-

The regional bank will record a pretax gain of about $1 billion as it continues to shed its stake in the payment processor Vantiv.

August 8 -

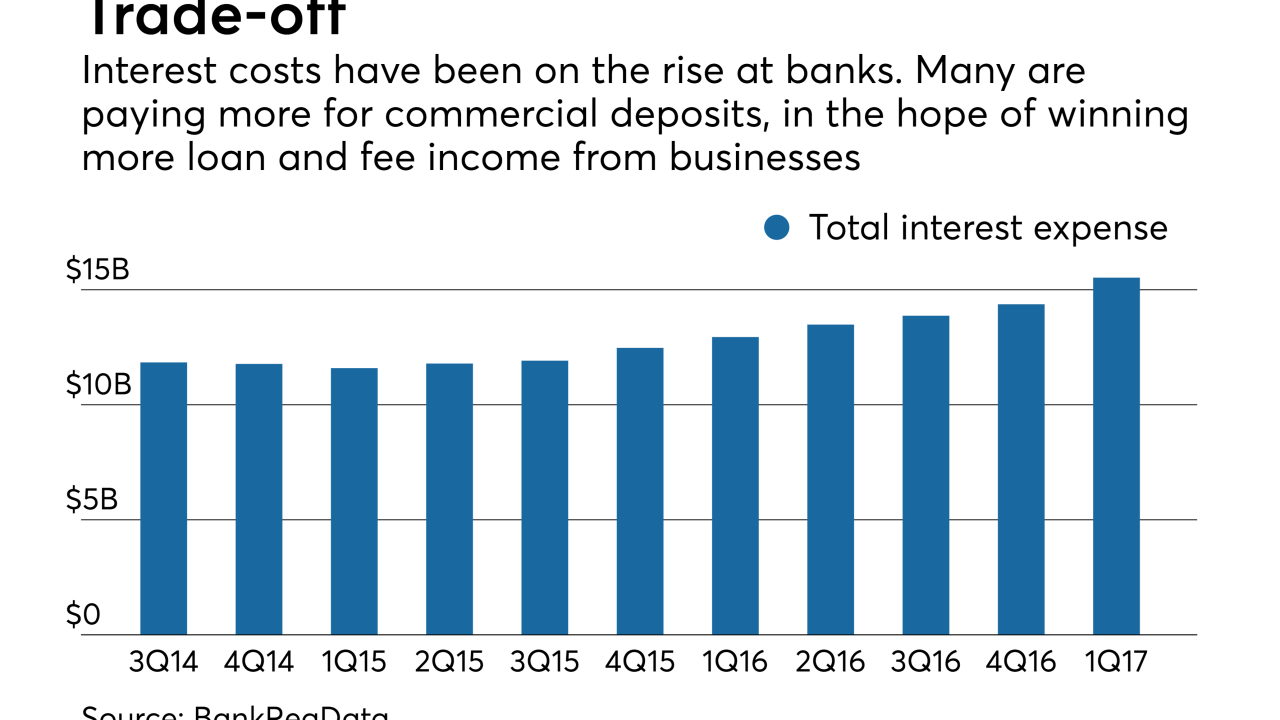

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

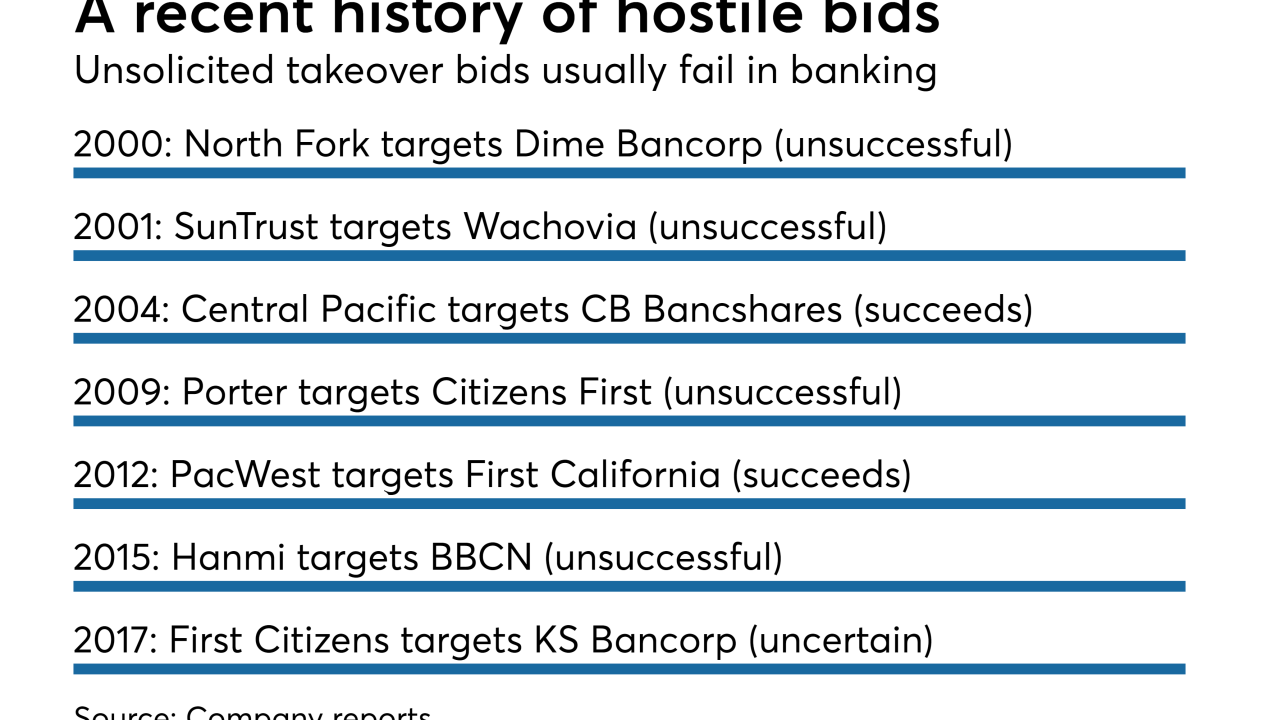

The key to an unsolicited bid is to avoid looking like a bully. That requires clear communication with a target's investors, employees and clients — along with any other banks you might eventually want to buy.

August 3 -

Rising taxes, declining population and the political landscape in Illinois have led several bankers to put more money and resources into nearby states.

August 1 -

Valley National's latest acquisition would make it a much bigger player in Florida and provide a platform to write more auto loans. Both markets present attractive returns but high risks.

July 27 -

Associated Banc-Corp is the latest industry welterweight to get back into M&A. That should benefit larger sellers that have watched the bigger regionals sit idle in the last couple of years.

July 21 -

The Birmingham, Ala., bank has been cutting exposure to indirect auto, multifamily and medical office lending, categories it deems high-risk.

July 21 -

The Ohio company also reported that credit quality metrics remain well within its targeted range.

July 21 -

Increased dealings in direct consumer lending and guaranteed student loans offset a decline in mortgage-related income. A lower loan-loss provision also helped the bottom line.

July 21 -

But the Connecticut company says the efficiencies of its recent acquisition of Suffolk Bancorp will begin to be realized soon.

July 20