-

Amazon is moving into new markets armed with local storage lockers and partnerships, while many traditional retailers still lack the proper online capabilities, claims Arik Shtilman, CEO and co-founder of Rapyd.

July 9 Rapyd

Rapyd -

Sensing a profitable opportunity in an underserved market, a variety of companies — ranging from traditional banks to fintech startups and even Amazon — are rushing into selling secured credit cards and other products designed for consumers with poor or thin credit.

July 9 -

U.K.-based small business lender Capital on Tap has partnered with small business software provider Receipt Bank to launch a new credit card with access to credit lines.

July 8 -

Installment payments are catching on quickly with merchants and their customers, creating a fierce competition among rivals who are building competing technology and business models to approach the new market.

July 8 -

Platforms like Ethereum’s IPFS enable immutable document access, so token issuers and purchasers can provide all necessary financial documents, audits and inspections directly to those who own the token.

July 8 RealT

RealT -

Once a dataset’s data and lifecycle events are in a known state with lineage, new and exciting opportunities are possible, writes David Levine, head of data product strategy for PeerNova.

July 8 PeerNova

PeerNova -

Much as the fintech wave has sparked investments and deal-making among legacy bank technology vendors and payment processors, Experian, TransUnion and Equifax are entering partnerships and making investments.

July 8 -

BBVA has formed a partnership with Uber enabling the ride-hailing company’s drivers and delivery workers in Mexico to establish a digital BBVA debit account through Uber’s app.

July 5 -

E-commerce payments and fintech services provider PayU has acquired a majority stake in Southeast Asia online payment software company Red Dot Payment in order to expand into the Asian market.

July 5 -

A centralized rules-based system can produce insights into how staff pay when traveling, which can inform broader vendor management, contends Yash Madhusudan, co-founder and CEO of Fyle.

July 5 Fyle

Fyle -

AI-focused venture fund Radical Ventures is the lead investor in a $31.5 million Series B round in Sensibill, which boosts it overall financing to $46.5 million. National Bank of Canada is also part of the investment round.

July 5 -

Adyen has added support for Interac, enabling Canadian merchants to accept Canada’s domestic debit payment method for in-app and online purchases.

July 3 -

Payoneer, which developed a platform to facilitate cross-border payments, hired FT Partners to explore options for expansion, including a private funding round, according to a person familiar with the matter.

July 2 -

Cloud computing has boosted P2P and makes it easier for developers to build new businesses and payment technology, says Demetrios Zamboglou, BABB's chief operating officer.

July 2 BABB

BABB -

PayPal is working with Visa to enable consumers and small businesses in Canada to move funds instantly from PayPal to their bank accounts using Visa’s debit push payments service.

July 2 -

FamilyMart and 7-Eleven Japan are using mobile payment technology to compete with each other and attempt to manage the country's labor shortage.

July 2 -

India’s soaring digital payments market has prompted Mastercard and Visa to increase their investments in India, targeting one of the world’s largest cash displacement opportunities while complying with local regulations such as expensive data store requirements.

July 2 -

For banks and financial institutions, the wave of the future is using technology to optimize, not eliminate, their cash-handling processes, writes Diebold Nixdorf's Devon Watson.

July 2 Diebold Nixdorf

Diebold Nixdorf -

Abercrombie & Fitch and Klarna are following a successful launch of short-term installment loans on apparel in Germany by adding more markets.

July 1 -

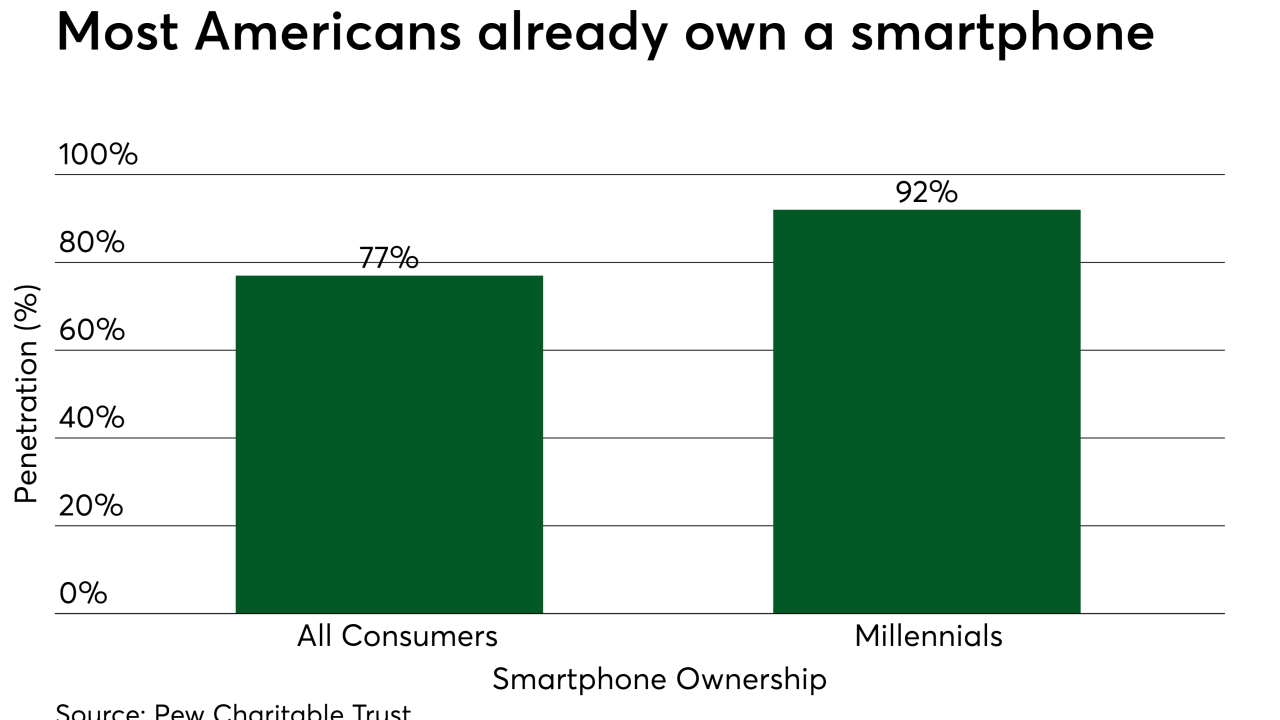

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1