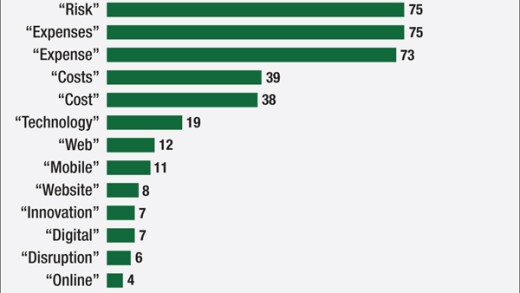

Calls with analysts to discuss the fourth-quarter results were dominated by questions about energy exposure, efficiency and the growing worry about when the next credit cycle may begin. Still, some banks managed to get in a few thoughts about how technology is reshaping their businesses.

-

Taking aim at a market dominated by decades-old private-network fuel card players, the San Francisco-based firm AtoB is teaming with Mastercard to launch an open-loop payments platform for trucking firms and fleet operators.

-

Dogwood State Bank and Community First Bancorp plan an all-stock deal to create a $2.2 billion bank, technology firm Fiserv announces a partnership with the National Hockey League's New Jersey Devils, former Texas secretary of state will join Cullen/Frost's board and more in our weekly banking news roundup.

-

PayPal hopes to demonstrate its coin's utility by using it to take a stake in a company called Mesh.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

As high interest rates continue weighing on banks' balance sheets, some are selling branches to real estate firms and leasing them back. The strategy is helping lenders that want to restructure their underwater bond portfolios.

A federal appeals court in Texas has delayed the implementation of the Consumer Financial Protection Bureau's small-business data reporting rule slated to go into effect in July. How the Trump administration proceeds from here could be instructive on its approach to other CFPB rules.

-

Refining internal processes and reassessing daily workflows is more important than ever at a time when bankers are frequently asked to do more with less.

-

Inflated home values were already making homeownership unattainable for millions of Americans; now it's interest rates. To change this dynamic, we need some creative thinking.

-

Congress will eventually turn its attention to the fact that taxpayers are subsidizing payments to large financial institutions.

-

The White House said it will appeal a circuit court ruling allowing Federal Reserve Gov. Lisa Cook to remain on the central bank board while her lawsuit challenging her dismissal is litigated.

-

Early Warning Service's peer-to-peer payments network saw payment volume growth accelerate in the first six months of 2025, buoyed once again by small-business payments.

-

As President Trump calls for scrapping quarterly earnings reports and switching to a six-month schedule, industry observers wonder whether the time saved would be worth the potential loss of transparency.

-

The Senate voted 48 to 47 to confirm Stephen Miran to the Federal Reserve Board, just ahead of the central bank's rate setting committee meeting.

-

The Minneapolis-based bank has rolled out payroll and bill pay features four months after unveiling a service to monitor card spending. An accounts receivable solution is on deck.

-

An alleged scandal involving the LA Clippers is just the latest reputation hit to the beleaguered fintech.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

American Banker's 2025 Small Business Banking conference yielded lessons about the need for speed, simplicity and safety in small-business lending. Other key takeaways included the significance of digital payment options and the importance of continuing to process SBA loan requests during the government shutdown.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsor Content from SAS

- Partner Insights from Consumer Bankers Association