-

Analysts say credit card companies could face a major hit to earnings, while banks would also be under pressure.

January 12 -

The American Bankers Association and other groups contend the president's plan to cap credit card interest rates at 10% would drive consumers toward less regulated, more costly alternatives.

January 12 -

Research from American Banker finds that bankers are still extremely worried about fraud, but hope that raising budgets for artificial intelligence could help.

January 12 -

New research from American Banker details how the 50 largest U.S. banks by U.S. assets are using stablecoins, cryptocurrencies and other distributed ledger technology.

January 12 -

Universal Commerce Protocol is an open standard that establishes a common language for AI agents and systems to work together, and will allow consumers to purchase products from retailers directly through Google's AI Mode in the browser or the Gemini app.

January 11 -

Significant regulatory, legislative and business developments could shape the industry this year, putting pressure on banks to respond.

January 9 -

The deal ends more than a year of speculation of who would take over Apple's coveted credit card portfolio.

January 7 -

The U.K. bank has completed a payment using the stablecoin alternative; while Revolut is trying to acquire Turkish neobank FUBS. Plus: execs tied to the Wirecard scandal are on their way to prison and more in the American Banker global payments and fintech roundup.

January 7 -

The bank is investing in Ubyx to help traditional financial institutions settle stablecoin payments and compete with nonbank fintechs.

January 7 -

With fintechs and legal cases pressuring payment fees, the card companies are leaning more on revenue from other sources.

January 7 -

-

Earned wage access fintechs say the Consumer Financial Protection Bureau's advisory opinion provides important clarity on the finance product, but legal experts warn that its practical impact could be minimal.

January 6 -

The bank's Kinexys blockchain unit processes a fraction of the institution's overall payment volume. It's betting that an appetite for the technology's promise of speedy processing and liquidity will make that larger.

January 5 -

The real value of stablecoins lies in their ability to provide instant and secure transfers of value. But, in a world where every company has a bespoke stablecoin, that promise begins to break down quickly.

January 5

-

Visa and Mastercard logged increases in holiday spending, an industry group called for increased BNPL regulation in the U.S., and more in this week's global payments roundup.

December 31 -

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

December 30 -

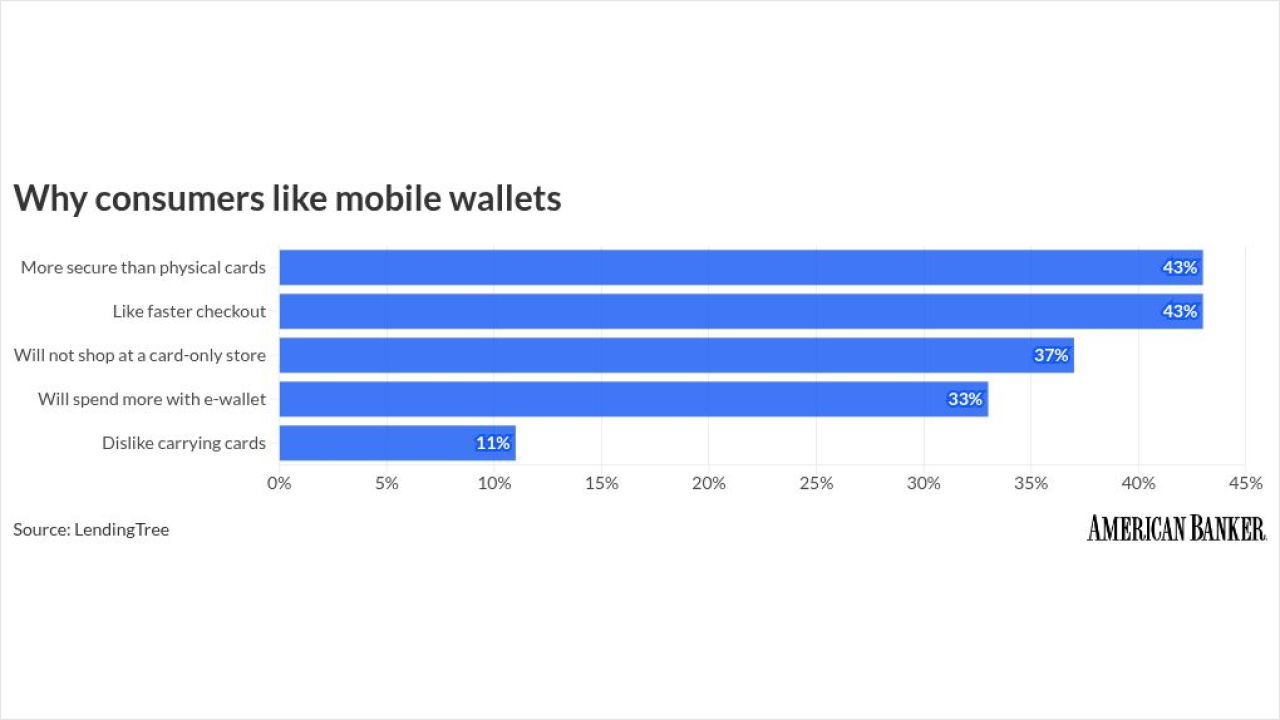

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26

-

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24