As the chief growth officer, Wu is tasked with customer acquisition and improving customer experience at the fledgling commercial bank, where she was an early employee.

Bankers, investors and analysts stop short of declaring a bubble. But the fintech startup and investor fields are getting crowded, and there's bound to be a culling of the herd.

-

Early Warning Services, which operates the peer-to-peer network, is among the latest to take a creative approach to educating consumers about the relentless onslaught of fraud schemes.

-

In reality, central bank digital currencies would provide only some of the benefits of a real cryptocurrency and would have numerous drawbacks.

-

Wells Fargo is expanding into New York City's Hudson Yards, Mastercard launches a new generative AI-powered shopping tool, Banc of California closes PacWest acquisition and more in the weekly banking news roundup.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

As recently as a few months ago, many observers predicted a surge of bank mergers this year. But longtime obstacles to dealmaking are still there and have been joined by new ones.

The nominee to lead Federal Housing Finance is head of Pulte Capital Partners, which invests in homebuilding related businesses.

-

To create sensible rules around decentralized finance, regulators have to have an open discussion with businesses in the industry. To do that, they must create a path for collaboration.

-

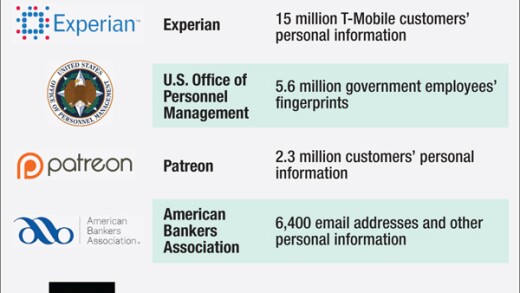

Widespread sharing of financial and other data creates enormous privacy risks for consumers, many of whom have no real understanding of the danger.

-

The system may be good for the banks that own it, but it is not meeting its public mission.

-

The Canadian institution plans a U.S. tokenized deposit, contending that it can help banks keep and grow deposits amid threats from fintech-issued cryptocurrency. Founder and President David Taylor is encouraging others to do the same.

-

Founder and executive chairman Edward Nigro will step back into the top executive spot after Ryan Sullivan informed the company he didn't plan to renew his employment contract.

-

The Bureau of Labor Statistics reported that the economy added 22,000 jobs in August, raising the unemployment rate to 4.3% and providing additional cover for the Federal Reserve to lower interest rates in September.

-

Fintechs are rolling out business financing tools that are packaged as buy now/pay later and earned wage access in the hopes of capturing momentum from the budding consumer finance industries.

-

Both Fannie Mae and Freddie Mac made similar changes to their policy when it comes to disclosures and retention rules for an appeal of a valuation.

-

Organizers of the planned Portrait Bank say they're well ahead of initial capital-raising goals as they near completion on leasing a property to serve as headquarters

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

U.S. regulators have reached a rock-bottom settlement deal with a former Wells executive accused of wrongdoing in the phony-accounts scandal. The OCC had sought to recover $10 million from Claudia Russ Anderson, a onetime risk executive at the bank.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado