John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

After having insisted many times that it couldn't begin returning funds to CUs until 2021, the agency may have found a way to start making payments as early as 2018.

By John ReostiJuly 20 -

The $482 million deal would be Associated's first bank acquisition since June 2007.

By John ReostiJuly 20 -

KS Bancorp initially chided First Citizens for its aggressive moves before deciding to mull the offer over.

By John ReostiJuly 19 -

First Home Bank raised nearly 20% more than it sought from investors, providing proof that Florida — especially the Tampa Bay area — is a hotbed of activity.

By John ReostiJuly 19 -

Working with Sungage Financial will help NBT Bancorp diversify its consumer loan portfolio and learn from a fintech startup with a speedy credit approval process.

By John ReostiJuly 13 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

By John ReostiJuly 11 -

Green Bancorp has pivoted from the troubled energy-lending market to SBA loans, which are appealing to more small banks because they can be sold at a premium and are getting more support from Washington.

By John ReostiJuly 6 -

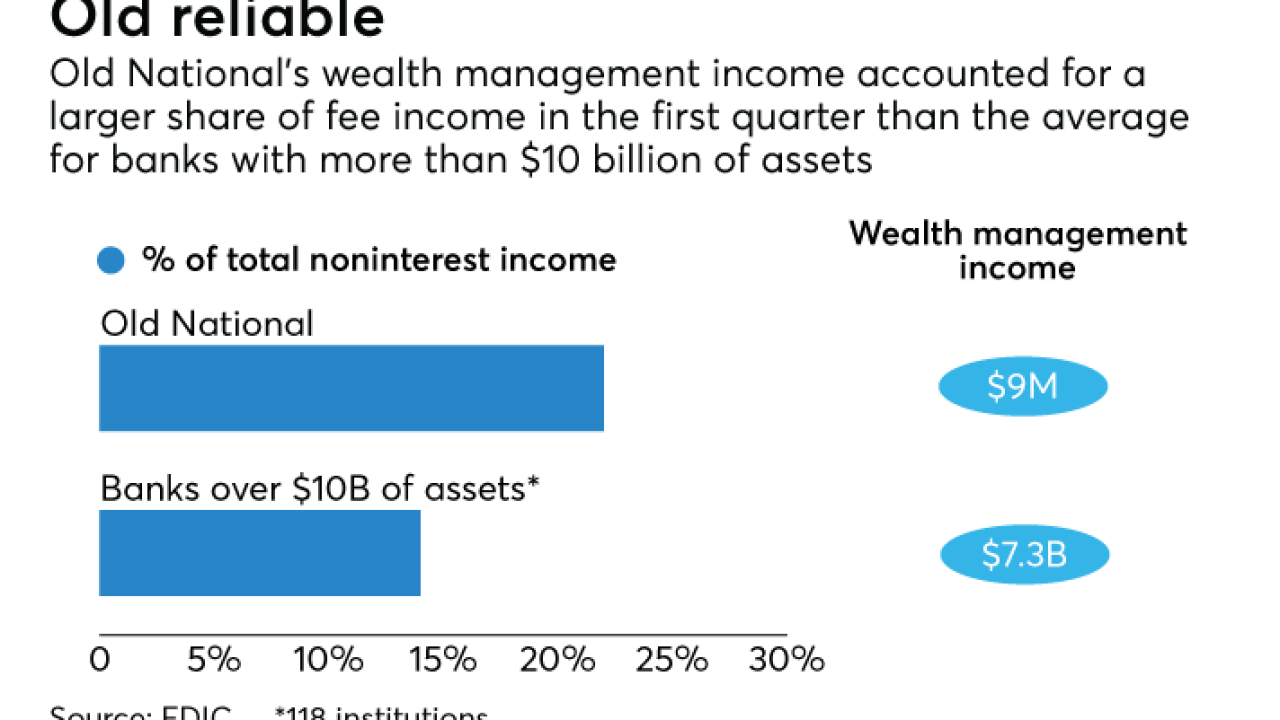

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

By John ReostiJuly 3 -

The $487 million deal would be OceanFirst's fourth, and largest, acquisition in its home state since 2015.

By John ReostiJune 30 -

Timothy Zimmerman, who once called CECL a dangerous proposal, now sees a justification for the FASB standard. And he is urging bankers to start working on plans to comply with the change.

By John ReostiJune 30