-

Ronald Rubin, who was a CFPB enforcement attorney, will head an office overseeing nearly 200 state-chartered banks.

February 26 -

A group of state regulators has signed off on 14 recommendations, developed by the fintech industry, aimed at streamlining multistate licensing and supervision.

February 14 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The lawmakers said the lack of someone with a state supervisory background among the agency's three inside board seats violates federal law.

January 31 -

Chris D’Angelo, the CFPB's associate director of supervision, enforcement and fair lending, is leaving the bureau after eight years to become a chief deputy attorney general in New York state.

January 24 -

The agency refuted claims by the Conference of State Bank Supervisors that the OCC was overstepping its authority.

January 8 -

Before the financial crisis, federal and state regulators unabashedly pitched their charters to banks as the better choice. That's happening again, despite warnings that such jousting might result in lax oversight.

January 6 -

Denice Schultheiss became director of the Office of Credit Unions in Michigan after John Kolhoff left to lead the Texas Credit Union Commission.

January 2 -

Banks hoping to make working with the cannabis industry easier saw a positive sign this week when Congress removed the prohibition on a less potent substance.

December 19 -

The two institutions had to change their names after a law passed in the Hawkeye State that forbid CUs from using a state university in their names.

December 18 -

A federal prohibition on marijuana has locked U.S. banks out of an industry surging toward $75 billion in sales. Who's catching that money? A small number of local credit unions, and the women who run their operations.

November 15 -

In a speech in Japan, the comptroller of the currency urged overseas institutions to consider a “single regulatory framework” instead of applying to multiple states.

November 14 -

John Kolhoff will lead the Credit Union Commission of Texas starting in early December.

October 16 -

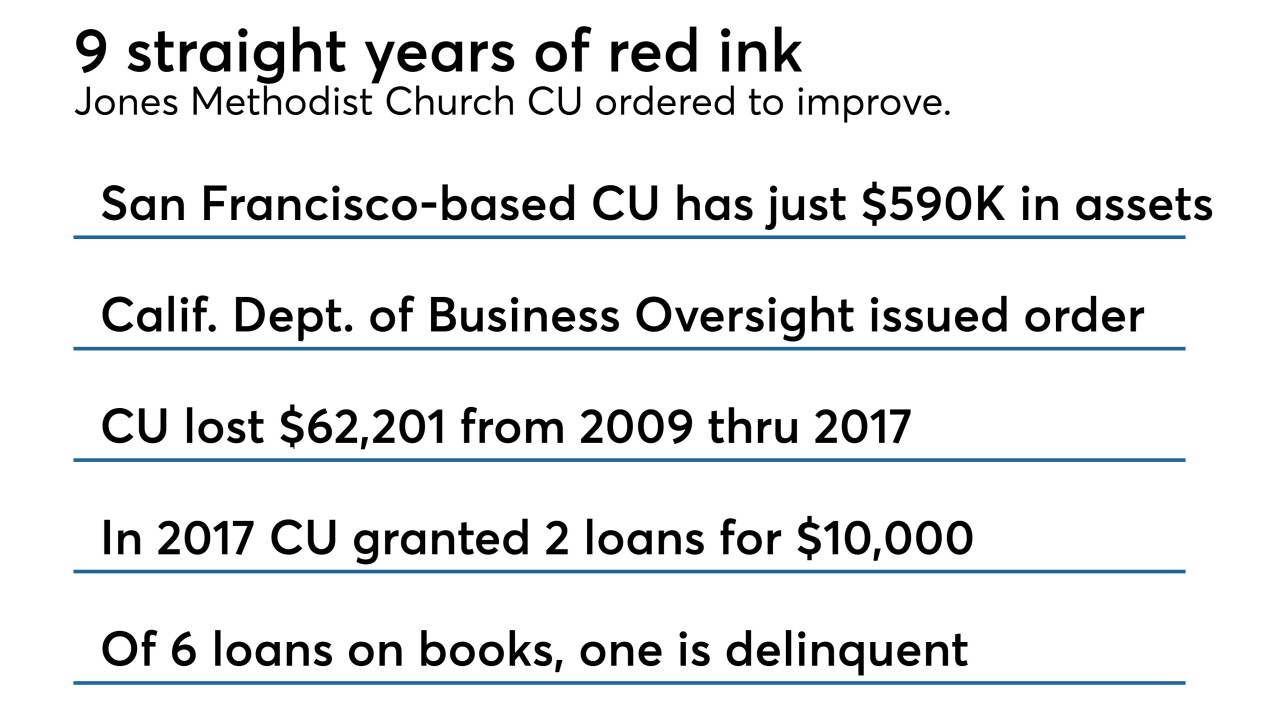

Jones Methodist Church Credit Union has been ordered to address "unsafe or unsound practices" following nine years of losses and other problems.

October 10 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

Gov. Jerry Brown’s administration sent letters Wednesday to 20 nonbank lenders that charge triple-digit annual percentage rates to try to determine if their use of online referrals is steering borrowers into larger loans than they want or need.

September 26 -

The Dodd-Frank Act requires that one of the five nonvoting members of the Financial Stability Oversight Council be a state banking supervisor.

September 7 -

If Gov. Jerry Brown signs the legislation headed to his desk, it would be the first law of its kind in the U.S. It is designed to allow small-business owners to make comparisons between offers in the often bewildering world of online business lending.

September 5 -

State Treasurer John Chiang says that Wells Fargo is keeping patterns of abuse hidden from view by resolving customer disputes through private arbitration.

August 23 -

Several states pledged to compensate for a slowdown in enforcement at the Consumer Financial Protection Bureau under Mick Mulvaney, but their efforts have been complicated by tight budgets and doubts over whether such initiatives are necessary.

August 20