Democratic senators are calling for Senate Banking Committee Chairman Tim Scott to compel the acting director of the Consumer Financial Protection Bureau to testify.

Can preferential loan terms encourage environmentally friendly practices among corporate borrowers? Barclays, BNP Paribas, and Standard Chartered are working with fintechs — and even Prince Charles — to develop a blockchain to answer that question.

-

Using watches, wristbands and other accessories at the point of sale is set for a boom, pressuring financial institutions to develop a strategy for the banking tech.

-

The request for information was issued as part of an executive order aimed at eliminating paper checks as a form of federal payment in most cases, which the administration says aims to curb fraud, modernize disbursements.

-

A focus on client relationships, rather than products, and investments in AI are helping the company in an increasingly competitive market.

Users of large language models and generative artificial intelligence need to be aware of the content and data those models are trained on, and be wary of potential infringement of copyright law.

The European Union is proposing rules that would make it easier for banks to sell off mortgages and reduce the amount of capital they must hold against certain bundled loans.

A bipartisan amendment from Sens. Bill Hagerty, R-Tenn., and Angela Alsobrooks, D-Md., would expand deposit insurance for business accounts, but the industry is split on who should bear higher FDIC premium costs.

-

The president-elect's sweeping victory last week suggests a mandate from voters to bring back the economy he presided over in his prior term. But his policies on immigration, trade and federal spending could give voters — and banks — exactly what they don't want.

-

As long as fraud-prevention efforts remain siloed and bank-specific, perpetrators remain free to employ the same strategies over and over. Banks need to do a better job of sharing information and collaborating.

-

Credit unions don't enjoy an unfair advantage. What they do is reinvest in their members and their communities in a way banks often do not.

-

JPMorgan's Ben Carpenter will join Evercore as a senior managing director; Wells Fargo appoints Jackie Krese to head syndications within its fund finance group; the SEC is probing Jefferies over its relationship to bankrupt auto parts supplier First Brands Group; and more in this week's banking news roundup.

-

The agency is weighing costly infrastructure needs, fraud risks and long-term decline in check use as it solicits public input on the possibility of winding down checks following an executive order phasing out paper in federal payments.

-

The Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. announced Friday that they are withdrawing from a 2013 interagency leveraged lending guidance, arguing it was overly restrictive, pushed activity to nonbanks and sidestepped official rulemaking.

-

The Trump administration's decision not to seek funding for the CFPB and transferring remaining enforcement cases to the Department of Justice were cited as reasons for the resignation of Michael G. Salemi, who took over as CFPB enforcement chief earlier this year.

-

The state is requiring merchants to accept cash denominations of $20 and under and prohibits them from charging extra to accept cash. The law, which goes into effect in March, comes as merchants are responding to the Trump administration's abrupt cancellation of penny production.

-

A bipartisan housing provision has emerged as a critical negotiating point for passage of an uncommonly bank-relevant defense authorization bill.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

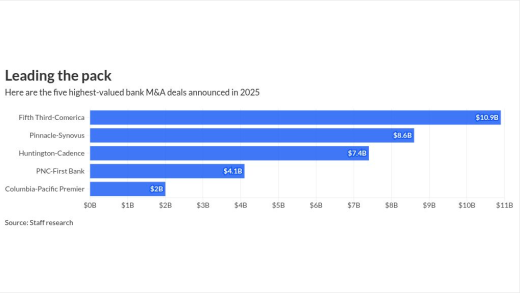

Bank merger and acquisition activity rebounded this year, led by Fifth Third's $10.9 billion proposed purchase of Comerica. Huntington, PNC and Columbia were involved in some of the other biggest deals announced in 2025.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Inscribe

-

-

- Sponsor Content from Avanade