-

After advancing into some retail settings in Italy last year, the Jiffy P2P payment service is now an option at the country's Carrefour Italia "super stores," supermarkets and express stores.

November 5 -

Western Union and Amazon are collaborating to bring the e-commerce giant's services to consumers who may not currently have access to online shopping or those who prefer not to make digital payments.

November 2 -

Credit unions enjoyed a boost to membership as consumers fled the big banks in the wake of the financial crisis. But they can't wait for the next global disaster to drive younger members into their arms.

October 30 FIS

FIS -

Shopify is no stranger to social media — it’s had a partnership with Facebook for three years — and it sees Venmo users' social sharing habits as the perfect means to expand its mobile commerce platform.

October 26 -

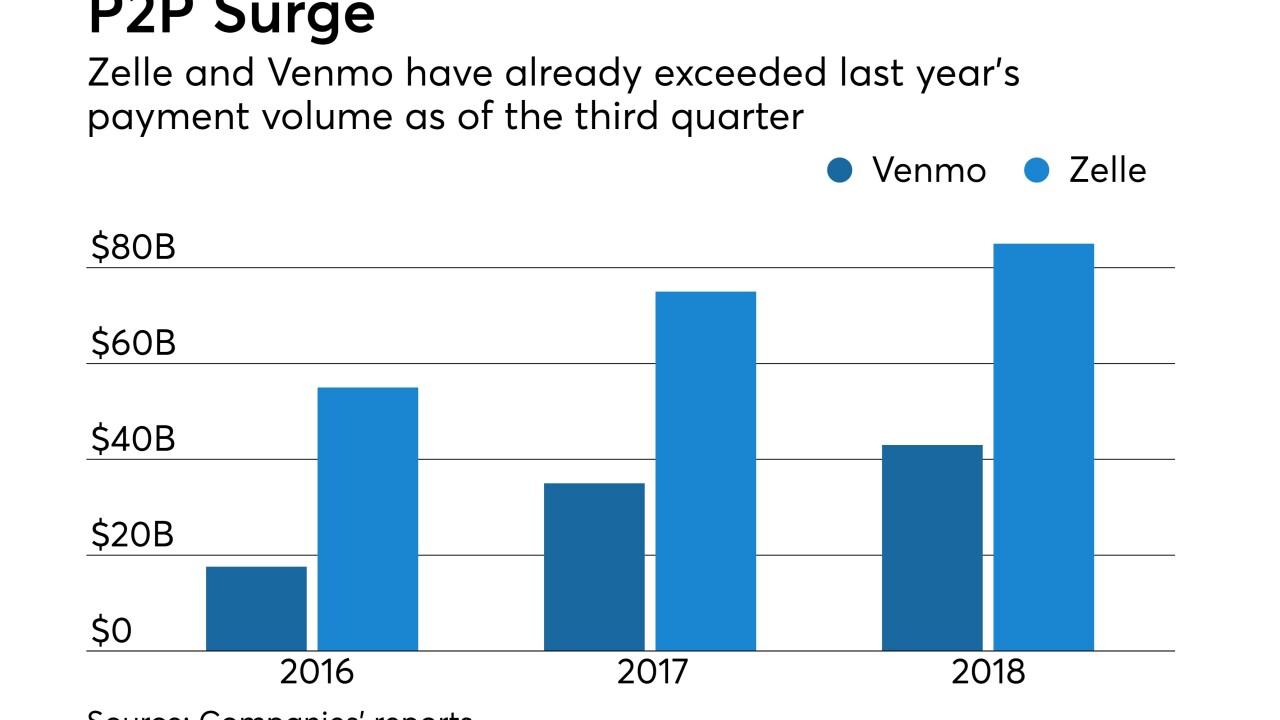

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The Zelle network processed 116 million transactions during the July-September 2018 timeframe with a total value of $32 billion in payments.

October 23 -

Cryptocurrency companies hope P2P transfers will prove habit-forming enough to convince consumers to try out a new currency.

October 23 -

As Venmo does battle with Zelle and Square for consumers' P2P payments, one thing is clear: Innovation is not cheap.

October 15 -

Financial crisis-era rebel Simple is turning to payments innovation — along with its traditional combativeness on fees and rates — to stay relevant against the many fintechs lurking at the edges of the banking world.

October 15 -

Banks are still in their experimental phase of using virtual and augmented reality to interact with customers, and the key to their success will be embracing the technology's social nature. And sometimes that means making an app designed for non-customers.

October 15 -

Angela Clark will be CEO of Beem It, which launched in May and has the backing of National Australia Bank, Westpac and Commonwealth Bank.

October 9 -

For more than a year, the central bank has been under pressure to speed the development of a real-time payment system. But it faces tough questions about what its own role should be.

October 3 -

Zelle doesn't require a bank or credit union to participate in its network to allow it to receive funds; so even Zelle holdouts will see some activity on their accounts. This allows credit unions to compare members' demand to usage, and to determine whether signing up with Zelle is worth the trade-offs.

September 24 -

Digital banking software provider Kony DBX will partner with Payveris to offer open-technology based digital payments.

August 30 -

It’s been a rough year of politically charged headlines and financial woes for Facebook, pressuring the social network to do more with its Messenger app's huge and largely unmonetized user base.

August 24 -

The real-time ticker of strangers’ spending habits could soon go away.

August 23 -

Account takeover (ATO) fraud currently drives the largest fraud losses at North American financial institutions within digital channels, according to a new report from Aite Group and Early Warning, the bank organization that operates the Zelle payment network brand. And according to data from RSA, phishing remains a vital part of this scam.

August 22 -

One expert says the U.S. lags behind other countries, but changes are coming soon – and fast.

August 17 -

With more than double the amount of transactions of PayPal's Venmo service, credit union analysts expect usage of the P2P payments service to continue to rise.

August 15