-

Better access to credit, an improving revenue picture and promises of regulatory relief are bolstering the confidence of small-business owners.

March 13 -

Wells Fargo community banking head Mary Mack is seeking three new deputies and shaking up regional leadership of the division she inherited after a bogus-account scandal.

March 8 -

The bank and cloud accounting platform will offer services to mutual customers via API.

February 15 -

People are warming up to mobile payment apps like Apple Pay and Samsung Pay, but concerns over fraud and ID theft could still pose headwinds.

February 2 Sage Payment Solutions

Sage Payment Solutions -

President-elect Trump has nominated Linda McMahon, a co-founder of the World Wrestling Federation, to run the Small Business Administration for the next four years. If confirmed, McMahon, a Republican, will inherit an agency that has supported record loan volume lately, but that many bankers still view as too bureaucratic and inefficient. We asked bankers and small-business advocates what is working well at the SBA, what they would like to see improved, and what else the Trump administration could do to stimulate small-business growth. Here's what they had to say.

January 18 -

Banks have traditionally used consumer products to serve small businesses. The growth of alternative payment options means banks may lose customers, particularly among young business owners.

January 13 Bill.com

Bill.com -

Integrations with software as a service providers are enabling small online retailers to partner with and compete against the mega-retailers across all major channels.

January 10 BigCommerce

BigCommerce -

The National Credit Union Administration acted appropriately, within its legal authority, when issuing its member business lending rule.

December 21

-

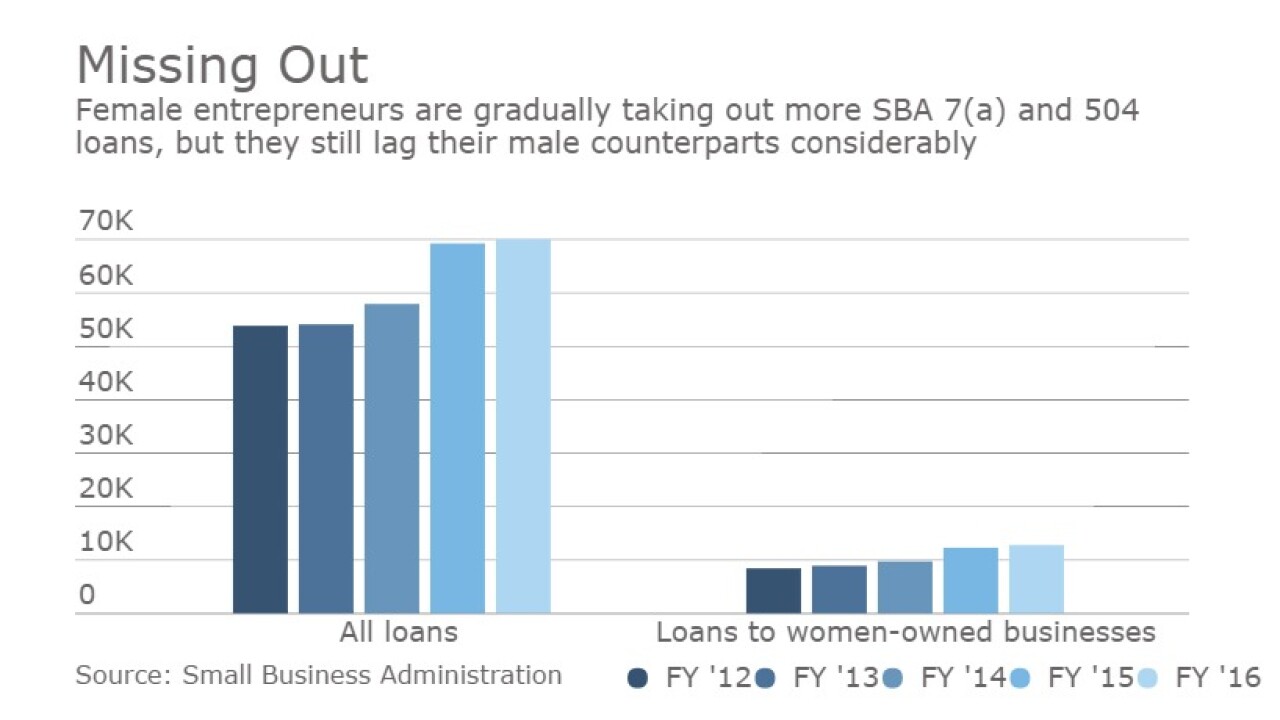

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

Following the passage of the November ballot initiative, it is hugely important that cannabis businesses in the nation's largest state be able to secure bank accounts, at a minimum.

December 20 Harris Bricken LLP

Harris Bricken LLP -

Just weeks after it shook up its executive ranks and suspended efforts to pursue new customers, the New York-based business lender confirmed Friday that it is eliminating dozens of jobs.

December 16 -

Capital Business Credit, a New York-based business finance company, has been acquired by a San Francisco-based lender.

December 15 -

The National Credit Union Administration rule expanding member business lending introduces new risks and lacks legal basis.

December 15 Calvert Advisors LLC

Calvert Advisors LLC -

BlueVine, an online small business lender based in Redwood City, Calif., said Wednesday that it has closed a $49 million funding round.

December 14 -

OnDeck Capital, the New York-based online small-business lender, has obtained a $200 million revolving debt facility from Credit Suisse.

December 9 -

The recent shake-up at CAN Capital could spark greater scrutiny of a sector that has drawn comparisons to the bubble-era subprime mortgage market.

December 1 -

CAN Capital said Tuesday that CEO Daniel DeMeo has been placed on a leave of absence. Parris Sanz, the company's chief legal officer, is now serving as acting CEO.

November 29 -

Huntington Bancshares in Columbus, Ohio, said it plans to add 1,000 jobs by 2024 at a new office complex in Columbus and lend $300 million to low- and moderate-income communities in the city over the next five years.

November 22 -

Cody Wilson, inventor of the world's first 3D-printed handgun, has struggled to keep his radical business going after banks and payments companies repeatedly cut him off. His story offers an unusually detailed window onto the dynamics of de-risking.

November 21 -

A bill looming in Congress would require the Internal Revenue Service to accept electronic transmission of lending-related forms, which could speed up the lending process by days.

November 21 Mirador

Mirador