Technology is moving quickly and retirement investing is now an individual responsibility, but the core purpose of a Wall Street career is still vital, the veteran banker said in an exit interview.

Hackers believed to be working from China accessed the computer systems of top officials at the Federal Deposit Insurance Corp., according to a top House lawmaker investigating the incident.

-

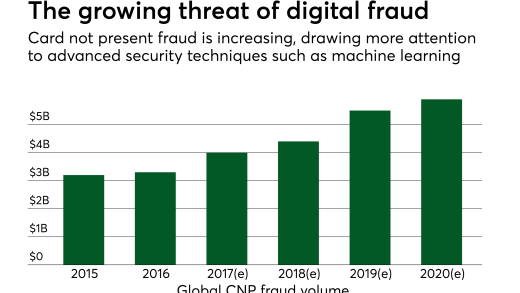

Mastercard launches service to fight instant-payment fraud, EU may green-light Apple's NFC-access plan, and more.

-

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

-

The bank will use biometric authentication to streamline checkout in stores starting in 2025. It has already completed internal and external pilots of the technology.

A year after announcing plans to collaborate with U.K.-based Featurespace to develop fraud-fighting tools with artificial intelligence and machine learning, Total System Services (TSYS) has rolled out a new offering that aims to predict new and unknown fraud types, while cutting back on “false positive" fraud warnings.

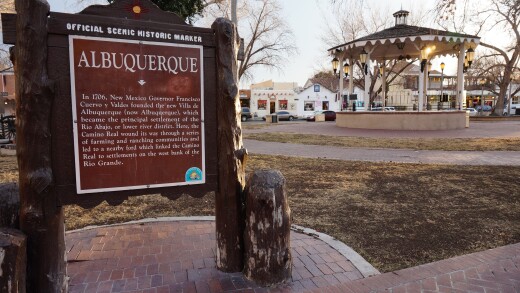

U.S. Eagle Federal Credit Union said it plans to acquire Southwest Capital Bank in a transaction slated to close next year. It would help the buyer expand its cannabis banking operation.

The Financial Conduct Authority is summoning industry professionals to weigh in on potential regulatory updates to make British institutions more competitive with the U.S.

-

The head of the Council of Federal Home Loan Banks argues that the special lien status of Home Loan bank advances, created by legislation in the 1980s, is largely irrelevant in today's marketplace.

-

The FDIC seems poised to let small banks off the hook for replenishing the deposit insurance fund after Silicon Valley Bank and Signature Bank's failures last month. But regulators should remember that small banks can still pose systemic risks.

-

In an open letter to National Credit Union Administration Chairman Todd Harper, NAFCU's B. Dan Berger calls for the 89-year-old interest rate ceiling to be reconsidered.

-

Personal income, which rose $95.7B in August, was overtaken by consumer spending, which jumped $129.2B, pushing the saving rate to 4.6% amid steady inflation and higher wages.

-

Payment-focused fintechs are acquiring – and keeping – merchants' business thanks to services such as fraud prevention, analytics financing and loyalty tools, according to Capgemini's 2026 World Payments Report. If banks want to compete, they'll need to change their game.

-

The $18.6 billion-asset Muncie, Indiana-based company agreed to pay $241 million in stock to acquire First Savings Financial Group and expand into the Southern end of the Hoosier state.

-

Federal Reserve Governor Michael Barr warned that subjecting the stress testing models to the notice and comment process could lead them to "ossify."

-

Goldman Sachs Group Inc. President John Waldron criticized the growth of barriers to movement put up by countries around the world, amid rising concern among American firms about the Trump administration's decision to charge $100,000 for a key type of visa.

-

In a Stanford University study, workers said receiving shoddy content from generative AI models creates almost two hours of extra work per incident.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

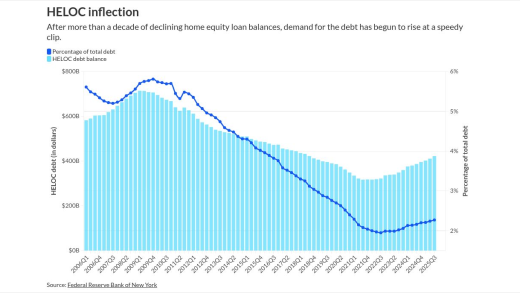

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from OneSpan

- Sponsor Content from NTT DATA

- Sponsor Content from LexisNexis® Risk Solutions

- Sponsor Content from Temenos