-

A group that includes the private equity firms Apollo Global Management and Blackstone Group is in talks to acquire Wells Fargo’s student loan portfolio, according to people familiar with the matter.

December 14 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

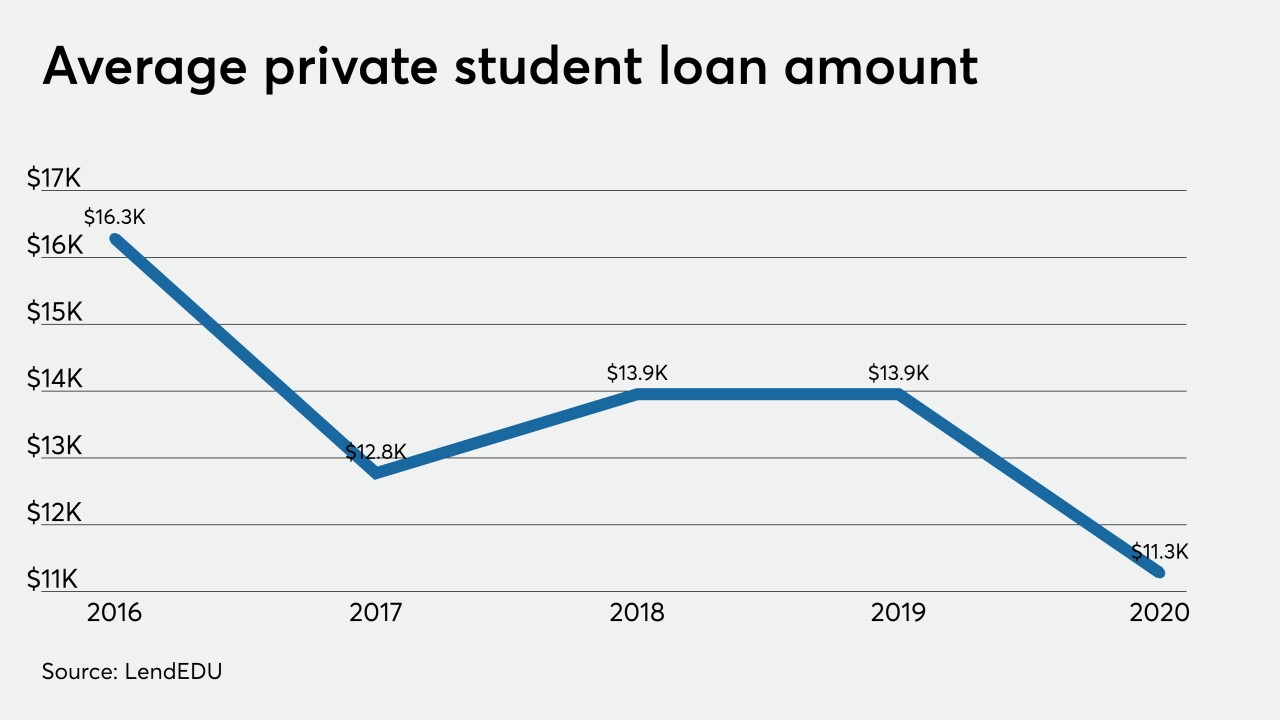

Jobs will be harder to find for graduates, and there are new underwriting platforms that can better predict students' future income in their chosen field.

December 1 Climb Credit

Climb Credit -

Jobs will be harder to find for graduates, and there are new underwriting platforms that can better predict students' future income in their chosen field.

November 16 Climb Credit

Climb Credit -

Wells Fargo is exploring a sale of its corporate-trust unit that could fetch more than $1 billion and is considering whether to find a buyer for its student loan portfolio, according to people familiar with the matter.

October 26 -

With the sector facing serious headwinds — from declining enrollment during the pandemic to the prospect of a Biden administration making college free for many families — the departure of a major player could be a shot in the arm for the likes of Discover and Sallie Mae.

October 22 -

The Cleveland company will exit indirect auto lending and close branches so it can devote more resources to mortgages, student loans and other relationship-driven, digital-friendly businesses.

October 21 -

The industry can gain lifelong members in this demographic by validating their financial concerns as the economy struggles and offering guidance without judgment.

October 9 FindCreditUnions.com

FindCreditUnions.com -

Credit unions need to improve their processes to ensure the problems that have arisen with credit reporting during the coronavirus don't happen again.

September 22 LendEDU

LendEDU -

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

The student loan company had said a three-year-old lawsuit alleging consumer abuses was superseded by a similar CFPB suit. Here’s why the 3rd U.S. Circuit Court of Appeals disagreed.

July 27 -

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Wells Fargo is pulling back from student lending as the surge in coronavirus cases threatens to further disrupt higher education and the broader U.S. economy.

July 2 -

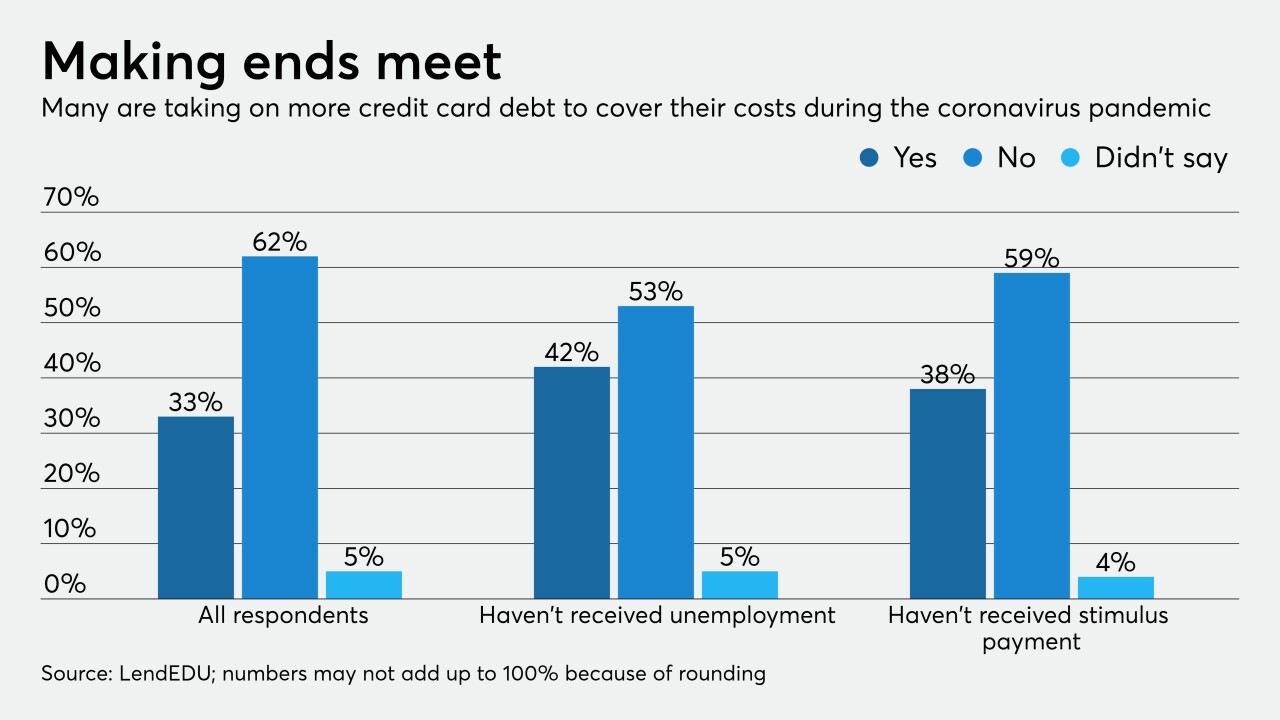

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5