-

The Credit Union Cherry Blossom Run, the industry's biggest annual philanthropic event, saw a nearly 10% increase in giving this year despite being canceled.

September 15 -

The company and its global peers have seen their profitability hurt by half a decade of negative interest rates, which effectively make banks pay for holding clients’ cash.

September 9 -

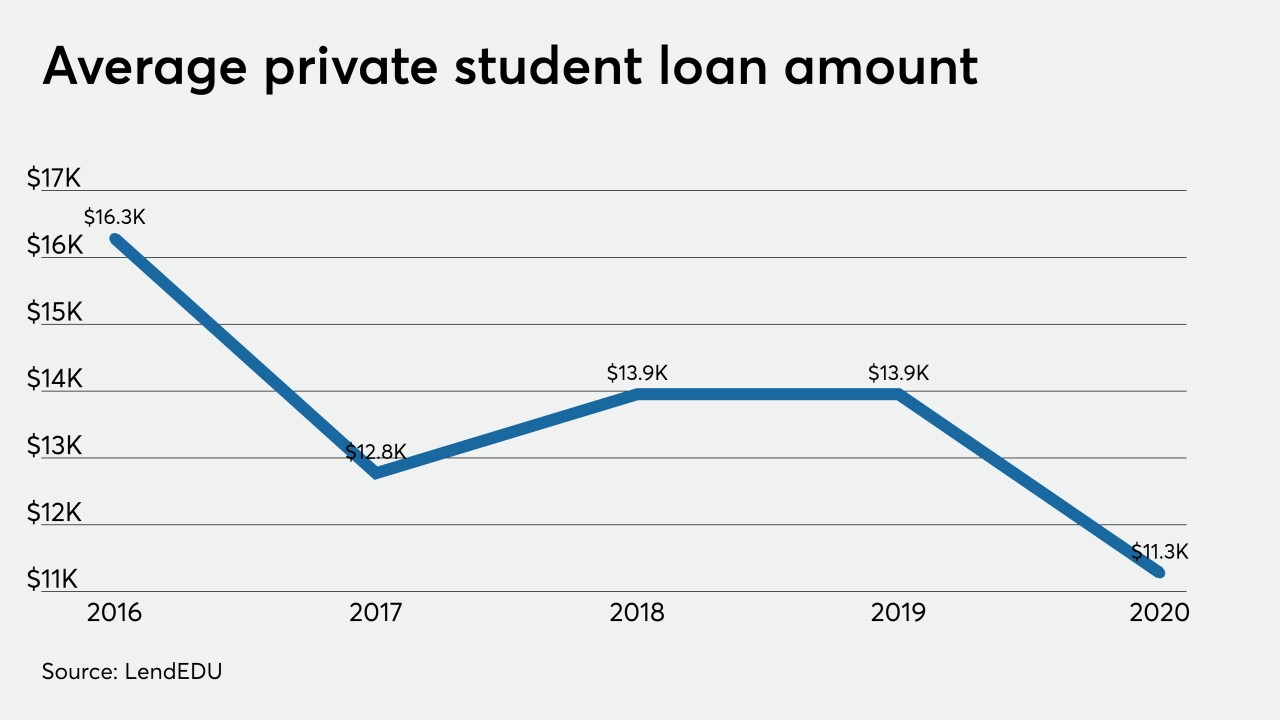

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1 -

CIT inherited the business with its purchase earlier this year of Mutual of Omaha Bank.

September 1 -

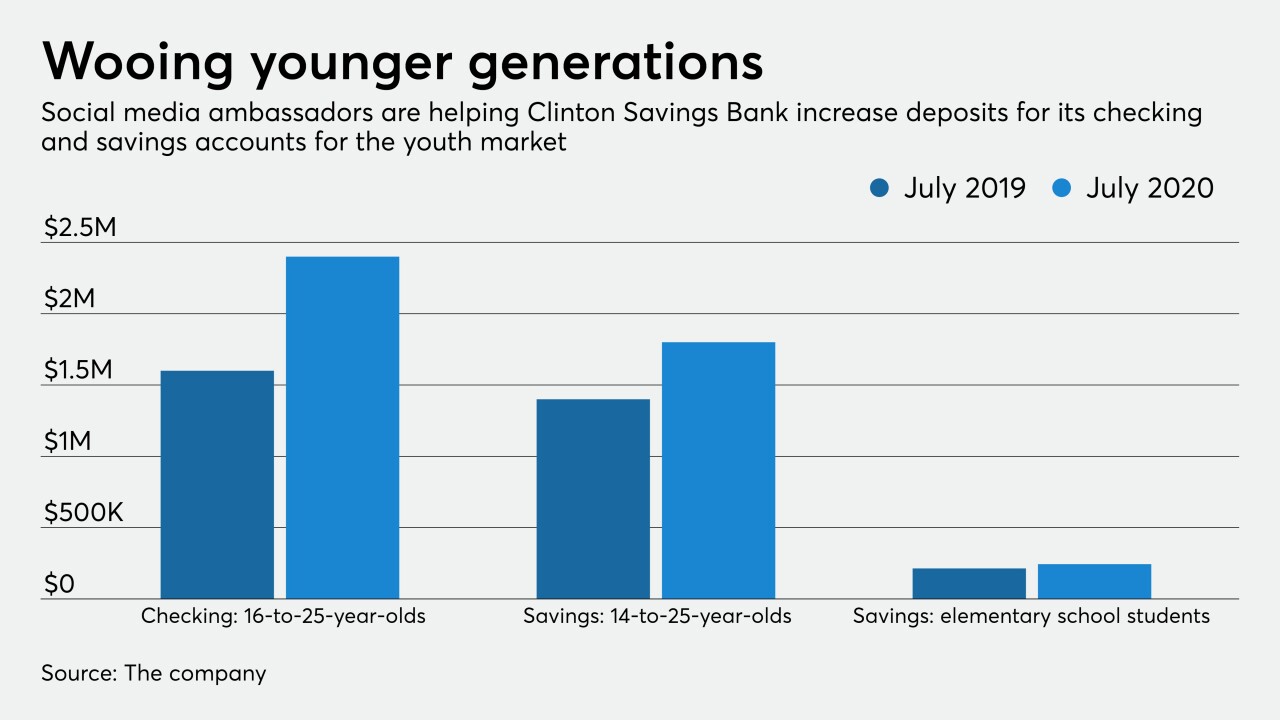

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

JPMorgan Chase is funding a two-year initiative in which Commonwealth, a nonprofit, will study the impact of artificial intelligence and other technologies on the financially vulnerable.

August 18 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 18 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 17 -

From student-run branches to courses on credit, budgeting and more, one of the industry's longest-running partnerships is being upended as districts across the country move to virtual learning.

August 12 -

Credit card balances declined most sharply as consumers cut back their spending due to the coronavirus pandemic and associated shutdown orders, the New York Fed said Thursday. But delinquencies also fell across all debt categories, thanks to government and lender relief efforts.

August 6

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)