-

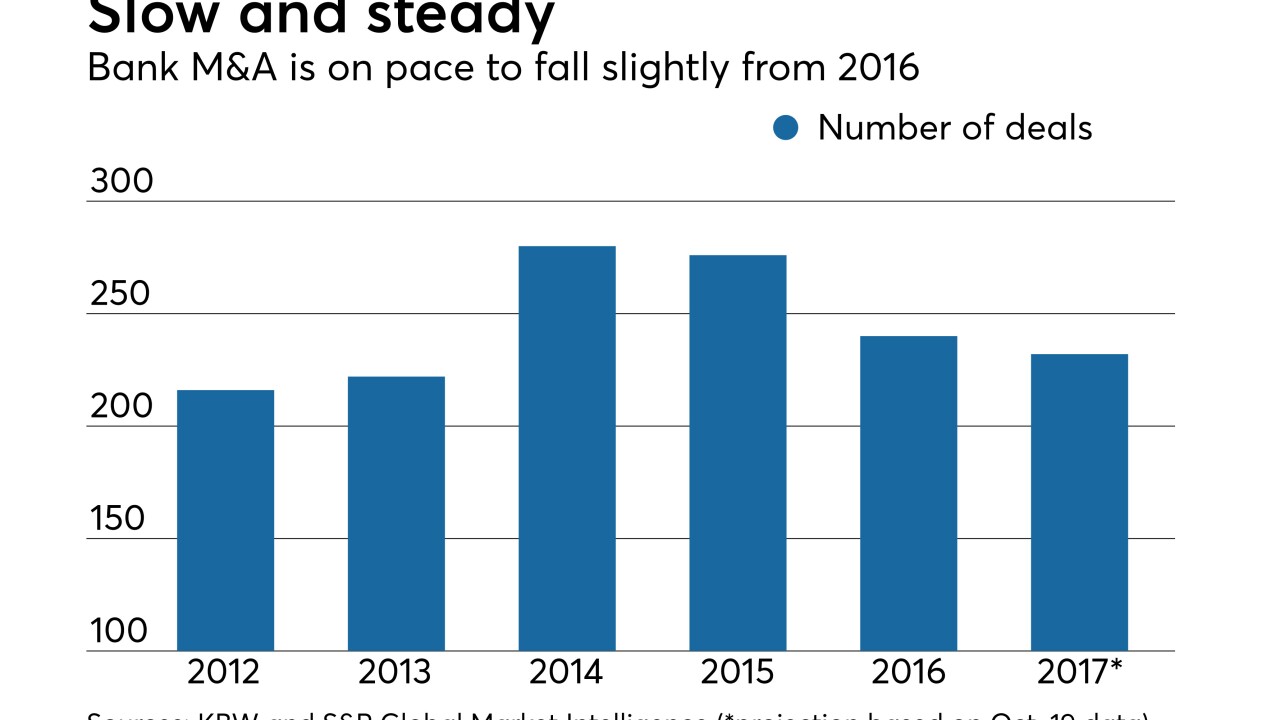

Freeing a number of big banks from enhanced oversight, including capital requirements, could motivate CEOs to pursue deals. Still, other impediments could prevent a flood of large mergers.

November 14 -

The planned sale will also include $70 million of loans in southern California.

November 13 -

Sterling Bancorp in New York is determined to turn Astoria Financial's largely residential operation into a commercial powerhouse. While investors are skeptical, CEO Jack Kopnisky has proven in the past that such an ambitious plan is doable.

November 13 -

Outsiders gained access to customer information at Southern National Bancorp of Virginia using a malicious email. Other financial institutions, meanwhile, are implementing policies in hopes of avoiding the same fate.

November 10 -

Fintechs should learn to value risk management — and the necessary bureaucracy that comes with it, bankers said this week in defending themselves again criticism that they are a pain in the neck to work with.

November 8 -

Mobile banking, oddly enough, is redefining the role of call center agents as customers handle routine tasks on their smartphones and reach out for help with bigger-picture questions.

November 8 -

The heads of some of the largest U.S. banks are calling for a new security-focused mindset among executives, better forms of ID and collective action in the aftermath of the Equifax breach.

November 7 -

The companies' recently launched partnership furthers the argument that the banking and fintech industries might be better served working together rather than competing.

November 7 -

Ira Robbins, the CEO-in-waiting at Valley National Bancorp, will have to complete a major acquisition, make the bank more competitive on returns and costs and tackle other difficult tasks after taking over for Gerald Lipkin.

November 3 -

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

The Alabama bank's provision for loan losses rose 59%, but it still reported an 8% increase in 3Q profits thanks to stronger margins and fee income.

October 27 -

Many institutions have delayed planning for a big change to reserve accounting despite a belief that they should start testing systems and methodologies next year.

October 27 -

If Congress changes the $50 billion-asset threshold for systemically important financial institutions, big banks could take it as a signal that regulators would be amenable to larger deals.

October 26 -

That loan growth helped boost the San Antonio bank's profit by 16.5% year over year.

October 26 -

While stress testing can provide valuable insight into the strength and resilience of our financial system, regulators are increasingly acknowledging shortcomings in the post-crisis regime.

October 26 American Bankers Association

American Bankers Association -

Huntington executives are surprised that chargeoffs are still so low and say they're prepared for things to get worse, yet they remain aggressive in auto and other categories. The juxtaposition is a sign of the times for lenders.

October 25 -

Provision costs surged to $44.5 million from $1.2 million. The company attributed that increase to higher chargeoffs in its taxi book.

October 25 -

Consolidation has led to too few community banks, which is amplified in areas where capital is needed most.

October 25 Calvert Advisors LLC

Calvert Advisors LLC -

Loan growth drove the New York bank’s 20% increase in third-quarter earnings, and those results don’t include its acquisition of Astoria Financial this month.

October 24