-

The president’s vow to impose a 20% tax on Mexican imports could make life harder for the Citigroup-owned unit, which is Mexico’s second-largest bank.

February 3 -

Bloomberg News conducted interviews and reviewed public statements to discover what each major bank is now planning in the wake of Brewxit.

January 31 -

Andrew Lo straps sensors to traders and watches how their pulses and body temperatures change when markets dive or trades go bad. The technology could be used elsewhere in a bank to address problems before they escalate.

January 30 -

While bankers feel more positive about the environment since the election, taking advantage of the new environment is what’s really important.

January 27

-

Fraudsters are licking their chops at the thought of infiltrating person-to-person payment systems and enabling a never-ending flow of small-value transactions — with the potential to strike bigger accounts.

January 24 -

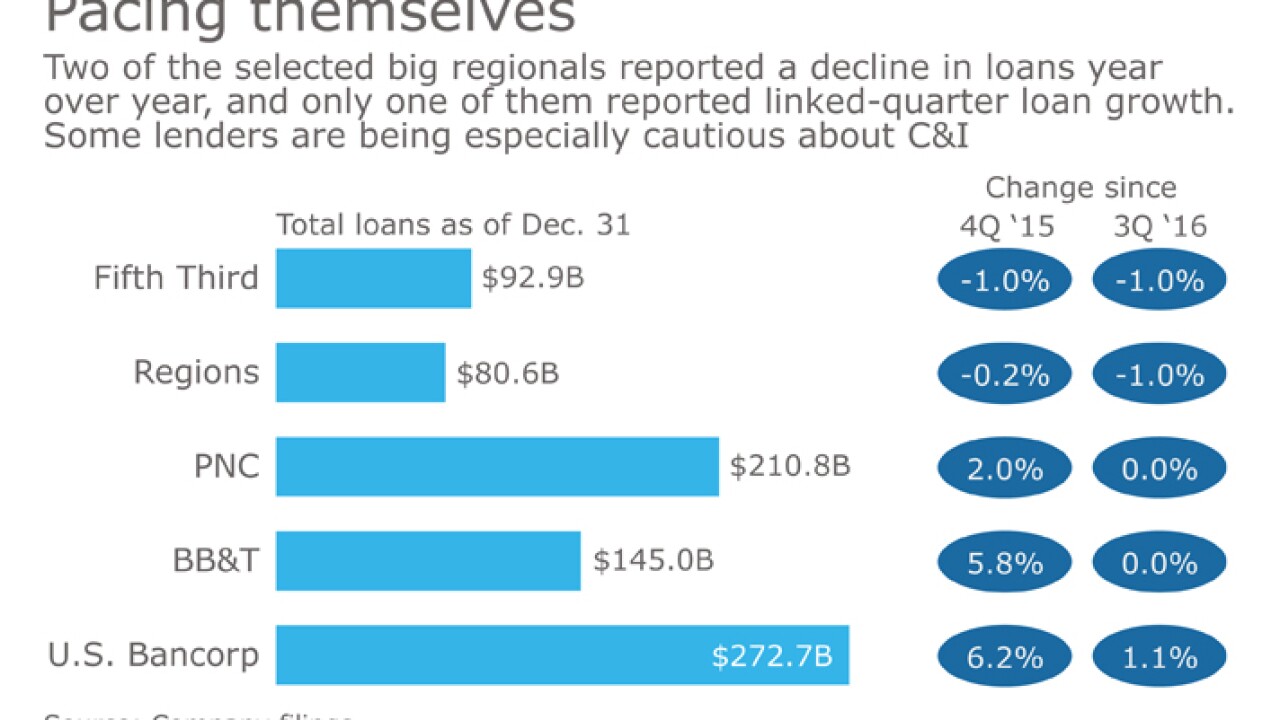

Fifth Third and other regionals have ditched what they deem to be high-risk commercial loans in hopes of strengthening credit quality over the long term.

January 24 -

Fraudsters are licking their chops at the thought of infiltrating person-to-person payment systems and enabling a never-ending flow of small-value transactions — with the potential to strike bigger accounts.

January 24 -

Payment processors have eyed the gambling industry as a just-out-of-reach gold mine for the past few years, especially with the expansion of online and mobile gaming, but the warning signs have always been very large.

December 28 -

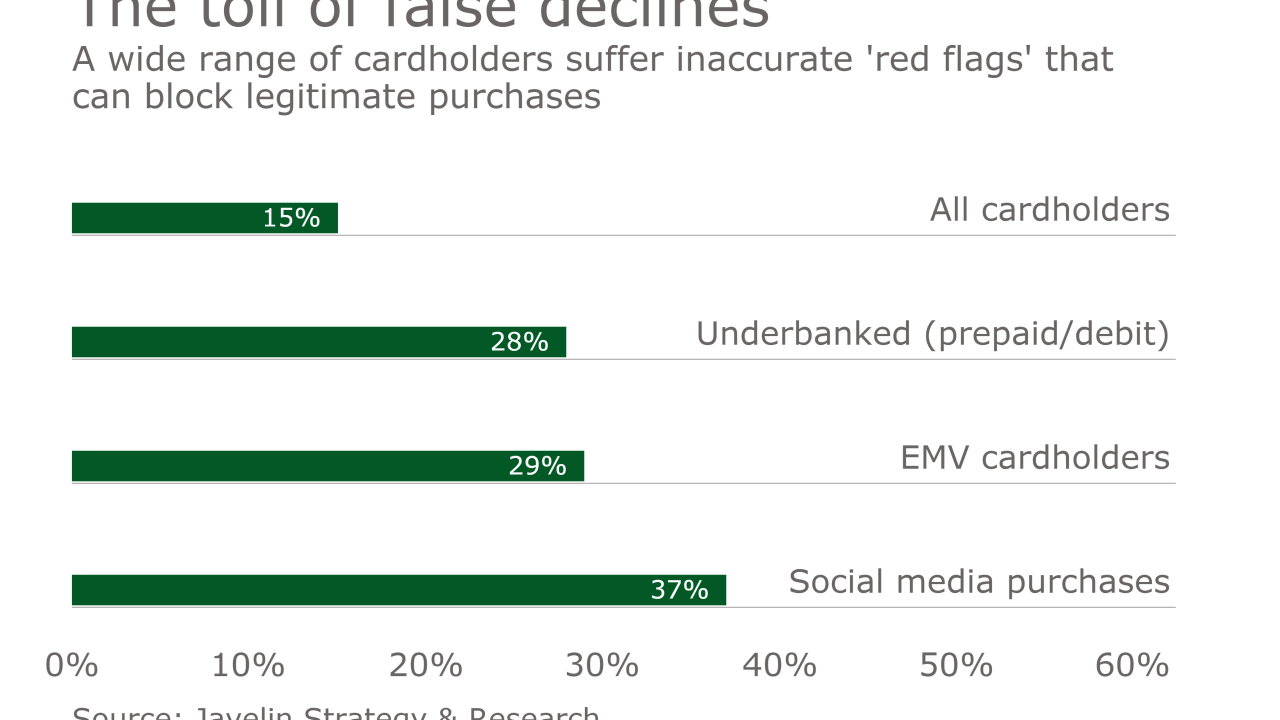

Inaccurate rejections of legitimate transactions aren't a new problem, and companies can't always use past transaction data to spot future risk on a large scale. Artificial intelligence can change the game.

December 1 -

Banks are warming to behavioral biometric software as one of an array of choices to prevent digital banking fraud.

November 18