-

AI-focused venture fund Radical Ventures is the lead investor in a $31.5 million Series B round in Sensibill, which boosts it overall financing to $46.5 million. National Bank of Canada is also part of the investment round.

July 5 -

Adyen has added support for Interac, enabling Canadian merchants to accept Canada’s domestic debit payment method for in-app and online purchases.

July 3 -

Payoneer, which developed a platform to facilitate cross-border payments, hired FT Partners to explore options for expansion, including a private funding round, according to a person familiar with the matter.

July 2 -

Cloud computing has boosted P2P and makes it easier for developers to build new businesses and payment technology, says Demetrios Zamboglou, BABB's chief operating officer.

July 2 BABB

BABB -

PayPal is working with Visa to enable consumers and small businesses in Canada to move funds instantly from PayPal to their bank accounts using Visa’s debit push payments service.

July 2 -

FamilyMart and 7-Eleven Japan are using mobile payment technology to compete with each other and attempt to manage the country's labor shortage.

July 2 -

India’s soaring digital payments market has prompted Mastercard and Visa to increase their investments in India, targeting one of the world’s largest cash displacement opportunities while complying with local regulations such as expensive data store requirements.

July 2 -

For banks and financial institutions, the wave of the future is using technology to optimize, not eliminate, their cash-handling processes, writes Diebold Nixdorf's Devon Watson.

July 2 Diebold Nixdorf

Diebold Nixdorf -

Abercrombie & Fitch and Klarna are following a successful launch of short-term installment loans on apparel in Germany by adding more markets.

July 1 -

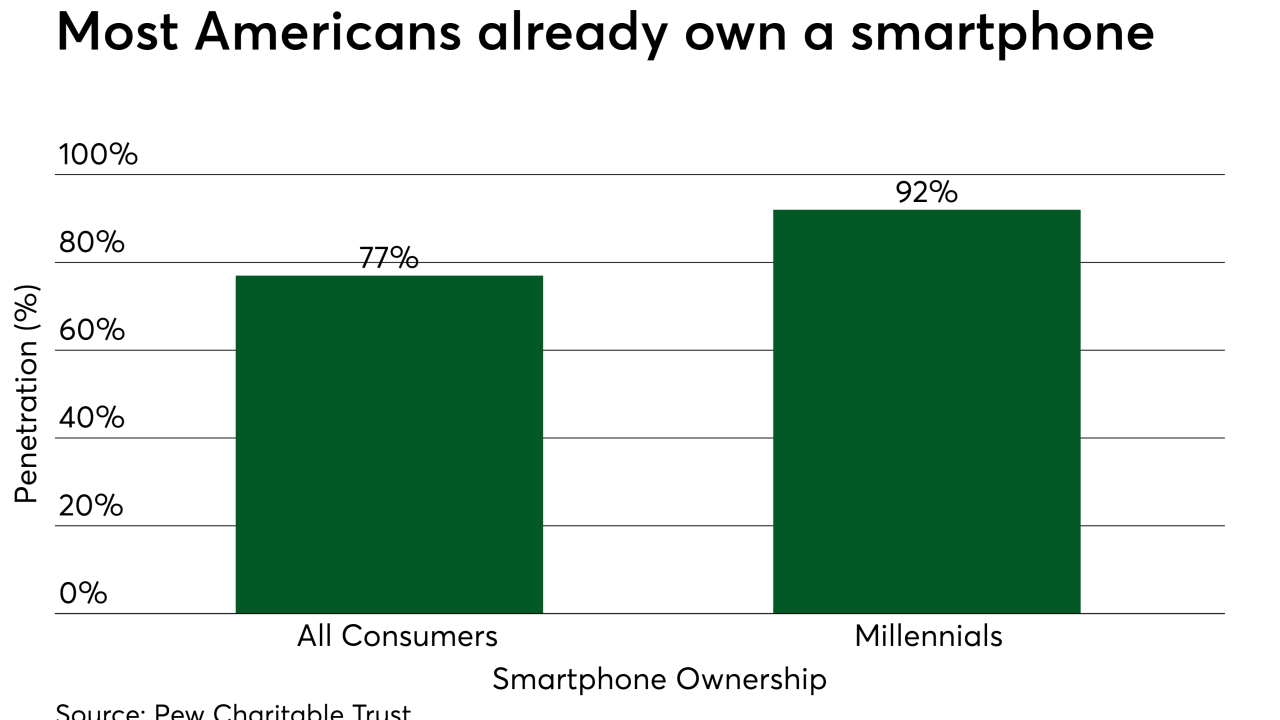

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

A large portion of business expensing, particularly travel and entertainment, takes place well outside of the office, making it tough for decision-makers to monitor, according to Yash Madhusudan, Co-Founder and CEO of Fyle.

July 1 Fyle

Fyle -

For many banks, especially midtier institutions, payments isn’t a core business — and their batch processing-based legacy systems weren’t designed to deliver real-time payments.

July 1 -

By turning compatibility into a nonissue, APIs help enable open banking, which has the potential to offer core banking services such as payment initiation or account balances through APIs, writes JPMorgan Chase's Stephen Markwell.

July 1 JPMorgan Chase

JPMorgan Chase -

Installment lending, whether it’s online or at the physical point of sale, is a market sector that has been experiencing a global boom in consumer demand for the last several years. Is this a short-term trend or are there potentially deeper-rooted factors that could make installment lending, especially online, a major source of future loans?

June 28 -

CaixaBank, Global Payments and terminal maker Ingenico are investing 5 million euros to establish an international innovation program designed to identify and aid promising fintech startups.

June 28 -

H&M will enable Klarna as a payment option in its 580 U.S. stores beginning this fall, building on a partnership the two Swedish companies established last year.

June 27 -

Visa’s chief economist recently warned that fintechs are disintermediating banks’ credit card businesses with instant access to installment loans. Now Visa is looking to disrupt the fintechs by giving issuers a way to do the same.

June 27 -

Many businesses mistakenly see alternative payment methods as only for consumers, but there are use cases for B2B, argues Pat Bermingham, CEO of Adflex.

June 27 Adflex

Adflex -

The pressure on banks, financial institutions and payment service providers to act as effective gatekeepers in the fight against financial crime is intense. Real-time payments considerably complicates that challenge, writes Sophie Lagouanelle, head of solutions at Accuity.

June 26 Accuity

Accuity -

Citigroup will be the first major issuer to use Mastercard technology to give U.S. credit card holders the ability to instantly redeem points on eligible purchases online and through a mobile app.

June 25