-

The Cleveland company will exit indirect auto lending and close branches so it can devote more resources to mortgages, student loans and other relationship-driven, digital-friendly businesses.

October 21 -

The industry can gain lifelong members in this demographic by validating their financial concerns as the economy struggles and offering guidance without judgment.

October 9 FindCreditUnions.com

FindCreditUnions.com -

Credit unions need to improve their processes to ensure the problems that have arisen with credit reporting during the coronavirus don't happen again.

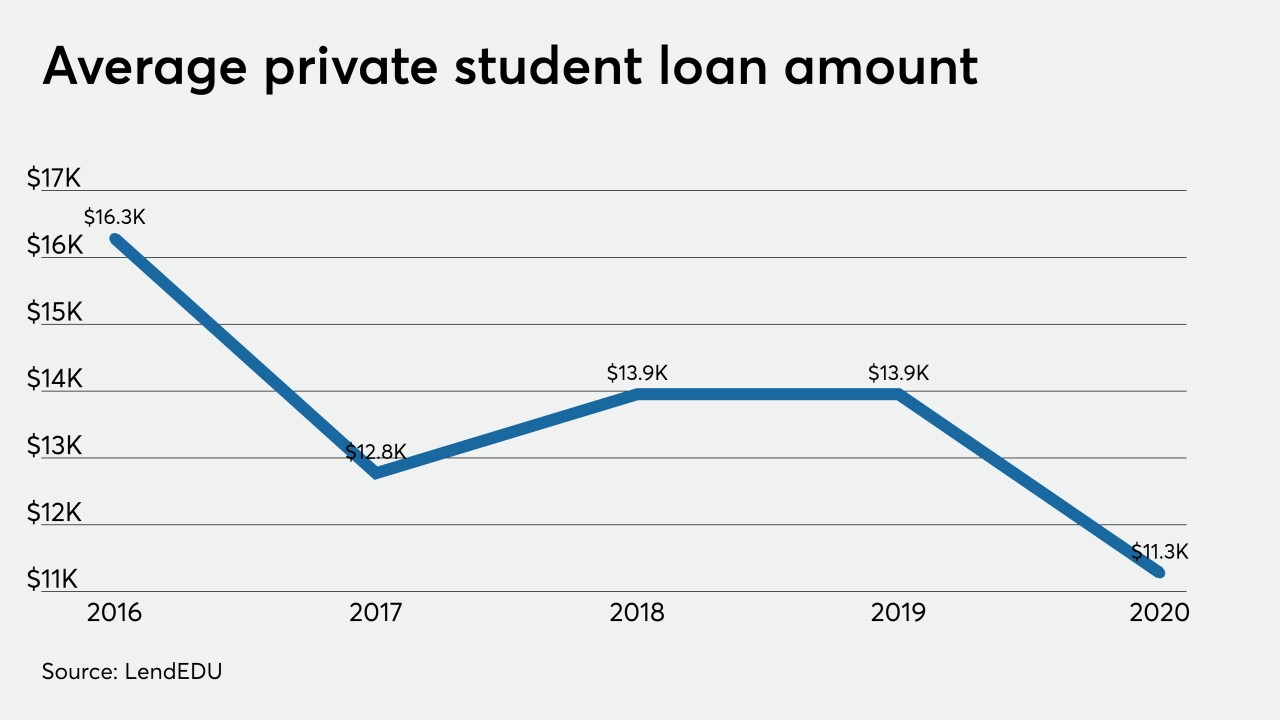

September 22 LendEDU

LendEDU -

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

The student loan company had said a three-year-old lawsuit alleging consumer abuses was superseded by a similar CFPB suit. Here’s why the 3rd U.S. Circuit Court of Appeals disagreed.

July 27 -

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23