-

The Sun Belt lender also increased fee income and kept expenses down in the first quarter.

April 27 -

Forecasts for better times ahead in banking have sellers wanting more and buyers pursuing less.

April 24 -

The Wisconsin regional's profits rose 35% in the first quarter on healthy loan growth, wider margins and an improved efficiency ratio, and it said its "satisfactory" CRA rating had been restored.

April 20 -

In an interview, CEOs for midsize banks said they are hopeful for a bipartisan Dodd-Frank Act reform bill that eases regulatory requirements for institutions with assets of more than $10 billion.

April 13 -

In his annual letter to shareholders, M&T Bank chief Robert Wilmers laid out in compelling detail how government policies intended to protect American families have ultimately stymied economic growth.

April 4 -

Because the fates of banks and the communities they serve are so intertwined, the regulatory impacts borne by regional banks are inextricably linked to the repercussions experienced by their customers.

April 4M&T Bank -

Creative growth strategies are helping banks with $10B to $50B of assets — including Webster and TCF — improve profitability. These ‘tweeners’ deal with tougher regulations than smaller competitors without the scale larger ones have to absorb the expense.

March 27 -

The recent decision by the Federal Reserve Board to exempt banks with less than $250 billion in assets from the qualitative aspects of the CCAR stress tests may be a sign of things to come, says Joo-Yung Lee, head of North American financial institutions at Fitch Ratings.

March 3 -

Critics of Dodd-Frank argue that post-crisis regulations put a damper on lending. But loan growth at regional and community banks has "actually been very strong," says Joo-Yung Lee, head of North American financial institutions at Fitch Ratings.

March 1 -

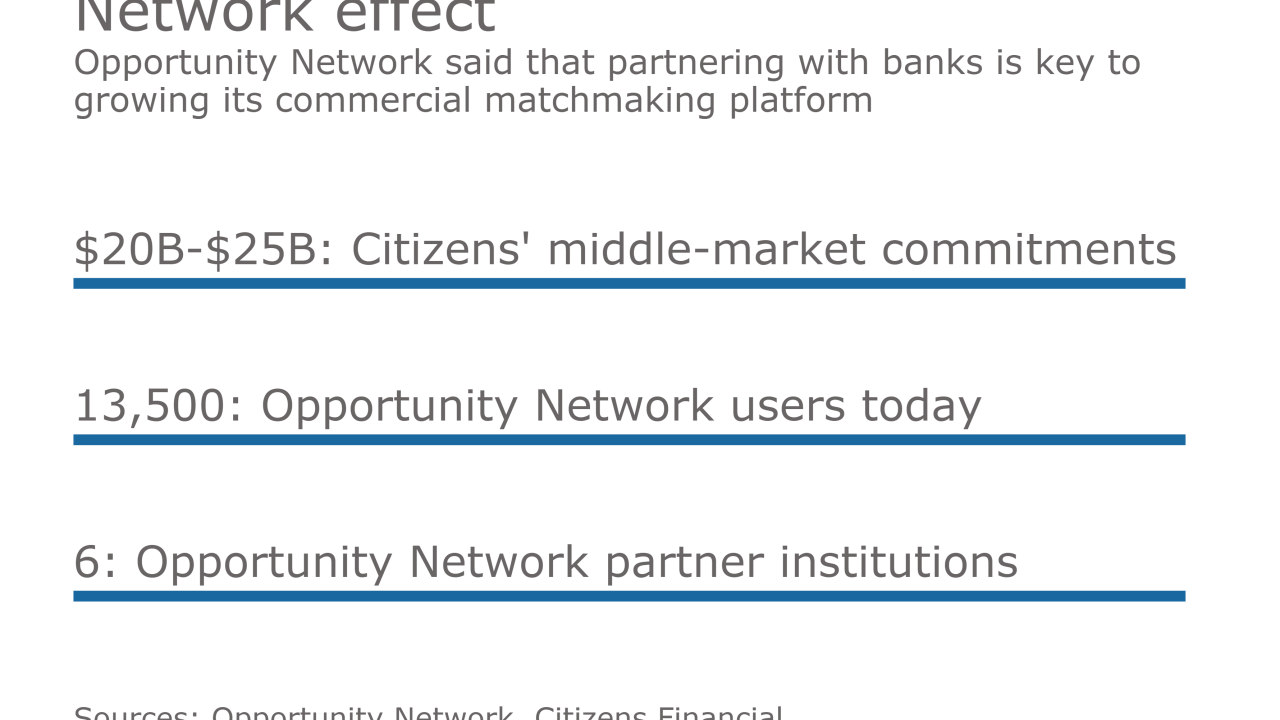

By partnering with the matchmaking platform Opportunity Network, Citizens will be able to better connect corporate clients to deals worldwide.

February 7