-

Security companies are using technology to stop more complex fraud based on a smaller amount of data, and investors are taking notice.

August 11 -

A look at how some CUs are using data analytics to improve operations and boost business.

August 9 -

The difference between regular credit card applicants and fraudsters is experience — scammers know their way around an application form.

August 9 -

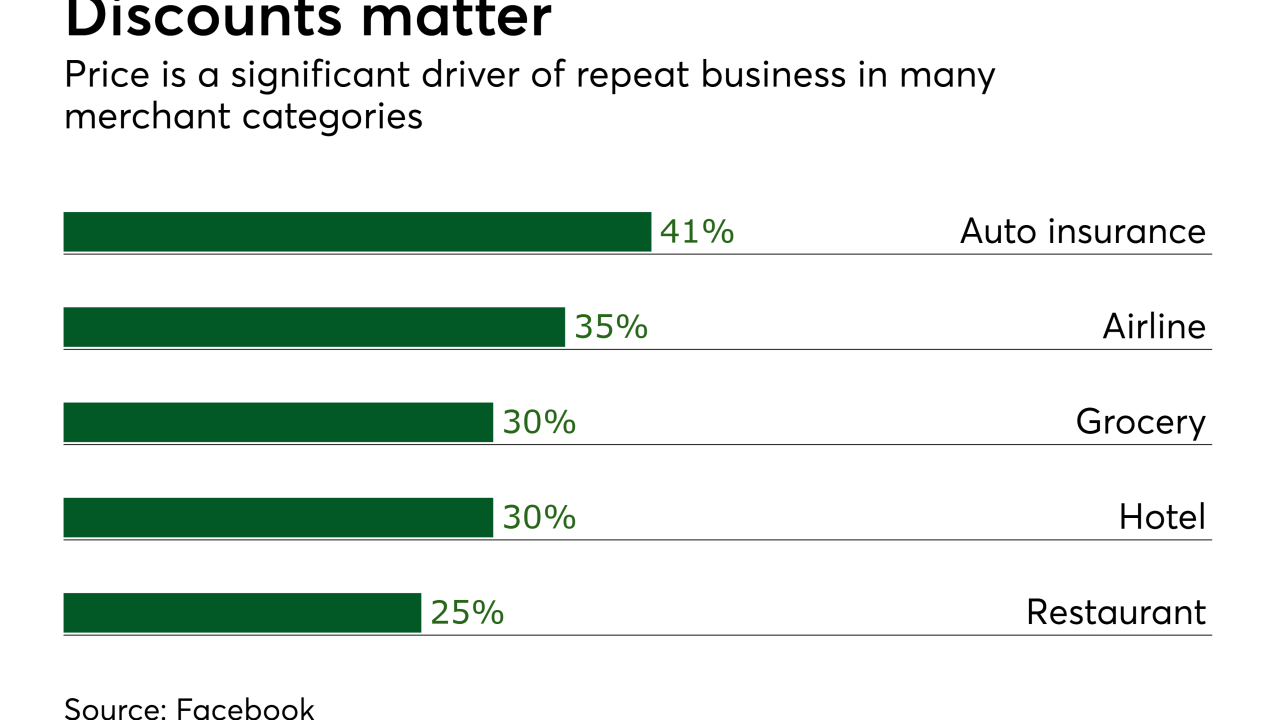

Enticements such as rewards, loyalty points and coupons seldom face pushback as a marketing concept, but there's been recent concern that these programs are devouring potential revenue from consumers who would be willing to pay full price.

August 3 -

Next month, India Prime Minister Narendra Modi’s government will begin amassing a warehouse of virtual information collected not just from traditional sources like banks but also from social media sites, as it looks to match residents’ spending patterns with income declarations, said people familiar with the matter.

July 28 -

Charging what people are willing to pay is an exact science, claims First Insight's Jim Shea, who contends the loyalty programs and price perks that merchants offer aren't always necessary.

July 28 -

Bay Dynamics and Symantec are working together to better protect payments and personal data from insider threats.

July 18 -

Community banks are less likely to close branch locations than their larger counterparts. But those branches should mix technology with the homespun local flavor customers have come to expect.

July 7 -

The image of traditional custody banks is as stodgy as it gets, but some are using machine learning to help their clients and their own research teams glean insights from massive amounts of data.

June 20 -

At the recent Analytics and Financial Innovation Summit in Minneapolis, attendees weighed in on whether credit unions have have what it takes to effectively dig into big data -- and, if they don't have it, what will it take to get it?

June 15 -

At the Analytics and Financial Innovation conference, two credit union consultants offered tips on how credit unions can achieve greater buy-in for implementing data analytics.

June 13 -

Hoping to convince e-commerce merchants to let Facebook target offers to customers, the social media giant is placing a strong emphasis on “dynamic ads” that include payment buttons.

June 9 -

Merchants increasingly sing the praises of analyzing customer payment data to learn more about spending habits and deliver customized offers through mobile devices. American Express is kicking off a project to do the same with corporate travel data.

June 7 -

In a partnership designed to protect online customers from attacks, digital security providers ThreatMetrix and Gemalto will provide holistic authentication options to an array of financial services providers.

June 6 -

The time needed to close a mortgage improved nine days since the start of the year as the market has shifted to doing more purchase loans.

May 19 -

The bank uses machine learning to customize content in real time on its website for every user, based on their behavior during their session.

April 26

-

Payments and financial services technology are still stuck in yesteryear, chained to paper and dangerously prone to fraud, according to Matt Streisfeld, a principal at Oak HC/FT.

April 25 -

Data and analytics tools can help banks and credit unions detect financial patterns that may indicate that human trafficking is occurring.

March 30 -

Data and analytics tools can help banks detect financial patterns that may indicate that human trafficking is occurring.

March 29 -

In the shift to online and mobile shopping, one group often left out is the 65 million Americans with poor or no credit. But as more retail categories like furniture move online, a growing number of e-commerce merchants is adding instant finance options for the subprime crowd.

March 23