Consumer banking

Consumer banking

-

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27 -

When TD Bank launched an audio brand identity across its communication channels early this year, the new jingle triggered a surprising reaction from consumers using the firm's ATMs.

June 27 -

Eras come and go, but the ongoing investments in developing, empowering, leading and retaining superior personnel will remain the highest priority of top-performing financial institutions.

June 26 -

General Motors' financial arm has halted its quest for an industrial loan company charter from the FDIC, but is signaling that it will try again. Observers said the automaker may wait until after the presidential election to decide how to move forward.

June 25 -

There were 27 bank acquisitions worth $5.45 billion announced in the second quarter as of mid-June. That was more than the $5.2 billion combined value of deals announced over the previous five quarters.

June 24 -

These 20 bankers and fintech executives are helping banks go digital in new ways.

June 24 -

This year Texas banks dominated American Banker's annual list of the top-performing larger community banks. See which institution came in at No. 1 for this asset class.

June 23 -

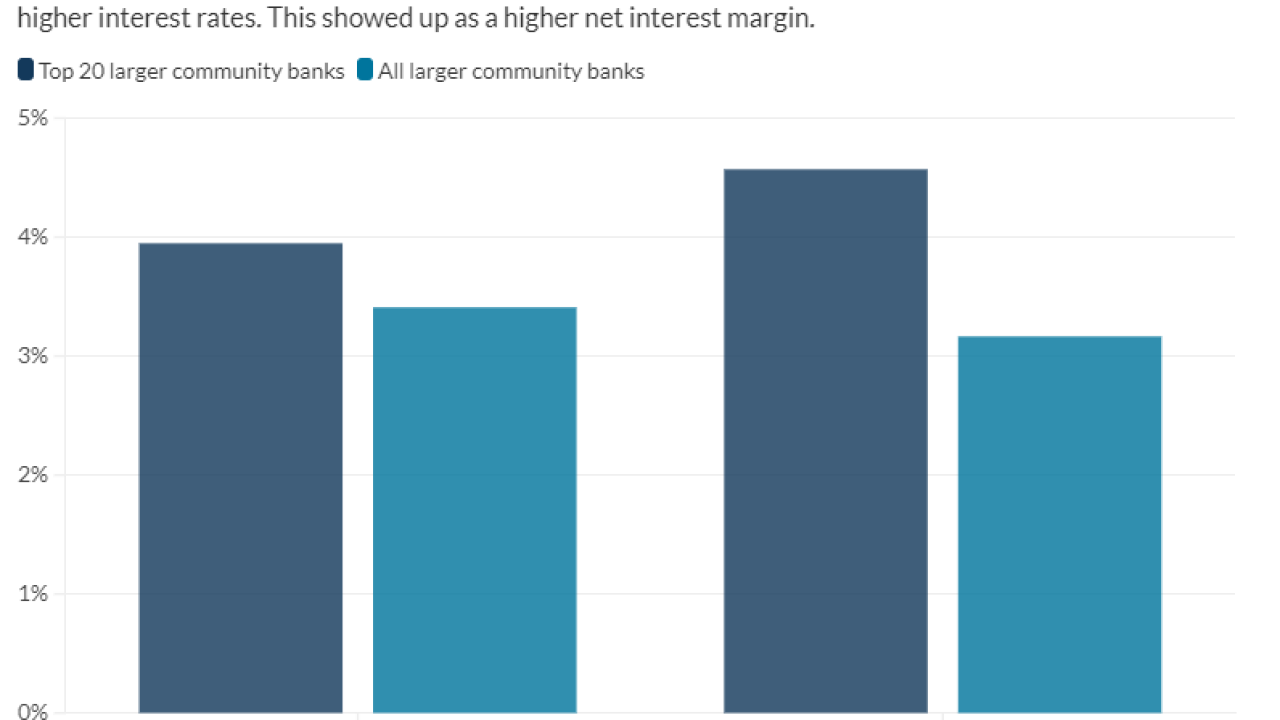

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

The head of digital product management, platforms and innovation at BMO Bank is one of American Banker's 2024 Innovators of the Year.

June 21 -

The founder and CEO of Owners Bank, a division of Liberty Bank, is one of American Banker's 2024 Innovators of the Year.

June 21 -

Why banks believe fraud prevention and customer experience are both top priorities

June 21 -

Vancouver, Washington's Riverview Bancorp announces Nicole Sherman as its next president and CEO; Happauge, New York-based Dime Community Bancshares is expanding its deposits strategy to Manhattan; UBS hires Guggenheim banker Ananya Das; and more in this week's banking news roundup.

June 21 -

U.K. banks are testing machines that can accept deposits from multiple machines.

June 21 -

PeoplesBank and Cornerstone Bank entered into an agreement to combine their holding companies in a deal slated to close early in 2025. The banks would continue to operate separately.

June 20 -

Financial services professionals should be in the business of normalizing discussions about personal finance. The result will be a more financially literate population, and that's good for everyone.

June 20 -

AI tools, such as large language models, offer the promise of increased efficiency; but they also carry with them potential legal and regulatory risks. Financial service providers will need to find a way to strike the right balance as technological advancements continue to emerge.

June 19 -

The high court will determine how much deference judges should give to regulators in interpreting laws passed by Congress. The upcoming ruling has especially big implications for the Consumer Financial Protection Bureau, which has drawn the banking industry's ire.

June 18 -

During the nine years Kevin Riley led the Billings, Montana-based institution, it quadrupled its size, largely through deals. New leadership could mean that the company focuses less on M&A and more on integration.

June 18 -

MC Bancshares and Heritage NOLA Bancorp announced plans to combine in 2023, but the companies called off the deal after difficulties securing approvals. It amplified what an analyst called the "ever-present risk" of examiner scrutiny.

June 17 -

IntraFi has joined two banking industry trade groups spearheading an effort to source large institutional deposits at small, cash-starved CDFI and MDI banks.

June 14