-

The Connecticut company, which will top that asset milestone when it buys United Financial, says it could acquire more banks in coming months.

July 16 -

The bank has been slashing expenses, but executives acknowledged they remain high. Between having to hire thousands of compliance employees and waiting on the next CEO to be named, investments in new technology or other long-term growth are limited.

July 16 -

David Cerwinski, who joined the CUSO in 2006, was appointed president of the technology provider.

July 16 -

The interim CEO told analysts Tuesday that the company remains committed to hiring an outsider who isn't connected to its scandals of recent years.

July 16 -

The Georgia regional plans to open more branches in the state as it looks to loan growth and fees as a way to offset intense competition for deposits.

July 16 -

As strategic planning season kicks off, credit union boards and executives must consider whether they’re doing enough to prevent evolving cybersecurity issues, including account takeovers.

July 16 -

The Connecticut company will add heft in its home state and Massachusetts when it buys the former mutual.

July 15 -

A number of credit unions showed their communities they cared by raising money for causes, such as supporting veterans and scholarship funds.

July 15 -

Hispanics are underserved by mainstream financial institutions, creating an opportunity for credit unions to step in and fill the void.

July 15 CO-OP Financial Services

CO-OP Financial Services -

The annual summer shopping bonanza will run across two days for the first time, and other retailers are following suit with offers of their own. Here’s how credit unions can capitalize on it.

July 15 -

From creative ways to recognize members of the armed services to July 4th celebrations and more, here's another look at how credit unions are making a difference in the communities they serve.

July 12 -

Other executives are being considered, too, but the list is dwindling as JPMorgan’s Gordon Smith and other big names are said to be out of the running. Meanwhile, senior Wells executives have pushed to keep interim CEO Allen Parker.

July 12 -

The autonomous vehicle lending market isn’t expected to peak for decades, but some CUs are already jumping in, and they could be at the forefront of rapid shifts in the automotive industry.

July 12 -

Jim Lumpkin, president and CEO of the Portland, Ore.-based institution, is planning to retire in the first quarter of 2020.

July 11 -

The $10 million-asset institution struggled with profitability, posting a loss of more than $12,000 during Q1.

July 11 -

Charles Friederichs, already serving in an interim capacity, has been appointed permanent CEO of the $1.1 billion-asset institution.

July 11 -

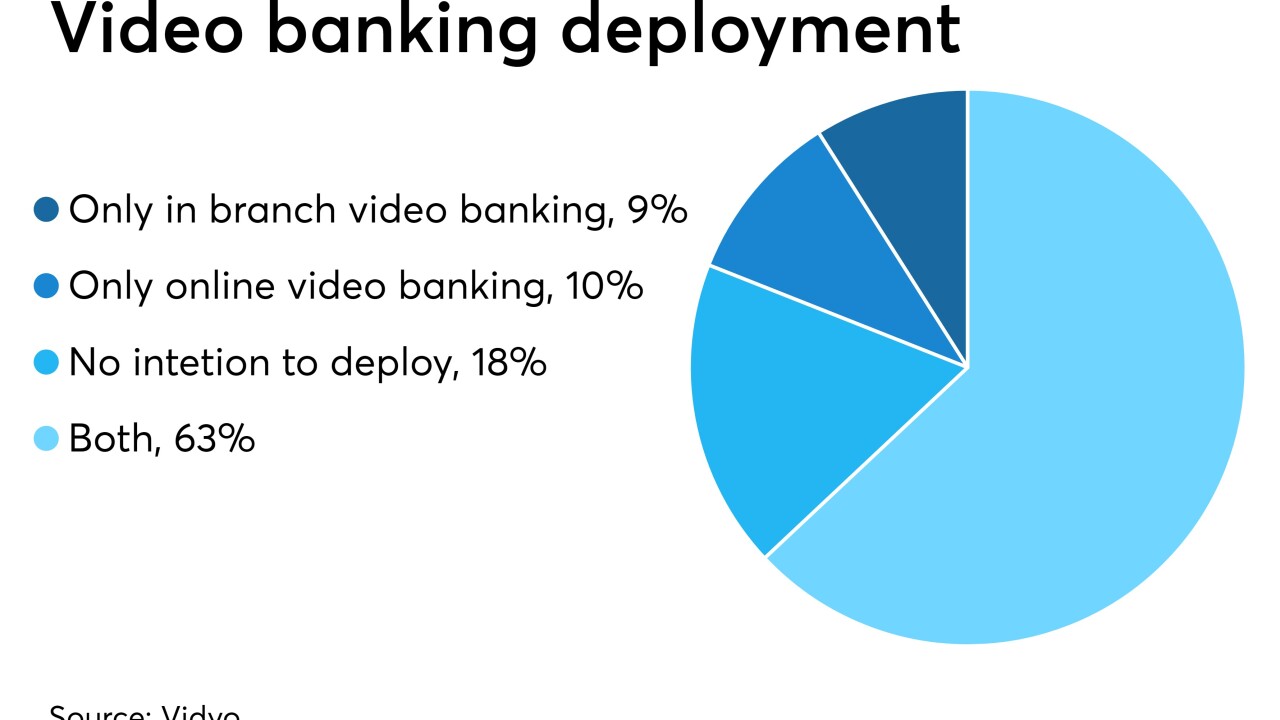

As more credit unions deploy mobile video banking, some observers say if credit unions don’t hop on board now they could be left behind in the next few years.

July 11 -

CUs in the Keystone State saw loan balances rise by 8.5%, while membership rose more than 3.3% to top 4.2 million.

July 10 -

Studies show that consumers trust posts from an organization’s employees more than the brand itself, and that could be key to using social media as a growth engine for credit unions.

July 10 Gremlin Social

Gremlin Social -

A growing number of credit unions are moving their headquarters to revitalized urban areas, and while some say that could help recruit new staff, it also carries the risk of being associated with gentrification.

July 10