-

Cleaning up bad data is expensive and time-consuming, but just leaving it alone costs even more. Here are strategies to improve the process.

October 17 MX

MX -

Banks such as Citigroup, Regions and TD have decided they need to offer mobile customers truly customized experiences. They are experimenting with different ways of doing so that come across as helpful without being intrusive.

October 12 -

Some financial institutions are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

Some banks are looking at how to translate the complicated and document-heavy mortgage lending process into the digital world of voice-interactive personal assistants.

October 4 -

First Tennessee took a leap of faith to hire a young digital services company for its overhaul of mobile and online operations, and it says its decision has paid off.

August 30 -

From preparing for the next recession and digital disruption to better planning and what millennials want, CUNA Mutual Group’s 2017 Online Discovery Conference covered a lot of ground.

August 24 -

Some banks are experimenting with virtual assistants that, going beyond the routine tasks they perform today, could offer investment advice or make mortgage loans 24/7. But will they ever be able to talk a nervous client through a market crash?

August 23 -

Baxter CU, Randolph-Brooks FCU and Coastal CU have already signed on with the service, which aims to create analytics strategies to help credit unions grow and improve service.

August 17 -

Using good, old-fashioned customer service and consultation to cut down on merchant attrition has been part of the acquiring playbook for years. But that playbook is long overdue for an update.

August 16 -

Partners FCU’s ‘Decision Summary Dashboard’ was the winner in this year’s Analytics Best Practices Competition from OnApproarch

August 11 -

Security companies are using technology to stop more complex fraud based on a smaller amount of data, and investors are taking notice.

August 11 -

A look at how some CUs are using data analytics to improve operations and boost business.

August 9 -

The difference between regular credit card applicants and fraudsters is experience — scammers know their way around an application form.

August 9 -

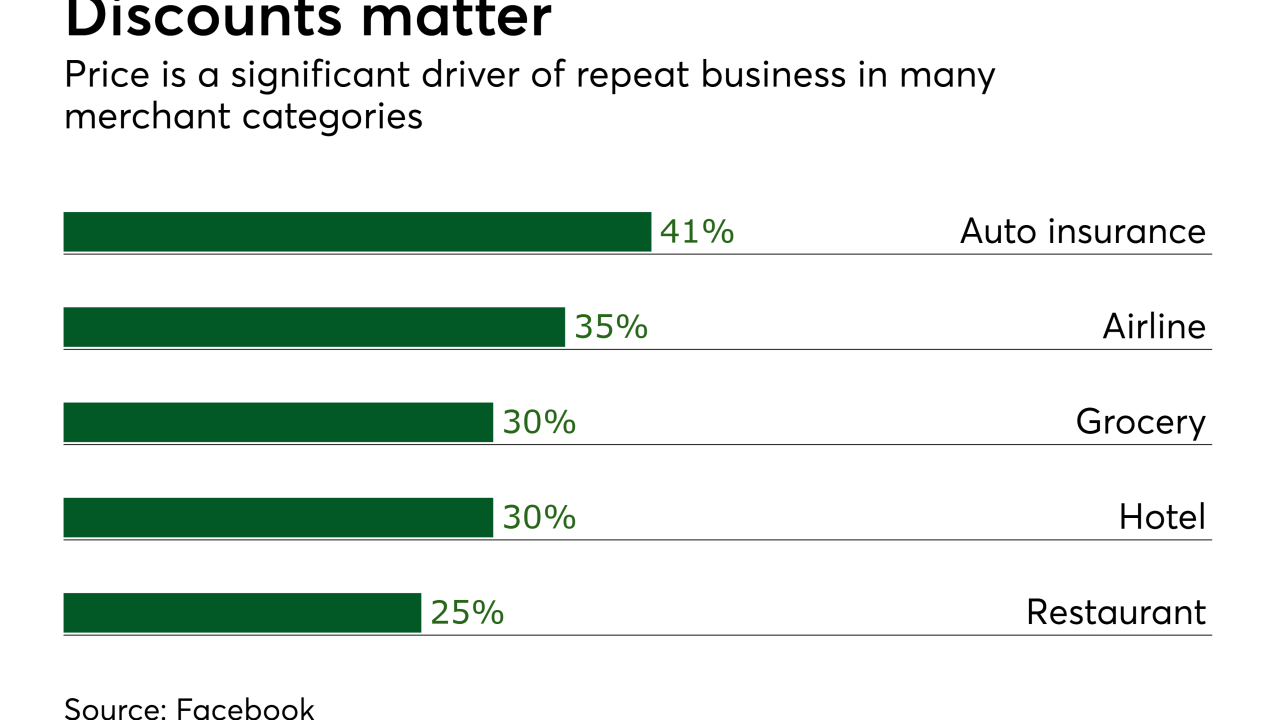

Enticements such as rewards, loyalty points and coupons seldom face pushback as a marketing concept, but there's been recent concern that these programs are devouring potential revenue from consumers who would be willing to pay full price.

August 3 -

Next month, India Prime Minister Narendra Modi’s government will begin amassing a warehouse of virtual information collected not just from traditional sources like banks but also from social media sites, as it looks to match residents’ spending patterns with income declarations, said people familiar with the matter.

July 28 -

Charging what people are willing to pay is an exact science, claims First Insight's Jim Shea, who contends the loyalty programs and price perks that merchants offer aren't always necessary.

July 28 -

Bay Dynamics and Symantec are working together to better protect payments and personal data from insider threats.

July 18 -

Community banks are less likely to close branch locations than their larger counterparts. But those branches should mix technology with the homespun local flavor customers have come to expect.

July 7 -

The image of traditional custody banks is as stodgy as it gets, but some are using machine learning to help their clients and their own research teams glean insights from massive amounts of data.

June 20 -

At the recent Analytics and Financial Innovation Summit in Minneapolis, attendees weighed in on whether credit unions have have what it takes to effectively dig into big data -- and, if they don't have it, what will it take to get it?

June 15