-

Our second monthly survey found a smooth transition to remote work and digital customer access channels — but technology issues still arose. The pandemic has highlighted the importance of having a strong digital presence across all retail sectors, including financial services.

May 15 -

Our second monthly survey found a smooth transition to remote work and digital customer access channels — but technology issues still arose. The pandemic has highlighted the importance of having a strong digital presence across all retail sectors, including financial services.

May 15 -

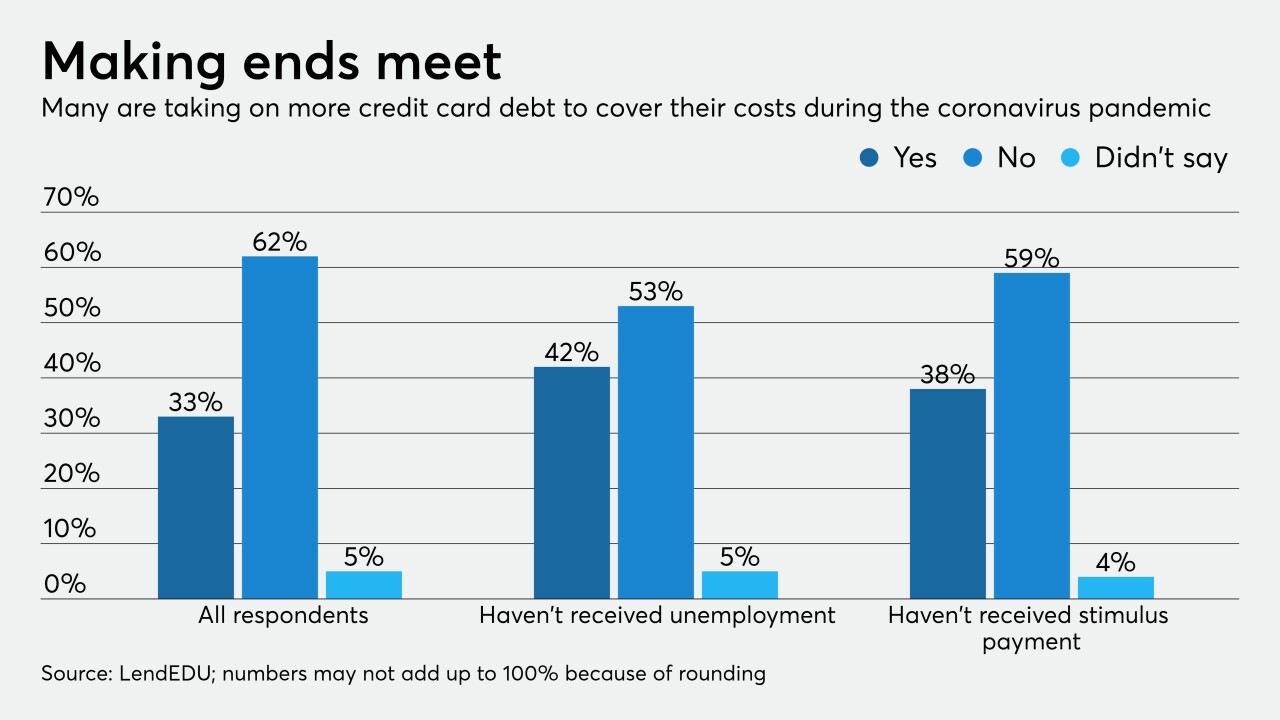

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

In a still male-dominated industry, does the network help attract and keep more women at the firm? CEO Shirl Penney says yes and has the results to prove it.

May 11

-

Institutions need to think about revenue streams and portfolio diversification as the coronavirus affects much of the U.S. economy.

May 8 Alliant Credit Union

Alliant Credit Union -

The pandemic has fostered the distribution of even more bad information on social media. Banks and other companies need to step up to solve the problem — including support of tougher legal restrictions on internet content.

May 8 Sustainability Center of BNP Paribas Asset Management

Sustainability Center of BNP Paribas Asset Management -

Through its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

May 7 -

Industry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.

May 7 -

The Illinois company will sell Bates Cos. to an undisclosed buyer less than two years after buying the wealth management firm.

May 4 -

Funneling fees from emergency loans to feed the hungry. Supporting psychological counseling for health care heroes and financial advice for the poor. Backing retrofits of customer operations to produce protective gear for front-line medical personnel. Bankers and financial educators have tossed out the traditional playbook to help clients and communities in crisis.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

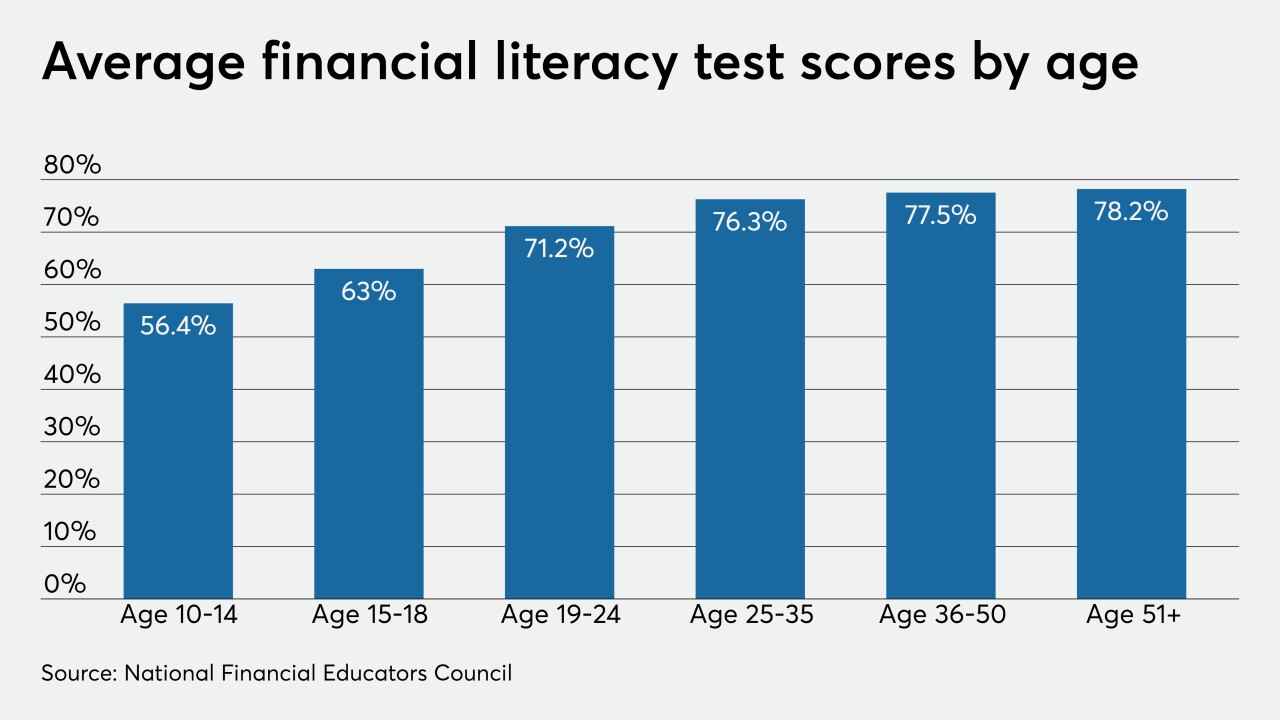

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8 -

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business -

The regulator will provide $4 million in loans and $800,000 in grants so institutions can assist their communities during the pandemic.

March 31 -

They are under less pressure from policymakers to halt repurchase plans, but some have already hit the brakes and others may unofficially do so if the pandemic worsens.

March 16 -

Sen. Sherrod Brown of Ohio, the top Democrat on the Banking Committee, said financial institutions "need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

March 12 -

Investors worry the drop in crude prices could spark a rash of defaults; the bank denies it opened accounts without customer permission to meet sales quotas.

March 10