As the government shutdown stalls key housing programs, lenders are shifting tactics to keep loans moving and preparing for bigger challenges ahead.

Many see the future of financial services being powered by partnerships between banks and fintechs, but both sides need to first make sure they understand themselves and what they want.

-

Bolstered by healthy first-quarter global card-spending trends, Mastercard is focusing on opportunities outside the U.S., including a unique card-processing arrangement beginning this month in China.

-

The Bank of England set a date of March 2025 for local banks to establish operational resilience plans, Ant Group is using artificial intelligence to aid shopping, and more.

-

Touting strong first-quarter sales and revenue growth, CEO Alex Chriss committed to rebuilding the firm's languishing Xoom cross-border unit and driving more Pay with Venmo options.

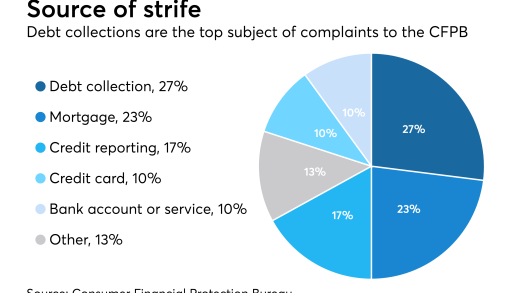

As the CFPB prods banks to improve their debt collection processes, tech firms are applying artificial intelligence, chatbots and self-service portals to create a more enlightened approach.

Most financial institutions are seeking ways to speed up payments, but one neobank is looking to slow them down to protect a segment of the population frequently targeted by scams.

Hackers breached the New York community bank's cybersecurity walls in 2022, drawing regulatory scrutiny and causing its CEO to resign.

-

There are existing ways to authenticate third-party permissioned data access that don't involve screen-scraping or expensive token-based systems.

-

At best, artificial intelligence will be a tool that helps good bankers be better at their jobs. It won't replace them.

-

The Federal Reserve's final rule severely restricting the ability of state member banks to engage in crypto-related activities was released without a legally required period of notice and comment.

-

Vis Raghavan's arrival last year has energized Citigroup's investment banking division, pushing his team to relentlessly pursue deals while cutting underperformers to make way for marquee hires.

-

After a slump of several years, there's been a renewal of payment and financial tech firms going public.

-

Senate Banking Committee ranking member Elizabeth Warren, D-Mass., led a group of congressional Democrats in a letter to bank regulators telling them that loosening capital rules wouldn't improve the Treasury market's functioning.

-

The cards, which are expensive, have not grown quickly. But payment companies are angling for a pickup.

-

The dollar-backed digital assets have to clear many hurdles before they find a place in the future of finance, speakers at a Columbia University event said.

-

The bank teamed up with Euronet Worldwide subsidiary Dandelion for cross-border payments to digital wallets in the Philippines, Indonesia, Bangladesh and Colombia in an optionality play.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

HoldCo Asset Management drops its pursuit of proxy battles with Columbia Banking System and First Interstate; Cape Cod's Mutual Bancorp prepares to acquire Bluestone Bank; Servbank HoldCo announces plans to acquire IF Bancorp; and more in this week's banking news roundup.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Qlik

-

- Sponsor Content from iProov

- Sponsor Content from Early Warning®