Generative artificial intelligence is driving significant innovation in data analytics,

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

As more tech-savvy shoppers come back to stores, the digitally focused payments company hopes to accompany those consumers by expanding its capabilities at the point of sale.

-

This week in global news, King Charles III to replace the late queen on coins, Revolut gets clearance on crypto from U.K. regulators, Mastercard expands digital payments in Dubai, and more.

-

The payment firm, which experienced a large but fleeting demand from at-home workers during the pandemic, is moving ahead with products designed for the needs of a transforming economy.

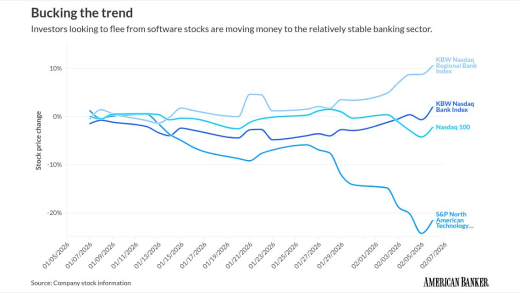

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

After working for the Federal Deposit Insurance Corp. for a decade, Marc Minish was determined that he could open his own institution. Now he is the primary organizer of the proposed Nova Bank in Huntsville, Alabama, which has received conditional regulatory approval.

Federal Reserve Gov. Lisa Cook said in a speech Monday the central bank is monitoring record highs in the stock market to see if it proves to be a bubble.

-

Banks are utilizing an array of overlay services to address historical market challenges, such as the continued use of checks among businesses that do not have the information or capabilities to send digital payments.

-

For too long, nonbanks have been allowed to form industrial loan companies to operate as banks without Fed oversight. This regulatory pass should not be given during a crisis.

-

Cross-border payments do not and should not exist in a vacuum, says Veem's Marwan Forzley.

-

The incident affected 7,500 people. The bank resolved the matter in less than a day.

-

The request for information was issued as part of an executive order aimed at eliminating paper checks as a form of federal payment in most cases, which the administration says aims to curb fraud, modernize disbursements.

-

The Federal Reserve's preferred measure of inflation moved closer to the 2% target last month, but the impact of tariffs remains to be seen.

-

As banks standardize their data in anticipation of the rise of open banking, they're turning to common formatting standards, including from the FDX.

-

Although the Trump administration is abandoning the CFPB's rule 1033, there are still a number of security standards to follow.

-

A focus on client relationships, rather than products, and investments in AI are helping the company in an increasingly competitive market.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The database contained internal user emails, KPI report templates and other internal data, but no personal or financial customer data.

Attackers used stolen vendor credentials to move $130M, underscoring vulnerabilities in real-time payment systems.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado