-

Speaking at a press conference, Federal Reserve Chairman Jerome Powell said the bank’s risk management failures have required a dramatic overhaul of its processes.

March 20 -

The bank was fined $25 million for what the Office of the Comptroller of the Currency said was an inability to provide the discounts to all who were eligible.

March 19 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

Federal regulators normally hesitate even to name specific institutions, but the Office of the Comptroller of the Currency appears to be taking a different tack with Wells.

March 15 -

With regulators and policymakers studying their every move, financial institutions need to put more focus on preventing mistakes in the first place.

March 15 Ludwig Advisors

Ludwig Advisors -

House Financial Services Committee Chairwoman Maxine Waters said the CEO's 2018 bonus was "outrageous and wholly inappropriate" and called for his removal.

March 14 -

The digital lender and payments platform is tailoring its affinity banking services for a new market.

March 12 -

Two years ago, Ellen Richey became Visa's vice chairman and chief risk officer, propelled to this role by over a decade of work that fundamentally changed how the average consumer makes a payment. Richey plans to retire this summer, ending a 40-year career in law and risk management.

March 12 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

The lab works with more than 200 data scientists to create access to affordable credit and help financial firms match products to customers, the company says.

March 7 -

The CUSO will work with AffirmX, which provides compliance and risk management offerings, on product development.

March 7 -

The league will work with Quatrro Processing Service to provide member credit unions with access to emerging technologies to combat fraud.

March 7 -

Maria Teresa Tejada joined the bank Monday as chief strategic enterprise risk officer.

March 4 -

Leading a credit union can be exhausting. Implementing these best practices can help ease the burden.

March 1 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

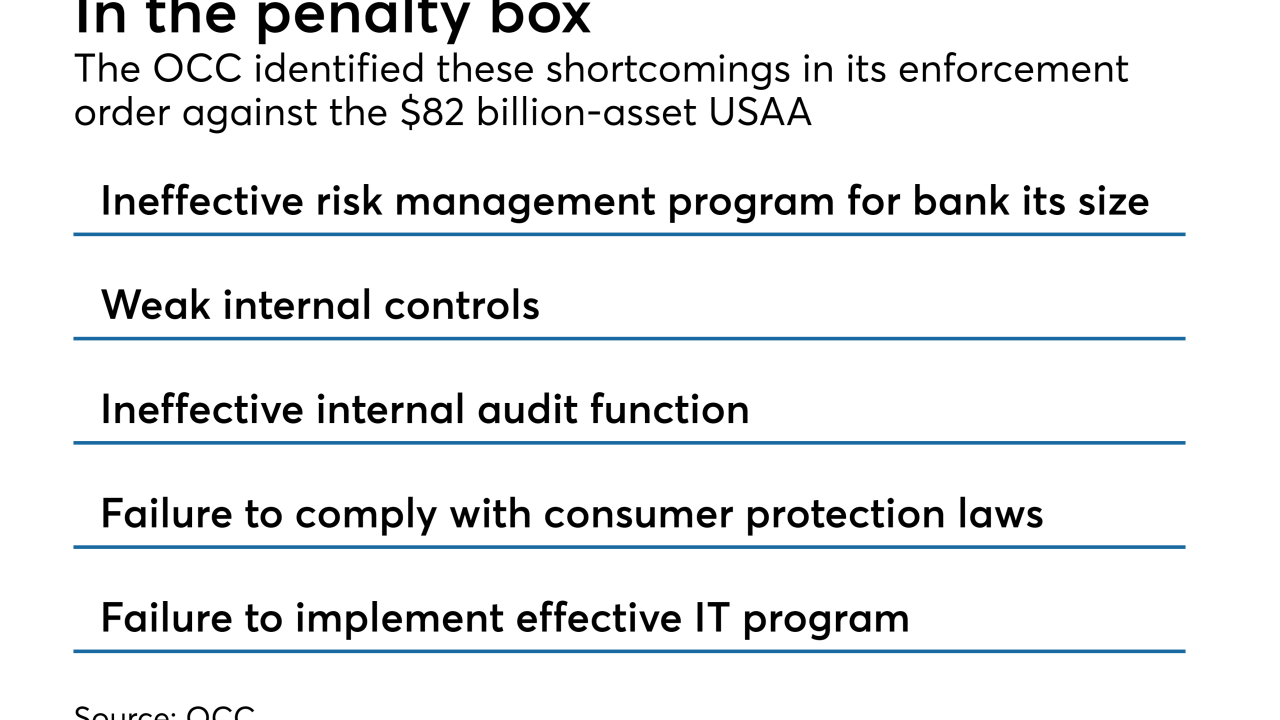

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

A MAPS Credit Union executive told the House Financial Services Committee her institution is proof credit unions and banks can safely serve the legal weed space.

February 13 -

The Federal Reserve’s top regulator, who assumed the chairmanship of the international board in November, said the FSB should explain the rationale behind its financial benchmarks while establishing new ones to combat emerging threats.

February 11 -

At least 14 suits have been filed this year alone accusing banks of operating websites that violate the Americans with Disabilities Act. Some banks prefer settlements to investments in technological overhauls, but experts say that strategy could be costlier in the long run.

February 10 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease banks and credit unions' fears about serving the cannabis industry.

February 6 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease bankers' fears about serving the cannabis industry.

February 6