-

A federal prohibition on marijuana has locked U.S. banks out of an industry surging toward $75 billion in sales. Who's catching that money? A small number of local credit unions, and the women who run their operations.

November 15 -

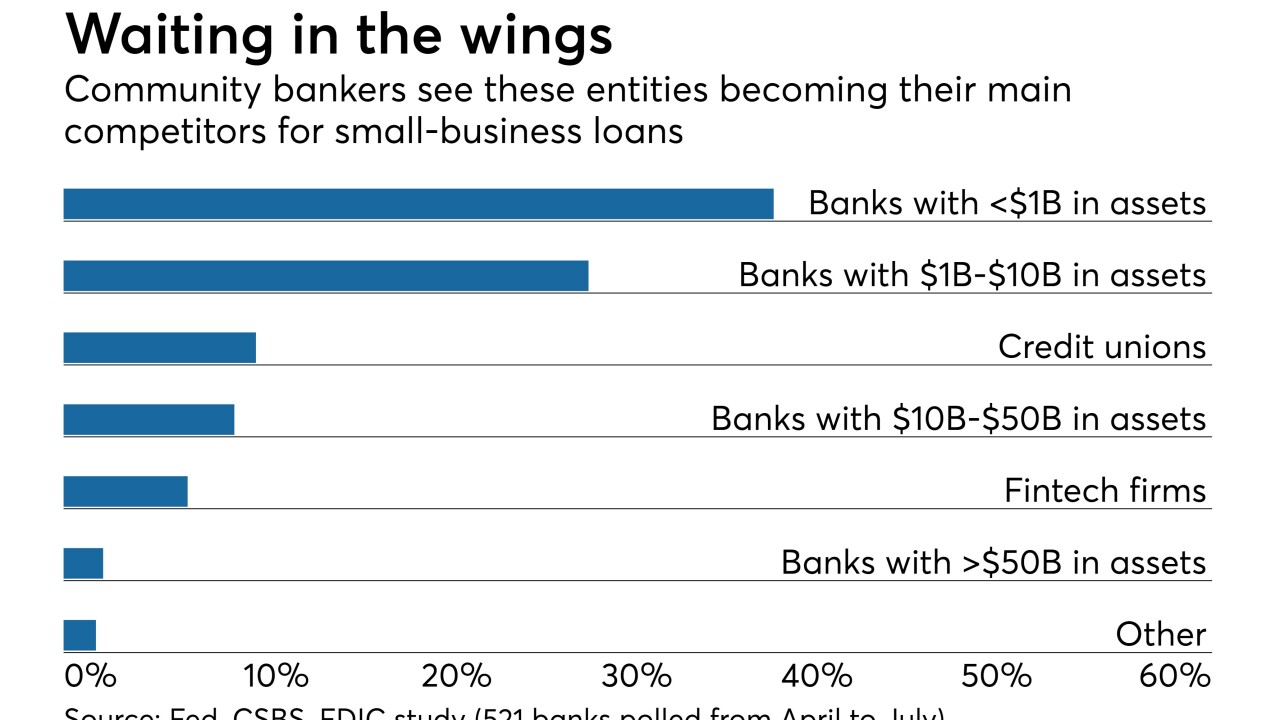

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

Azlo, Bento, Bank Novo and other neobanks argue they are better at helping small businesses, giving them extra attention, technology and advice.

October 31 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

The pledge comes as Fifth Third, which had previously committed $30 billion to community development, looks to close on its acquisition of MB Financial in Chicago.

October 29 -

Bank Novo isn't a business lender (lots of firms already do that) or an account provider (it has a bank partner for that). Instead, it provides small businesses tools to track and analyze their banking activities.

October 9 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

Readers parse JPMorgan Chase CEO Jamie Dimon's latest public comments, debate a California small-business lending bill, weigh the impact of open banking and more.

September 27 -

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

The legislation would help small-business owners better evaluate financing options by requiring updated disclosures.

September 25 Lending Club

Lending Club -

The legislation, which creates new disclosure standards for financing costs, could hamstring commercial lenders that offer revolving credit facilities.

September 19 Commercial Finance Association

Commercial Finance Association -

By improving STP processes for small business, these players will greatly expand their reach of serviceable suppliers, resulting in higher revenues and better service for the clients they serve, writes Blair Jeffrey, COO of Noventis.

September 7 Noventis

Noventis -

While there are automated reconciliation and straight-through processing (STP) solutions for large businesses, small businesses, in particular, continue to be underserved due to their smaller and less frequent invoices, contends Blair Jeffery, COO of Noventis.

September 4 Noventis

Noventis -

The move is important for new banks in states like California, where a small-business lending program requires a three-star rating from the agency.

August 24 -

Visa has continued to establish a more complete B2B offering, working through its Visa B2B Connect blockchain payments service to help companies establish application interfaces and platforms to handle business transactions more efficiently.

August 8 -

The partnership targets home improvement and some health care merchants that accept American Express. These merchants will be able to drive more sales by providing financing options for large purchases.

August 6 -

Paying international suppliers through a bank portal is a painful, expensive process that creates unnecessary friction for burgeoning cross-border trade. There are better fintech alternatives, writes Karla Friede, CEO of Nvoicepay.

July 31 Nvoicepay

Nvoicepay -

Since the marketplace model is relatively new, the vast majority of the merchants selling through that channel are new too, meaning they do not have the track record that banks look for when providing loans, writes Keith Smith, CEO of Payability.

July 27 Payability

Payability -

The Boston bank said the digital lending platform has cut down the time it takes to deliver loan decisions by roughly 40%.

July 23 -

An integrated payments and receivables solution is helping two Michigan credit unions boost engagement with small business members.

July 20