-

The appointment comes nearly two years after Davis said he was stepping down from the Minneapolis bank to pursue "another calling."

October 17 -

Mark Decello will take over for Gerald Guy, who has served as president and CEO at KEMBA for 30 years.

October 17 -

Credit unions based on the island made history receiving CDFI grants for the first time ever, but larger issues tied to population decline remain.

October 17 -

Promoting diversity must go beyond putting women in the C-suite. It’s about creating products and practices that help support and elevate those who tend to be overlooked.

October 17 Kabbage Inc.

Kabbage Inc. -

John Kolhoff will lead the Credit Union Commission of Texas starting in early December.

October 16 -

The Dallas bank has picked a bad time to shift from cost-cutting to expansion as big banks are in a commercial lending funk.

October 16 -

Credit unions around the globe added more than 40 million members between the end of 2013 and 2017, according to a new report from the World Council of Credit Unions.

October 16 -

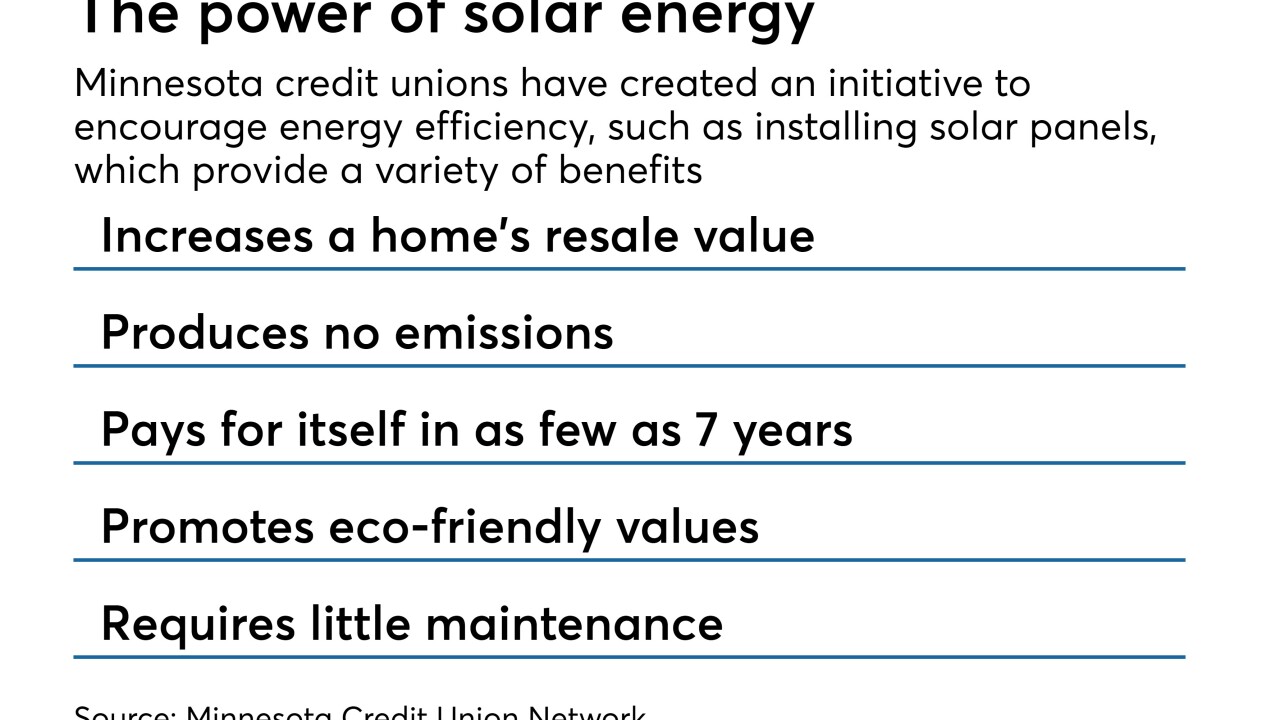

CU Green was developed to give Minnesota residents better access to clean energy products.

October 16 -

Financial institutions can take a few easy steps to ensure their leadership is more representative of their customer base, including looking outside of the industry for talent. Women and people of color are not that hard to find.

October 16 Russell Reynolds Associates

Russell Reynolds Associates -

The $5.4 billion-asset credit union said FOM expansion continues to be part of its long-term growth strategy.

October 16 -

Another look at how credit unions are giving back and making a difference in the lives of consumers who live in the communities they serve.

October 15 -

Several female executives accepted leadership roles throughout the industry and in regulatory roles during the past month.

October 14 -

The largest U.S. bank's strong third quarter did not insulate its leaders from being pressed about the downside of pricey investments in technology, whether capital rules make commercial lending growth hard for big banks to achieve, and whether another economic downturn is edging closer.

October 12 -

Augusta VAH Federal Credit Union in Augusta, Ga. has announced plans to merge into SRP FCU, across the state line in nearby North Augusta, S.C.

October 12 -

The Montana company will spend $200 million to buy Idaho Independent and Community 1st Bank.

October 12 -

The uproar over the incendiary writings of a Consumer Financial Protection Bureau official have led to calls for his removal, but the agency’s interim chief says he won’t “let any outside group dictate who works here.”

October 11 -

Sarah Vega, chief of staff to NCUA Chairman Mark McWatters, succeeds Paul Gentile, who announced plans to leave the multi-state credit union league earlier this year.

October 11 -

The company agreed to buy Mainland Bank for nearly $20 million in stock.

October 11 -

A growing number of the top lawyers at major financial institutions are women. What’s it going to take to get other departments to follow suit?

October 11 Sullivan & Cromwell LLP

Sullivan & Cromwell LLP -

Consumers may say they like where they bank, but a survey suggests banks and credit unions lag behind retail brands like Amazon in ease of service and satisfaction.

October 11