Consumer banking

Consumer banking

-

Washington Trust warned that it could lose $3 million in annual revenue after two top advisers left to join a brokerage firm. Other banks are facing similar hits.

November 7 -

The Honolulu-based credit union saw a nearly 7% increase in new members, thanks in part to an expanded branch presence in West Oahu.

November 7 -

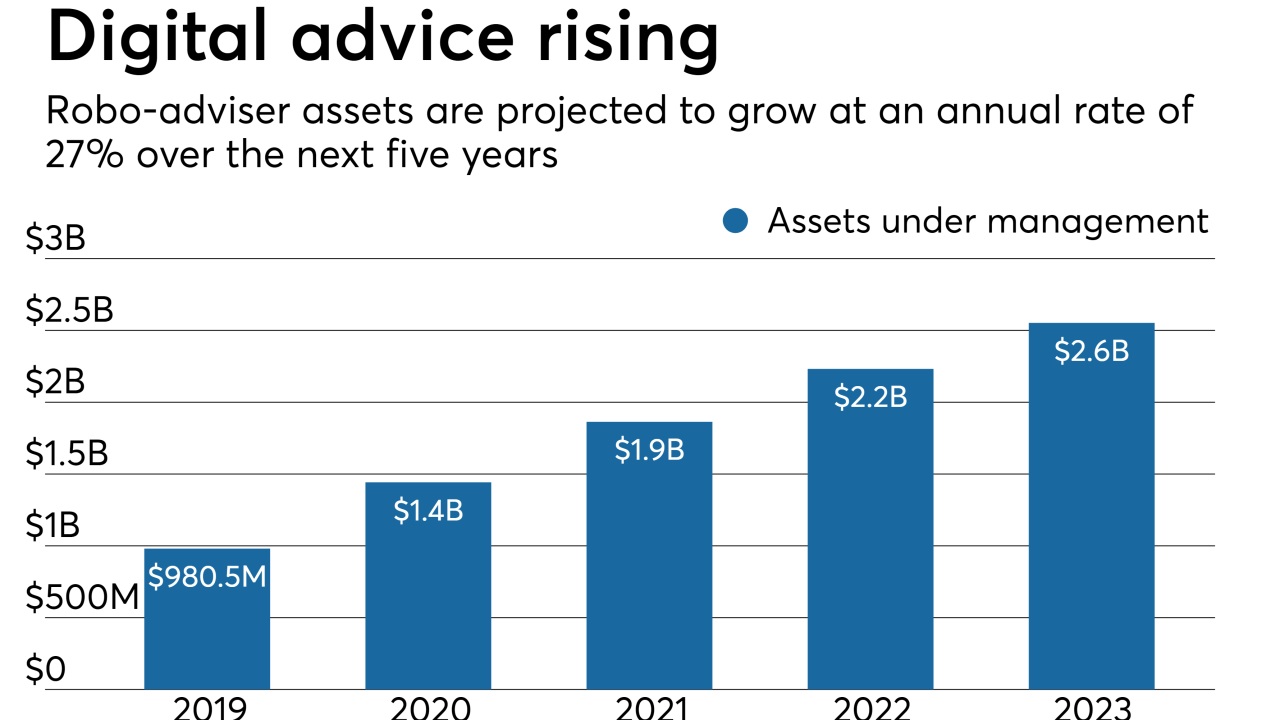

A new partnership will let some community banks and credit unions roll out robo-advice platforms without a significant investment of their own.

November 7 -

Consumer identities are becoming increasingly digital and more prone to privacy risks. Lawmakers cannot sit idle.

November 7 -

Clear communication is critical when banks undergo a leadership or operational change.

November 7 -

More details have surfaced about Interactive Brokers' planned bank. It would accept deposits and originate loans through an online channel only, its application says.

November 7 -

While layoffs at big banks get the headlines, small and midsize lenders are also trimming payrolls in response to lower rates and fears that a recession is getting closer.

November 6 -

The FDIC ordered the Seattle bank to pay a nearly $1.4 million fine tied to improper agreements with real estate brokers and homebuilders.

November 6 -

The bank is open to adding branches in cities where it has a high population of cardholders and where its largest co-brand card partners are based, Anand Selva, head of the lender's U.S. consumer unit, said.

November 6 -

An e-wallet in development would give tech companies the ability to provide millions of customers virtual bank accounts and to offer perks such as car loans or discounts on home rentals to those who keep money stashed there.

November 6 -

The Maryland company agreed to acquire Rembert Pendleton Jackson, which has $1.3 billion in assets under management.

November 6 -

With so many data breaches targeting merchants, banks and credit unions should not assume they are in the clear.

November 6 -

Recent closings could portend a stiffer regulatory stance on capital adequacy and risk.

November 5 -

The financial services industry has struggled with how best to explain privacy and data-sharing practices to customers. Mastercard is offering a new framework.

November 5 -

After shaking up the financial services industry last month by eliminating commissions for all online trades, Charles Schwab is setting its sights on building out its lending services.

November 5 -

Three Rivers Credit Union in Bainbridge, Ga., and DOCO Credit Union in Albany, Ga., are expected to operate independently once the transactions are completed.

November 5 -

One organization's findings reveal that financial counseling, when done right, can also help boost institutions' lending and brand recognition.

November 5 -

With so many data breaches targeting merchants, banks should not assume they are in the clear. Banks are, after all, where the money is.

November 5 -

A group affiliated with Interactive Brokers Group has filed an application with the FDIC to form Interactive Bank.

November 5 -

Cash access has grown tighter in the U.K. as more consumers adopt digital payments and banks shrink their fleets of branches and ATMs. Could the U.S. could see a similar phenomenon?

November 5