-

The largest financial institutions say the agency’s proposal to require public companies to disclose their contributions and vulnerability to climate change is consistent with investor demand. Community banks say it would create an unnecessary regulatory burden.

June 14 -

The agency's plan would strengthen requirements that banks use a minimum amount of their real estate for the business of banking, but three grade groups say banks need flexibility in the pandemic to manage occupancy.

March 23 -

The American Bankers Association has requested more time to respond to a proposal that would expand lending authority for credit union service organizations.

March 9 -

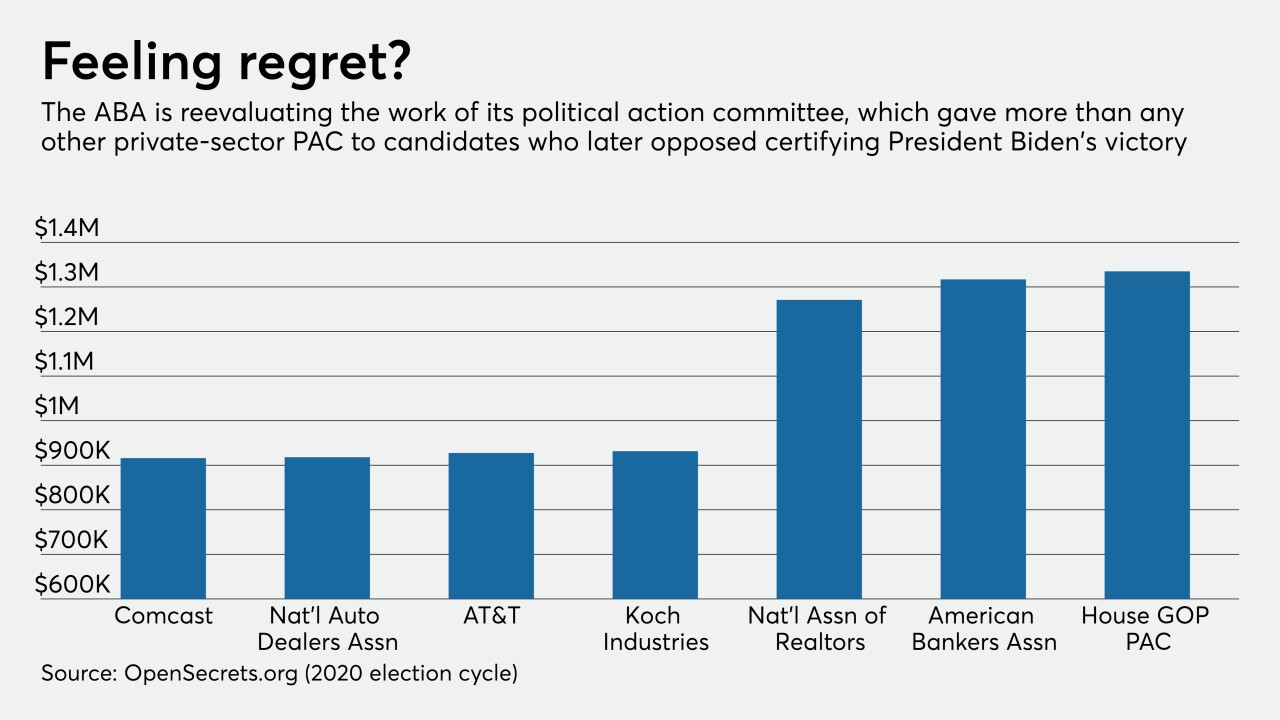

Election-reform advocates say the American Bankers Association and other organizations should take into account candidates’ commitment to democracy, not just their stances on issues, in directing donations.

February 17 -

Bank of America and Citigroup trimmed compensation for their chief executives in 2020, a year in which banks exercised restraint in compensating employees as the pandemic ravaged the economy.

February 16 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

With many Americans and members of Congress questioning the results of the presidential election, financial services trade associations quickly vowed to work with the incoming administration.

November 11 -

Opening a bank or investment account — or even securing employment in a racism-free workplace — is out of reach for many Black Americans.

November 9 -

Thomas Pinder held jobs at the Justice Department and FDIC before coming to the American Bankers Association in 2012.

November 5 -

The proposed regulation would codify a 2018 pronouncement by regulators that guidance does not carry the force of law.

October 29 -

The Paycheck Protection Program and encouraging digital innovation are top priorities for James Edwards, CEO of United Bank in Georgia. He also expects the American Bankers Association to promote diversity and regulatory reform in the next year.

October 26 -

Both the Federal Deposit Insurance Corp. and the American Bankers Association are encouraging the industry to offer basic products that could bring more unbanked households into the financial mainstream.

October 19 -

Gary Cohn, former head of the Trump administration’s National Economic Council and onetime top executive at Goldman Sachs, says technological changes will continue to make it harder for smaller financial institutions to compete and force many to be sold.

October 19 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 30 -

Various trade organizations sent letters to a House Financial Services Committee task force saying lawmakers should "actively discharge their oversight prerogatives" as the national bank regulator considers giving licenses to companies that do not accept deposits.

September 29 -

Banks and other financial firms say the proposal to reverse restrictions on investment advisers does not go far enough. Meanwhile, investor advocates say it would loosen necessary protections.

August 12 -

The agency sought feedback on potential changes to the Equal Credit Opportunity Act. But a coalition of industry and advocacy groups want a longer comment period to afford “a greater opportunity for thoughtful public participation.”

August 10 -

A site run by Keith Leggett, a former American Bankers Association senior economist, was frequently critical of credit unions and called for parity among federal regulators.

August 3 -

The regulator approved a proposal that mirrors a rule banking regulators implemented in February 2019 to cushion the Current Expected Credit Losses standard's impact on capital levels.

July 30 -

Acting Comptroller of the Currency Brian Brooks said the agency plans to issue new assessment procedures within weeks as a follow-up to recent Community Reinvestment Act reforms. He also touched on the “true lender” issue and why the agency is considering a narrow-purpose payments charter.

July 30