-

The legislation, which creates new disclosure standards for financing costs, could hamstring commercial lenders that offer revolving credit facilities.

September 19 Commercial Finance Association

Commercial Finance Association -

By improving STP processes for small business, these players will greatly expand their reach of serviceable suppliers, resulting in higher revenues and better service for the clients they serve, writes Blair Jeffrey, COO of Noventis.

September 7 Noventis

Noventis -

While there are automated reconciliation and straight-through processing (STP) solutions for large businesses, small businesses, in particular, continue to be underserved due to their smaller and less frequent invoices, contends Blair Jeffery, COO of Noventis.

September 4 Noventis

Noventis -

The move is important for new banks in states like California, where a small-business lending program requires a three-star rating from the agency.

August 24 -

Visa has continued to establish a more complete B2B offering, working through its Visa B2B Connect blockchain payments service to help companies establish application interfaces and platforms to handle business transactions more efficiently.

August 8 -

The partnership targets home improvement and some health care merchants that accept American Express. These merchants will be able to drive more sales by providing financing options for large purchases.

August 6 -

Paying international suppliers through a bank portal is a painful, expensive process that creates unnecessary friction for burgeoning cross-border trade. There are better fintech alternatives, writes Karla Friede, CEO of Nvoicepay.

July 31 Nvoicepay

Nvoicepay -

Since the marketplace model is relatively new, the vast majority of the merchants selling through that channel are new too, meaning they do not have the track record that banks look for when providing loans, writes Keith Smith, CEO of Payability.

July 27 Payability

Payability -

The Boston bank said the digital lending platform has cut down the time it takes to deliver loan decisions by roughly 40%.

July 23 -

An integrated payments and receivables solution is helping two Michigan credit unions boost engagement with small business members.

July 20 -

Citi and other banks are investing in automation aimed at speeding up the old-fashioned process for institutional clients' receivables and payables.

July 20 -

To improve videoconferencing adoption, banks are advised to focus on one particular group of clients.

July 19 -

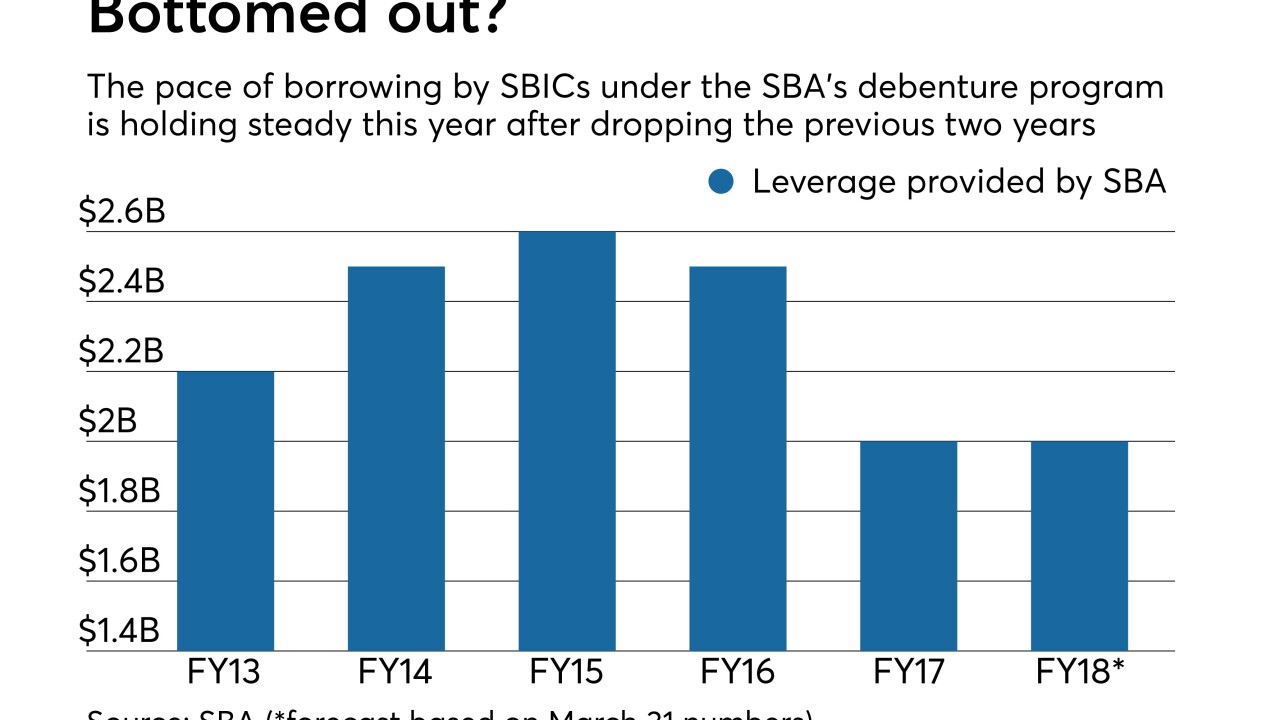

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

A cash management offering by Mastercard and Strands is the latest example of new answers to commercial clients' demands for better digital services.

July 9 -

The Illinois commercial bank gained a new role when it realized it shared the same digital transformation challenges as its customers.

June 29 -

It usually costs small businesses a lot of time and money to calculate their own value. TD Bank is offering them a free digital tool that performs the task quickly.

June 28 -

Businesses are accustomed to on-demand processes and easy digital transactions in the consumer app economy, and now expect the same experience in their business supply chains, according to Jamshed Khan, tech chief at LeaseQ.

June 27 LeaseQ

LeaseQ -

The two companies have worked together for 22 years, with the pending card designed to streamline experience to keep more B2B commerce in-house.

June 26 -

In a new initiative announced Friday, Bank of America said that it will work with several nonprofits to source a pipeline of local talent in its markets.

June 8 -

California lawmakers have voted to authorize the establishment of state-chartered banks for the limited purpose of serving the marijuana industry.

June 1