The Virginia-based bank had been an example of what can go wrong when banks partner with fintechs. After being released from an OCC enforcement action, Blue Ridge is now focused on operating as a traditional community bank, said CEO Billy Beale.

The image of traditional custody banks is as stodgy as it gets, but some are using machine learning to help their clients and their own research teams glean insights from massive amounts of data.

-

Security worries have kept many financial institutions from sending payments on TCH's real-time payments network and FedNow. But ABNB Federal Credit Union had other ideas. Here's how its team prepared.

-

Firms such as Circle, Binance and Coinbase say new bipartisan legislation will attract banks to the market, providing a boost for mainstream payments.

-

Utah is the latest state to push a pro-industry EWA bill. If signed, it would mark the sixth state with legislation specific to the budding cash-flow product.

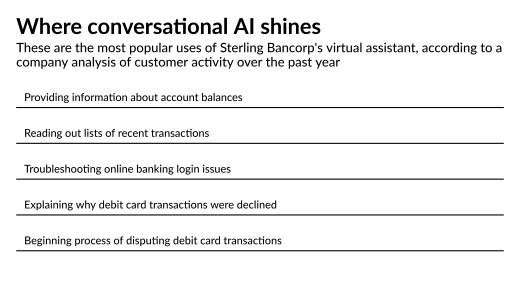

The suburban New York bank says Skye, its conversational artificial intelligence assistant, is doing the work of 100 full-time employees.

The U.S. arm of Spanish banking giant Banco Santander is offering a high-yield savings account through its digital bank, Openbank, to eligible Verizon customers, a move that will introduce Santander to millions of potential new customers.

The Senate advanced the One Big Beautiful Bill Act through a procedural vote, opening the legislation for debate followed by Monday's vote-a-rama.

-

The best way for banks to alleviate the effects of extreme weather events is to continue to do what they do best — lend.

-

Economic downturns are inevitable, but regulatory overreaction to them shouldn't be. We need to rethink the way banks are allowed to recover from economic shocks.

-

The company's shareholders are ill-served by its large investments in fossil fuel projects that both damage the environment and present major financial risks.

-

Central Bancompany said in a presentation to investors this month that it's looking to overhaul its core technology and data systems, while also hunting for a deal.

-

The Consumer Financial Protection Bureau Thursday will publish a revamped version of its Section 1071 small business data collection rule, dramatically scaling back the data to be collected and the number of lenders who must comply.

-

An appeals court's decision will make it harder for consumer-lending-focused fintechs to operate in Colorado. But the impact could eventually be felt more widely, according to both industry groups and consumer advocates.

-

The new rules require banks in the ACH network to implement risk-based monitoring to combat rising fraud and scam schemes.

-

As opportunities grow for private student lending, Sallie Mae has entered a multiyear "strategic partnership" with the world's largest private equity firm.

-

The Consumer Financial Protection Bureau, building on an executive order by President Trump, wants to eliminate the legal framework of "disparate impact" from its implementation of the Equal Credit Opportunity Act.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Part of the growing "phishing-as-a-service" economy, the Spiderman kit offers novice hackers sophisticated tools to target customers of major EU institutions.

Enova International, a nonbank lender in Chicago, plans to gain scale by taking over Grasshopper Bank's national bank charter. The deal already faces skepticism from critics of Enova's high-cost lending model.

The 23rd annual ranking of women leaders in the banking industry.

-

-

-

- Sponsor Content from Wolters Kluwer