Technology

Technology

-

The bank's Kinexys blockchain unit processes a fraction of the institution's overall payment volume. It's betting that an appetite for the technology's promise of speedy processing and liquidity will make that larger.

January 5 -

Mike Dargan, former chief operations and technology officer for UBS, stepped down at the end of 2025 and will become the CEO of neobank N26 this spring.

January 2 -

The lender traps consumers in an "exploitative cycle of debt," Brandon Scott said.

January 2 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2 -

Articles about the AI deployments of big banks and of scammers generated clicks from American Banker readers.

January 1 -

Fintechs sought to acquire the rights and privileges of bank charters in various ways this year, from de novo applications to buying up banks.

December 31 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30 -

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

December 30 -

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

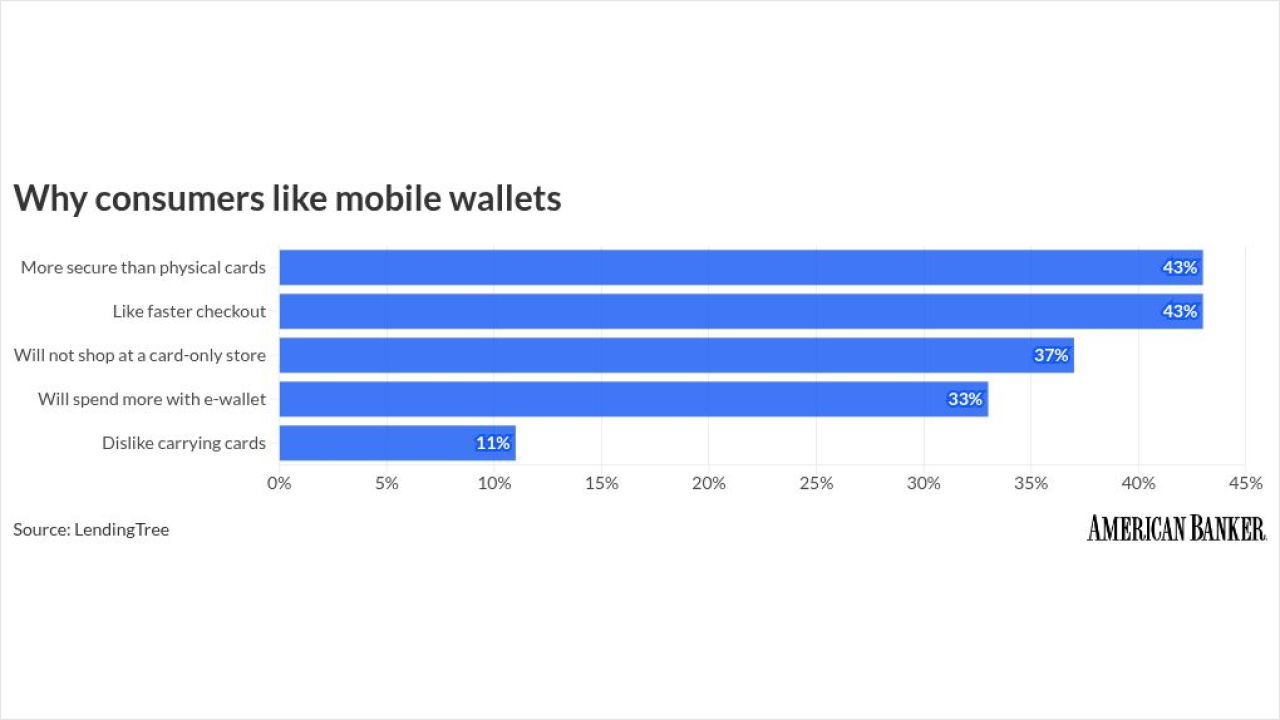

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26 -

CodeBoxx Academy is filling a void for banks and other companies that desperately need AI experts. Peret's time behind bars uniquely informed how he runs the school, he says.

December 25 -

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24 -

Michigan State University Federal Credit Union avoided $2.57 million in fraud exposure through blocking AI deepfake fraud calls with Pindrop products.

December 23 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

An American Banker survey found that bankers think the industry isn't prepared for growth in artificial intelligence and digital assets.

December 23 -

Noelle Acheson shares her top 4 stablecoin trends of 2025 and what they taught us about the changing nature of money.

December 23