-

The pandemic will have an impact on customer adoption of digital technologies. Financial institutions and fintechs can achieve growth by gaining consumers' trust and changing their mindset about new platforms.

July 31 -

The bank is testing the emerging technology with IBM in an effort to speed up risk analysis and derivatives pricing.

November 25 -

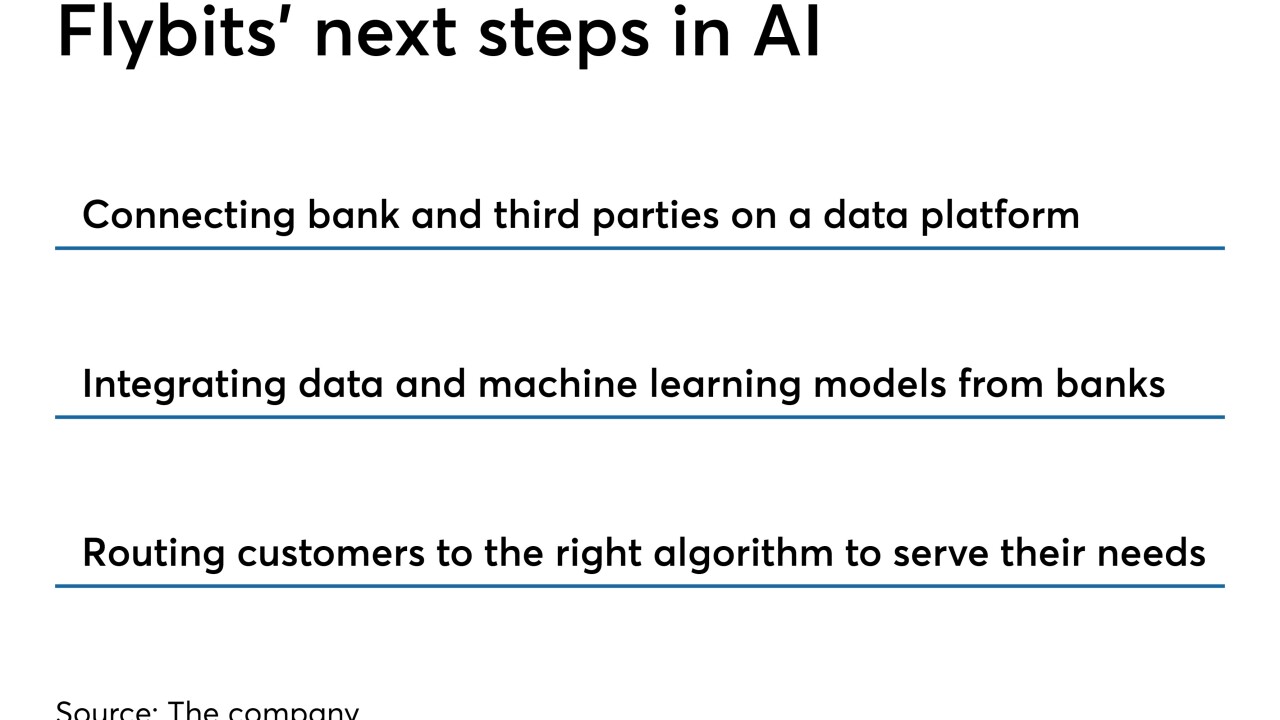

Flybits is building a marketplace to connect banks with third parties that might want to share data across channels.

July 18 -

The British startup OakNorth sees U.S. community and regional banks as good prospects for its lending technology.

April 23 -

CariClub crunches employee data to connect young banking professionals with nonprofits on the hunt for junior directors.

April 12 -

Thanks to big tech companies, the business world is moving to third-party platforms, or online marketplaces where buyers pull sellers' products off digital shelves. A growing number of financial institutions — including BBVA, Citi and community banks like Eastern — say they can't afford to sit out the trend.

January 31 -

The Boston bank said the digital lending platform has cut down the time it takes to deliver loan decisions by roughly 40%.

July 23 -

The London company unveiled FusionFabric.cloud at Money 20/20 Europe this week.

June 8 -

The $142-billion asset bank expects to deepen relationships with existing customers and add new ones, by collaborating with Intellect Global Transaction Banking to develop new services.

May 31 -

Nymbus is offering its bank clients a service to create a digital brand under their existing charter in as little as 90 days.

April 25 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

Banks that are customers of one or both vendors may look to leverage the situation to get better terms for certain products. But would small clients get enough attention from the global player the merger would create?

March 13