-

President Trump on Thursday signed an executive order to reinforce the country’s cybersecurity defenses, a move that financial institutions view as a positive step toward creating a more resilient financial system.

May 11 -

The Consumer Financial Protection Bureau plans to launch an inquiry into small-business lending, the first step toward crafting a rule for the collection and reporting of data.

May 10 -

The acquirer of the failed Guaranty Bank took a pass on the latter’s 107 in-store branches, leading to their shutdown and a disruption in service for many low-income customers.

May 9 -

Fannie Mae and Freddie Mac issued proposals Monday to create pilot programs for loans on mobile homes, part of an ambitious plan for underserved and rural housing markets.

May 8 -

As Keith Noreika takes over as acting head of the Office of the Comptroller of the Currency on Friday, he faces a daunting challenge: a precipitous drop in morale at the agency.

May 4 -

The debate over banking policy has tended to leave out all the other factors examiners use to gauge institution strength, therefore sidestepping a comprehensive approach to safety and soundness regulation.

April 28 MP Alpha Advisory

MP Alpha Advisory -

The Consumer Financial Protection Bureau said Tuesday that it will hold a public hearing next week on small-business lending.

April 25 -

Readers sound off an attempt to block prepaid regulations, threats to consumer privacy, FSOC’s political bent, the proper use for SARs, and more.

April 21 -

An internal agency report paints a scathing portrait of the OCC, acknowledging that it missed several red flags on the Wells Fargo matter.

April 19 -

The Consumer Financial Protection Bureau's prevailing mindset is apparently not affected by convincing evidence regarding options for borrowers looking for small-dollar credit.

April 17 Community Financial Services Association of America

Community Financial Services Association of America -

Readers weigh in on a notable OCC personnel change, the Scottrade breach, the ability of corporate owners to still be anonymous and more.

April 14 -

A carve-out that shielded billions of dollars in collateralized loan obligations from Dodd-Frank's risk-retention mandate could work against banks and other CLO managers if Dodd-Frank is overhauled.

April 12 -

The Office of the Comptroller of the Currency's top examiner at Wells Fargo was removed last month, according to Reuters.

April 7 -

Reader reactions to criticism of Jamie Dimon, the House GOP ganging up on Richard Cordray, a bank's decision to part with Excel to measure credit losses, and more.

April 7 -

Fifteen months before he resigned under a cloud, Jeffrey Lacker, then president of the Federal Reserve Bank of Richmond, found himself in an odd position.

April 6 -

In a private meeting with lawmakers, White House economic adviser Gary Cohn reportedly said he supports a policy that could radically reshape Wall Street's biggest firms by separating their consumer-lending businesses from their investment banks.

April 6 -

Republicans on the House Financial Services Committee barraged the director of the Consumer Financial Protection Bureau on Wednesday with accusations that the agency is corrupt, as they tried to lay the groundwork for President Trump to remove the director for cause.

April 5 -

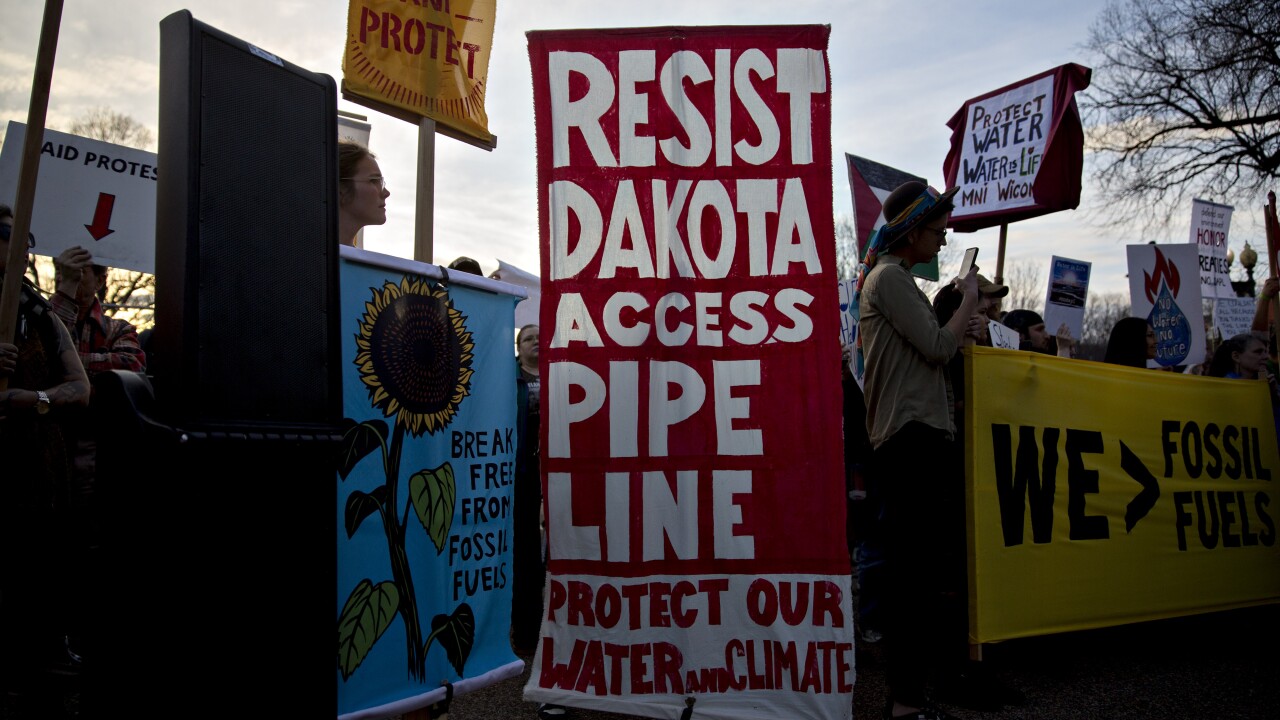

The French megabank has sold its $120 million stake in a $2.5 billion syndicated loan to build the controversial Dakota Access pipeline.

April 5 -

Efforts at regulatory reform often ignore the source of what led to the overregulation in the first place: the legislative process.

April 3 Werb & Sullivan

Werb & Sullivan -

Nearly 40 current and former congressional Democrats — including the namesakes of the Dodd-Frank Act — challenged the notion that Congress may not dictate the organization of federal agencies.

March 31