-

Goldman Sachs CEO David Solomon sticks to rogue banker defense in scandal; bank misses earnings, revenue estimates.

January 17 -

American homeownership has been on the decline, and Federal Reserve researchers point to the high cost of college as one culprit.

January 16 -

The company's fourth-quarter results were also stymied by costs tied to severance and litigation, along with investments in technology.

January 16 -

The Financial Solutions Lab, a joint initiative, has announced the winners of its annual competition to identify solutions to consumer financial challenges, this year focusing on startups dedicated to improving financial health in the workplace.

January 15 -

The San Francisco company's quarterly earnings also reflected higher wealth management revenue.

January 15 -

Its savings, budgeting, spending and goal-setting tools, combined with artificial intelligence to add smart insights and advice, are a good example of how regional banks are trying to distinguish their mobile products from those of bigger banks with larger tech budgets.

January 14 -

From canned food drives to sponsoring a 5k race, here is a look at how credit unions are making a difference.

January 11 -

Three credit unions will receive $18,000 each and work with the Center for Financial Services Innovation to track the strength of certain products and services.

January 11 -

Shareholder approval, usually a formality, is far from guaranteed when an acquirer's share price is sliding.

January 10 -

Its data-driven financial management services for workers who live paycheck to paycheck — and a contract with Walmart — have attracted executives from Facebook, Slack and elsewhere as well as a major investment from the head of Box.

January 10 -

New CEO Ronald O'Hanley is pushing to reduce expenses, automate more functions and simplify the organizational structure.

January 9 -

There had been a cascade in recent days of downgrades and other negative forecasts in connection with big banks, but some analysts on Wednesday picked up the industry's argument that fundamentals are stronger than the markets are giving banks credit for.

January 9 -

More companies are adding financial health programs to their benefits, creating a market that fits with one of the common uses consumers have found for prepaid cards.

January 7 -

The Pennsylvania company has agreed to buy Forney Financial Solutions.

January 3 -

-

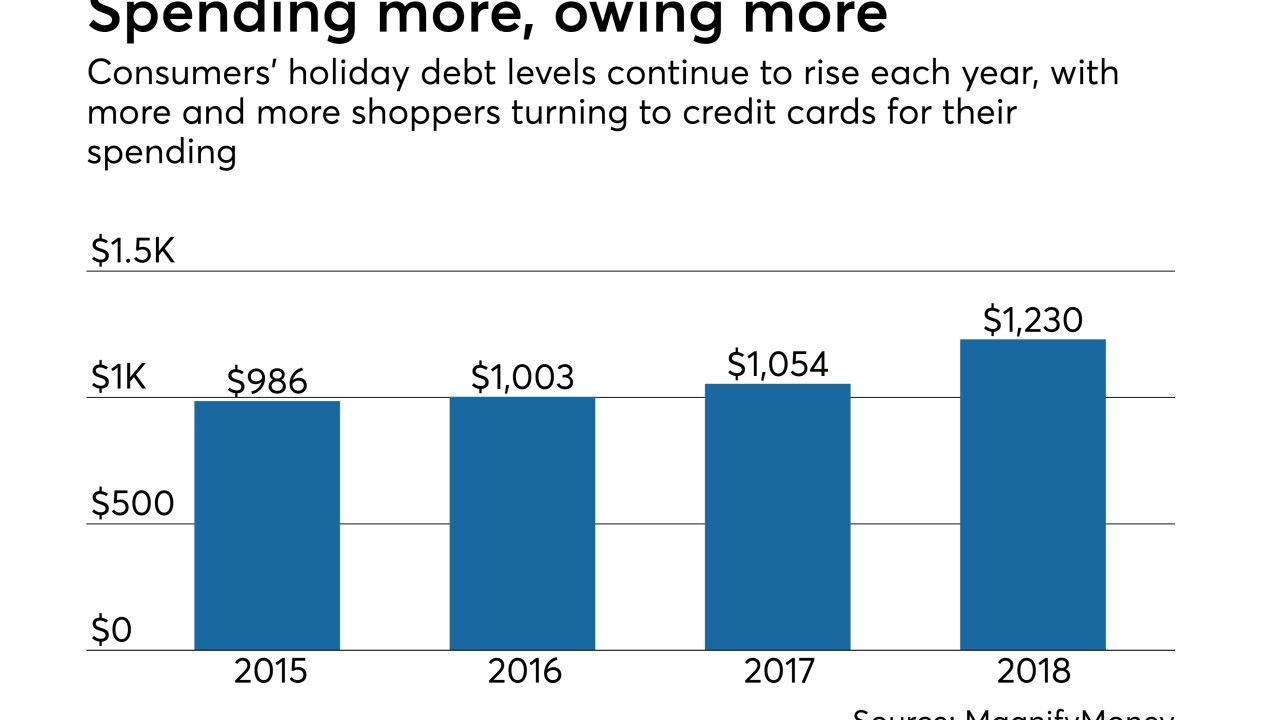

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

Rushing to copy the Amazon experience, banks and fintechs are focused on simplifying financial services online. A Georgia Tech researcher says that approach is risky.

December 27 -

From stress tests to tailoring the Dodd-Frank Act to the Volcker Rule, the banking agencies have a number of important proposals to finalize in the coming year. But there are several potential obstacles that could throw those plans off track.

December 26 -

Investors are spooked by banks' exposure to oil and other sectors threatened by a global slowdown as well as by policy uncertainties, but banks argue credit quality is strong and recession fears are exaggerated.

December 26 -

It was a year to remember for women executives at SunTrust and Amex’s new CEO, and one to forget for Wells Fargo and investors in bank stocks.

December 25