-

Its decision to hire a consultant to trim expenses highlights the difficulty regionals face in making long-term technology investments in a low-growth era.

April 24 -

Live Oak Bancshares wants its next bank president to “step on the gas” as it accelerates growth into new industries.

April 24 -

Citigroup chairman Michael O'Neill said he's "agnostic" about keeping chairman and chief executive officer as separate roles and directors will consider Mike Corbat to be his successor.

April 24 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

A pair of credit unions in North Carolina and Florida – separated by nearly $2 billion in assets – have formed an alliance to share advice, support, best practices and innovations.

April 24 -

Another look at how credit unions are giving back to the communities they serve.

April 23 -

Nearly a third of NBT Bancorp's revenue comes from fee businesses, though it took patience, several acquisitions and a tolerance for added regulation to get there.

April 23 -

The high-profile hiring of Huntley Garriott comes a year after the North Carolina company had brought on a veteran banker to run the unit.

April 23 -

Hanisch joined CO-OP in 2000 and has been chief operating officer since April 2017.

April 23 -

The California company, which also focuses on Asian-Americans, agreed to buy First American International.

April 23 -

IoT and omnichannel require fast informed data-driven decisions for merchants, a challenge Mastercard hopes to address with predictive analytics, driving more transactions and fee income.

April 23 -

Philanthropy, tech donations, giving back to homeless veterans and other ways credit unions are giving back in their communities.

April 20 -

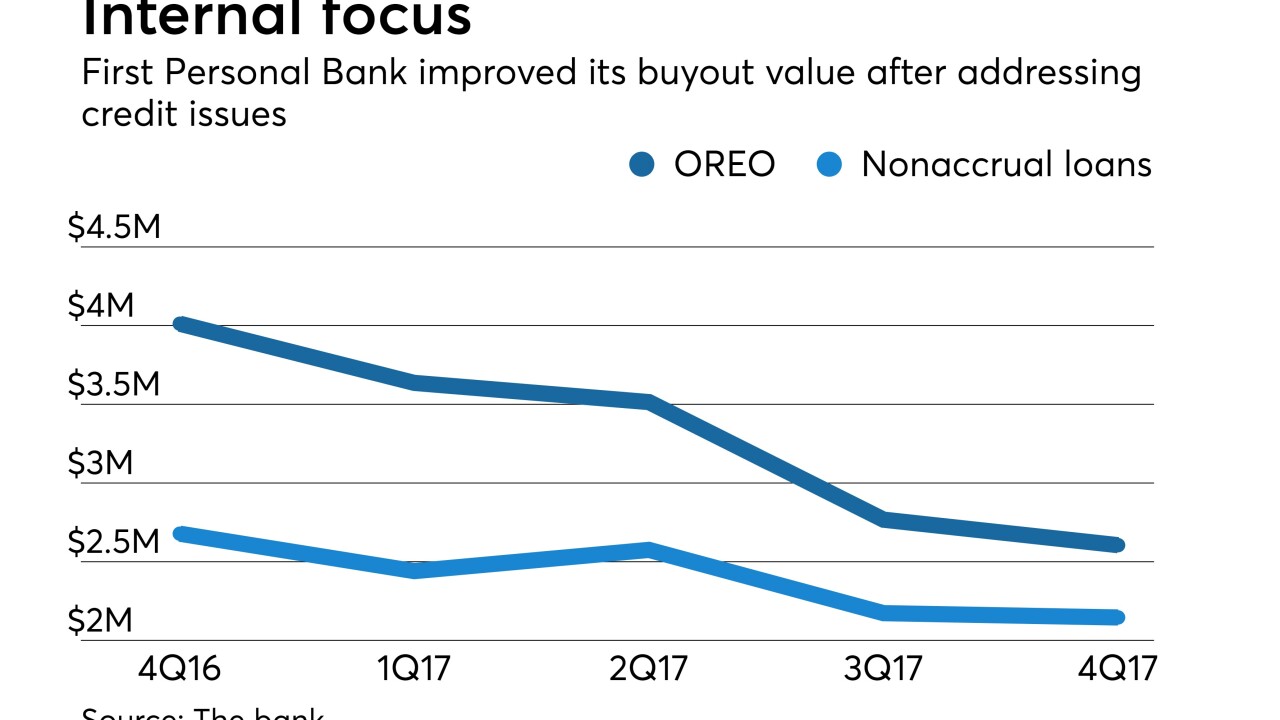

First Personal Bank in Illinois tried — and failed — to sell itself three times. The bank finally found an eager buyer after tackling several lingering problems.

April 20 -

Several banks have reported digital service outages this year, but now there’s a detailed breakdown of one of them — and it shows that the damage goes far beyond reputation.

April 20 -

The Louisiana company has vowed to meaningfully improve investor returns and efficiency over the next two years.

April 20 -

Steven Bugg is set to take the top job at the Illinois-based credit union.

April 20 -

An $378 million agreement to buy Farmers Capital will allow the West Virginia company to bridge a gap between Louisville, Ky., and Huntington, W.Va.

April 20 -

As NCUA amended at 2014 regulation on capital planning and stress testing, the two-person committee also marked 24 months of operating with a vacant seat on the board, commending one another for a productive working relationship.

April 19 -

Investing in technology has been an important focus for banks. But big questions remain about these investments, including how best to pay for them.

April 19 -

The North Carolina company's efforts to contain expenses made up for a marginal increase in revenue.

April 19