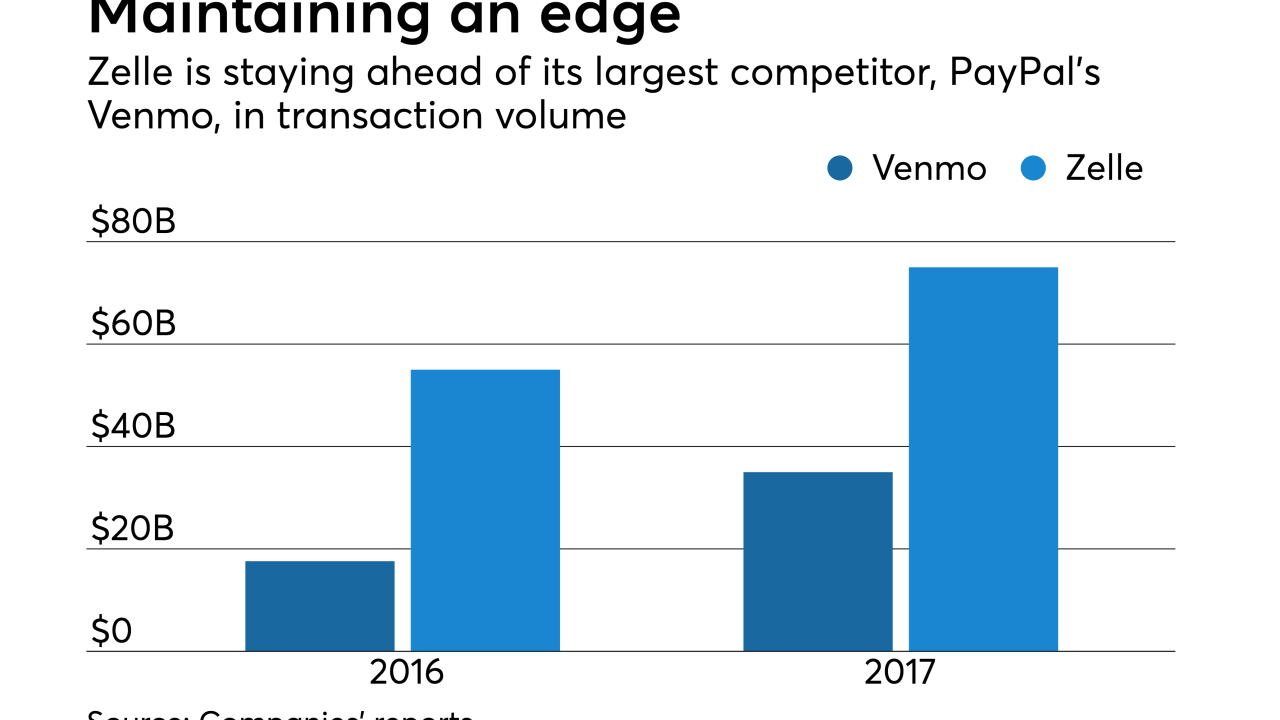

In addition to changing the name of the Consumer Financial Protection Bureau, the acting director wants to also nix public complaints; the good, bad and ugly in Zelle's ascendance; a case study for digital outage recovery; and more from this week's most-read stories.

April 27 -

PayPal and Barclays have formed a strategic partnership enabling Barclays customers in the U.K. and U.S. to manage their Barclays and PayPal accounts within each app.

April 25 -

Banks using Zelle share the good, the bad and the indifferent of the person-to-person payment network.

April 25 -

There are lots of layers technology risk-mitigation features, and in addition, network-level mitigation is provided as well, writes Robb Gaynor, chief product officer at Malauzai.

April 24 Malauzai

Malauzai -

The bank-led P2P service Zelle is on track to move more than $100 billion at its first anniversary in June — a milestone that is at odds with overall consumer awareness of digital P2P options.

April 17 -

Bill.com has implemented a strategy to make B2B payments more like Zelle or Venmo, removing the same pain points that those P2P apps do for consumer payments.

April 10 -

Several states have created their own operations aimed at shoring up what they see as oversight holes created by the CFPB; JPMorgan CEO’s annual letter (47 pages, this one) runs the gamut.

April 6 -

In deploying the Social Pay money transfer service, ICICI Bank says it is the first bank in India to allow nonresidents to send money to family and friends in the country for special occasions like festivals and birthdays.

April 5 -

Despite increased bank and investor activity around digital P2P payments, consumers haven't flocked to P2P in expected numbers.

April 3 -

These apps may not seem like much of a threat as long as they stay in their lane — but increasingly, ride-sharing companies are pushing the limits of how their apps can be used for payments.

March 29 -

Uber is clearly doing more to get into payments, but is hampered by a heavy regulatory burden and self-inflicted wounds to its brand.

March 28 -

Despite more bank and investor activity around digital P2P payments, consumer usage of P2P is a mixed bag.

March 27 -

The voice-activated payment option through Assistant has been added to Google Pay's features to address situations in which consumers have to pay someone back, for example, after a weekend activity.

March 22 -

To accomplish what she has in her 10-year tenure with Mastercard, Dana J. Lorberg simply had to be two things: "I am a programmer and a girl geek."

March 12 -

As chief fraud policy and control officer for Early Warning, it’s Donna Turner’s job to ensure security when consumers enroll through the Zelle app, and protect consumers and participating banks when users zap payments to recipients at different institutions.

March 12 -

Against the backdrop that is the contentious immigration debate in the U.S., Louise Pentland can say she has a passion and firsthand experience for improving the lives of those navigating the process of being accepted into this country.

March 12 -

deVere Group has added "Companion Accounts," which is designed to remove fees and enable shopping and expense management for relatives and companions that are in other countries, such as students or spouses.

March 9 -

By adding direct deposit for payroll, Square is diversifying the Cash App as it competes in the P-to-P space with Venmo and Zelle.

March 7