Bank of America is set to price today a $1 billion bond issue to fund COVID-19 relief efforts. It's the first sale from a U.S. financial institution that explicitly links all proceeds to tackling the virus, Bloomberg data show.

Congress authorized the Federal Deposit Insurance Corp. to intervene if the pandemic caused a liquidity scare, but nearly two months later deposits are through the roof and the agency has not acted on the expanded authority.

Mastercard Inc. is starting to see signs of improvement in U.S. consumer spending as cities and states ease restrictions on social distancing.

The sharing economy faces its first true crisis, but the payment companies that enable nontraditional payrolls say that the best way to fuel the recovery is to simply be more creative in how people get paid.

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

PSD2 compliance remains a necessary step to protect data and ID even if the coronavirus presents more challenges, says GlobalSign's Arvid Vermote.

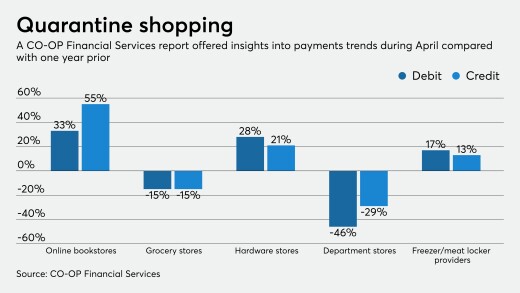

A report from CO-OP Financial Services showed how credit union members' spending patterns adapted to social distancing during April.

A properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.

-

Bank of America is set to price today a $1 billion bond issue to fund COVID-19 relief efforts. It's the first sale from a U.S. financial institution that explicitly links all proceeds to tackling the virus, Bloomberg data show.

May 14 -

Congress authorized the Federal Deposit Insurance Corp. to intervene if the pandemic caused a liquidity scare, but nearly two months later deposits are through the roof and the agency has not acted on the expanded authority.

May 14 -

Mastercard Inc. is starting to see signs of improvement in U.S. consumer spending as cities and states ease restrictions on social distancing.

May 14 -

The sharing economy faces its first true crisis, but the payment companies that enable nontraditional payrolls say that the best way to fuel the recovery is to simply be more creative in how people get paid.

May 14 -

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

May 14 -

PSD2 compliance remains a necessary step to protect data and ID even if the coronavirus presents more challenges, says GlobalSign's Arvid Vermote.

May 14 GlobalSign

GlobalSign -

A report from CO-OP Financial Services showed how credit union members' spending patterns adapted to social distancing during April.

May 14