Consumer banking

Consumer banking

-

Credit card and debit card spending have improved for several weeks in a row, according to a report from PSCU.

May 27 -

The company will incur an upfront fee but will save $7 million a year by walking away from a deal with the Los Angeles Football Club.

May 27 -

A new program is intended to reach individuals without a fixed address or checking account more easily access COVID-19 relief funds — and hopefully keep those consumers as members.

May 27 -

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

May 26 -

Cybercriminals have targeted at least four financial services technology companies in recent months, potentially giving hackers back-door access to clients. Here’s how banks can guard against that.

May 26 -

Year to date through Dec. 31, 2019. Dollars in thousands.

May 26 -

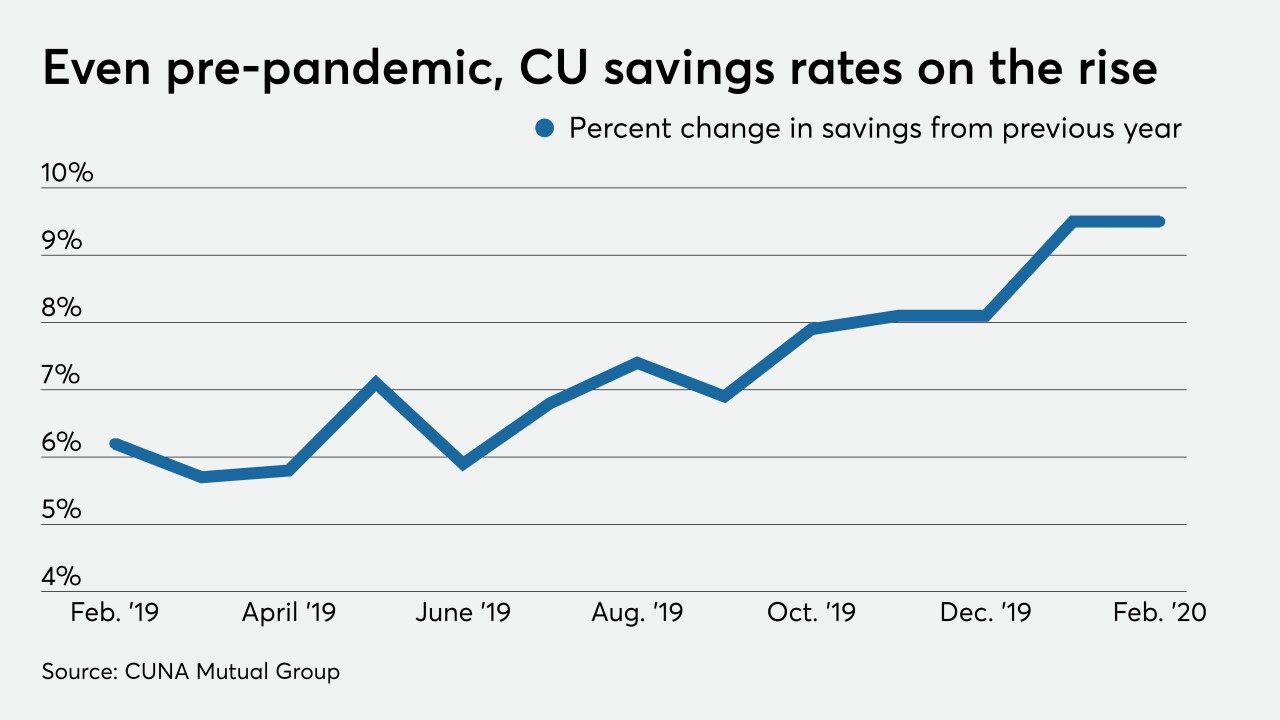

Credit unions need a clear strategy if they hope to break through to consumers already overwhelmed by the coronavirus.

May 26 -

The bank is trying to recover millions of dollars in returned deposits. It also has a $14 million loan to the company that allegedly conducted the scheme.

May 26 -

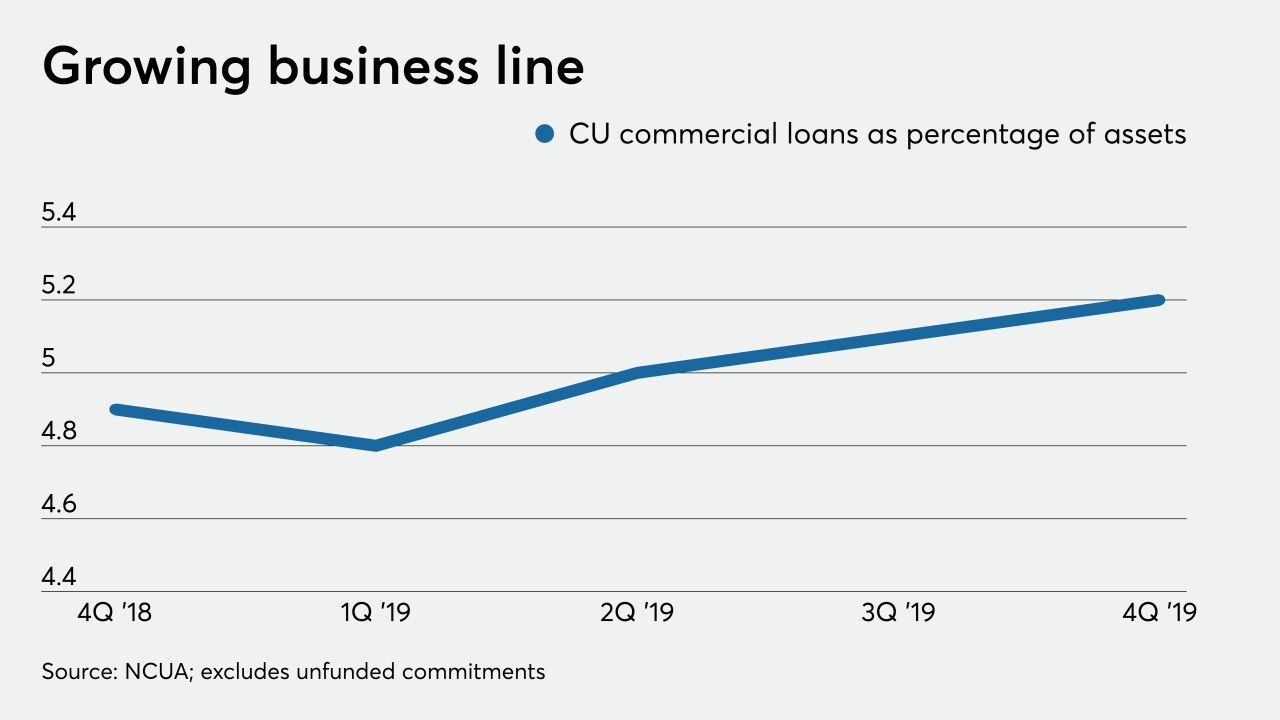

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Demand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

May 24 -

The Rhode Island company's post-pandemic plan also includes returning some overseas call center functions to the U.S. and bringing its office staff back in phases, says CEO Bruce Van Saun.

May 22 -

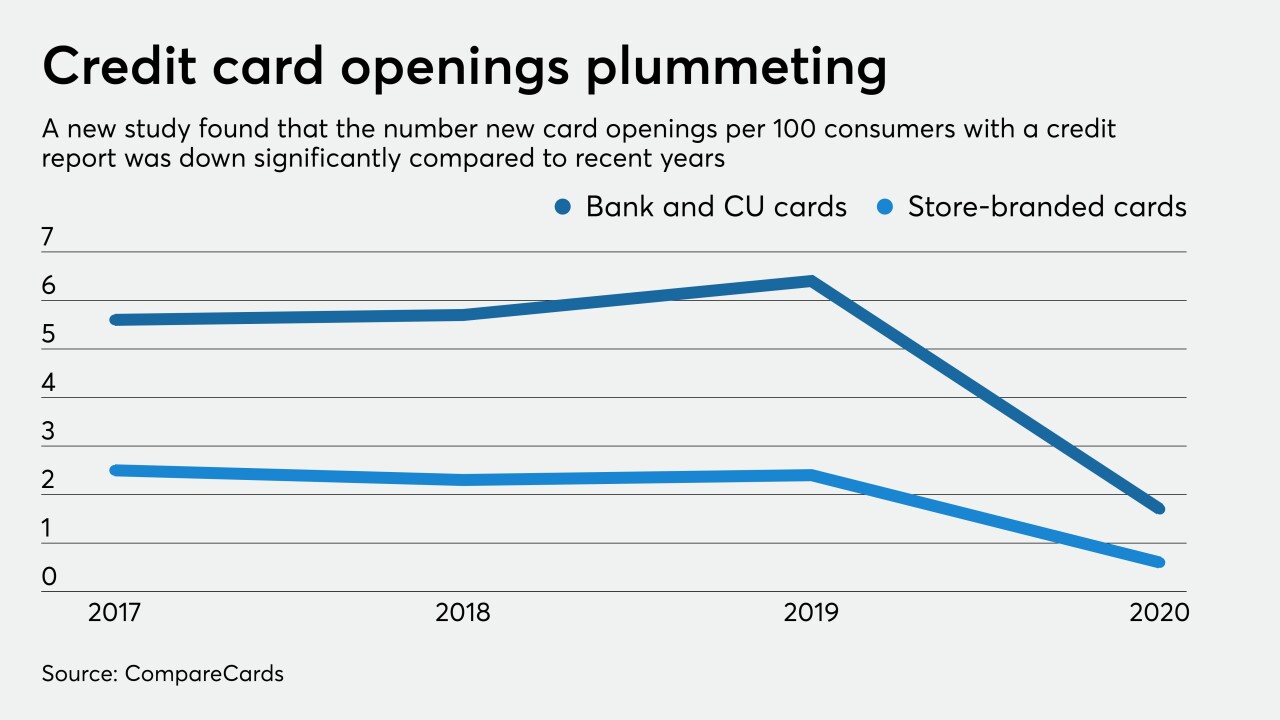

The drop is likely from both a decline in consumer demand and lenders becoming more cautious, according to CompareCards.

May 22 -

When a bank subscriber to Sure Profile pulls a credit report on an applicant for a loan or account, Experian will check to see if the identity data matches a real person.

May 22 -

Customers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

May 21 -

The company, the product of a big merger shortly before the outbreak, had to build portals on the fly, help many customers shift to mobile and accomplish in days tasks that once took months, its digital chief says.

May 21 -

The Office of the Comptroller of the Currency watered down numeric metrics that some groups blasted and allowed more institutions to opt out of the new regime. But whether the agency has won over any detractors remains to be seen.

May 20 -

The Ohio company said the decision reflects branch overlap and lower customer usage of the locations being shuttered.

May 20 -

The sellers will continue to service the loans and retain the fees they receive from the Small Business Administration.

May 20 -

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

May 19