As more banks sell around Miami, those that remain are focusing on tech upgrades and diversifying their loan portfolios to remain relevant.

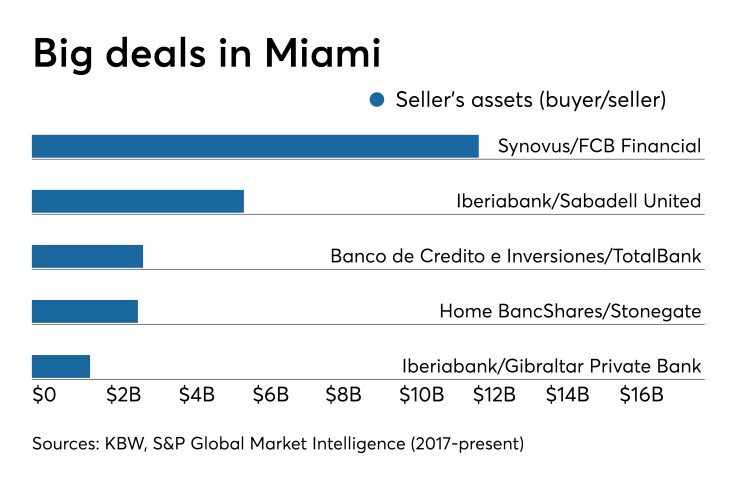

There have been 24 whole-bank deals in Florida since early 2018, with several Miami-area banks among the sellers. They include TotalBank, FCB Financial and Gibraltar Private Bank.

Another seller was TransCapital Bank in Sunrise, Fla., which agreed in March to be sold to the $655 million-asset Power Financial Credit Union in Pembroke Pines.

While TransCapital was profitable, the $204 million-asset bank saw the influx of bigger competitors and knew it would need to make a major investment in technology to keep up, said William Himes, its president and CEO. Doing so would have required a capital infusion.

“Technology is the big thing,” Himes said. “People don’t need the brick and mortar today.”

Technology has surpassed regulation as the top driver for small bank M&A, Himes said. Bigger banks are starting to merge, stoking fears that banks the size of TransCapital will struggle to find buyers.

U.S. Century Bank in Doral, Fla., is interested in making acquisitions because scale has become an important way to offset technology spending, said Luis de la Aguilera, U.S. Century's president and CEO. He said there are attractive sellers that the $1.2 billion-asset bank would be interested in buying — at the right price.

“Community banks are not the innovators of technology,” de la Aguilera said. “But we have to be as cutting edge as possible.”

Millennials aren't the only customers driving change. U.S. Century's older clients are also demanding for options for their iPhones, de la Aguilera said.

Banesco USA in Coral Gables, Fla., recently received more than $11 million in capital, which it plans to reinvest in new mobile and online banking platforms.

Jorge Salas, the $1.3 billion-asset bank's president and CEO, said it embarked on a series of new fintech partnerships last year. In April it announced an alliance with Plug and Play that allows Banesco to leverage the Silicon Valley company's platform to upgrade its consumer and commercial offerings, Salas said.

The driving force behind the upgrades is Miami's booming economy, bankers said.

The city is a growing source of deposits, which increased by 35% over the five-year period that ended last June, according to data from the Federal Deposit Insurance Corp.

Miami also boasts a diverse population and a good number of startups.

“It’s a very vibrant place,” Salas said.

To be sure, bankers must remain vigilant in Miami, which was hit hard during the last recession after the

Miami has more professionals with experience in BSA issues than other markets "because they’ve been through the wars,” said Ken Thomas, president of Community Development Fund Advisors. "I know companies ... poach South Florida BSA people because they’re so well trained.”

While many South Florida banks remain active with commercial real estate, several are trying to diversify.

U.S. Century, for instance, is looking to do more commercial and industrial lending, while participating in Small Business Administration programs. The bank is seeking owner-operated businesses and professionals such as doctors, lawyers and accountants, de la Aguilera said.

In March the bank started a group focused on C&I, with an emphasis on health care organizations, nonprofits and aviation firms. The company hired Juan Rincon from Citigroup’s commercial bank in Miami to lead the group.

Banesco also aims to make more C&I loans, given intense competition for real estate deals. C&I relationships are important sources for deposits, Salas said.

Salas said banks that are Banesco's size have an advantage with $10 million to $20 million loans. He said those credits are often too small for big banks, and smaller lenders can’t compete on rate.

Lending struggles at small banks may have contributed to the recent spate of buyouts, which have led to market disruption.

M&A fallout presents an opportunity for the local banks that remain, as customers of acquired banks become frustrated, de la Aguilera said.

“I’ve run into clients that are at a bank that’s been merged and you hear horror stories about service and technology,” he said.