What bankers can be thankful for this year

Consider, first of all, the recent legislative action on Capitol Hill. After the surprise Republican sweep during last year's elections, bankers began putting

Regulatory agencies in Washington are also becoming a more business friendly. In early February, days after the administration took office, the

Important personnel changes have begun to take shape this month. CFPB Director

In addition to public policy matters, business is going well. Big banks such as

So, bankers, say a word of thanks for the current business and political environment. As the industry — and the country as a whole — learned last year during the election, things can change quickly.

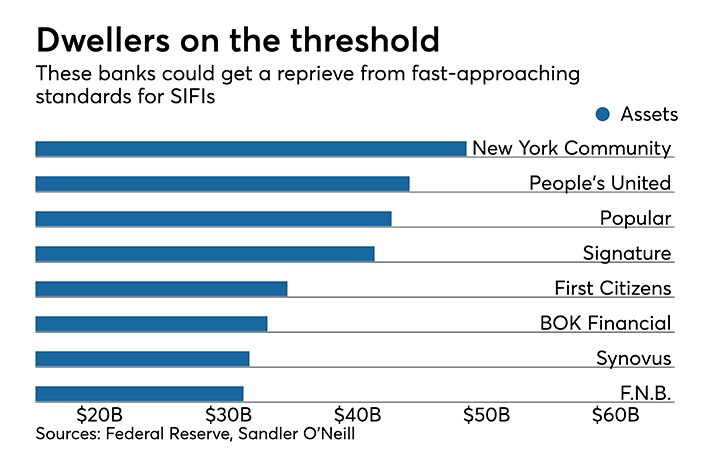

A potential end to SIFI-dom for regional banks

But relief is on the way — at least for some. A

Only about 12 SIFIs would remain in the industry under the legislation, including global banks and large regionals, such as the $459 billion-asset U.S. Bancorp in Minneapolis.

The thawing relationship between banks and regulators

In his first public speech as the Fed’s vice chairman of supervision, for instance, Randal Quarles told an

Change is also on the horizon at the CFPB, following Cordray's planned departure later this month. One of the names floated to lead the agency on an interim basis is Mick Mulvaney, head of the Office of Management and Budget. A former congressman, Mulvaney was a critic of the CFPB when he sat on the House Financial Services Committee. He once referred to the agency as “

And then there is the OCC. During

His permanent successor, Otting, is also expected to set a business-friendly tone. He was

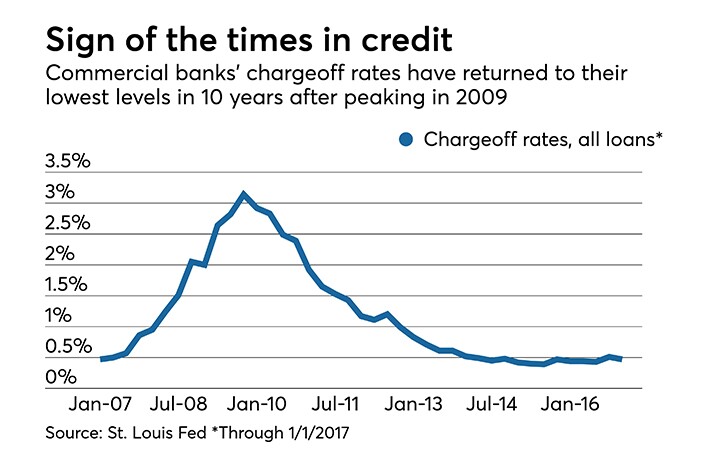

Credit is (mostly) good

Chargeoffs overall are

Still, there are signs of trouble on the horizon. Several large banks and credit card lenders — including

Most depositors aren’t demanding higher rates

There are signs the dynamic is starting to shift.

It’s unclear how, exactly, price competition will play out once it begins on a larger scale. Advances in mobile technology have made it easier to move funds between banks — and that may cause deposit prices to rise at a rapid clip as banks pay up in an attempt to encourage customers to stay put,

Bank stocks continue to climb

Over the past year, the KBW Nasdaq Bank Index has climbed by more than 30%. The S&P 500, meanwhile, this week hit a record high as Congress debates legislation that would slash corporate tax rates.

There have been stumbles along the way, of course. For instance, a Senate proposal to delay the corporate tax cut until 2019

But the bull market has nonetheless charged on, sending share prices higher across the industry.

Banks are co-opting the best parts of fintech

Through partnerships with upstart firms, banks have found new ways to adopt Silicon Valley’s sleekest innovations as their own. Consider the wave of banks

Online business loans are also a core offering at many traditional banks. JPMorgan this summer