Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

Payments are slow, fees continue to increase, and merchants are increasingly feeling the pressure from holdbacks being imposed on them by acquirers. In the pandemic crisis, that's unacceptable, argues Nuapay's Nick Raper.

There is nothing in U.S. federal laws or general payment processes that stops businesses from taking a consumer's money and using it for payroll or to finance a marketing campaign.

The industry dodged a bullet after the former vice president outlasted more progressive rivals for the Democratic presidential nomination. But some worry the presumptive nominee will have to consider calls for tougher regulation from his party's liberal wing.

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

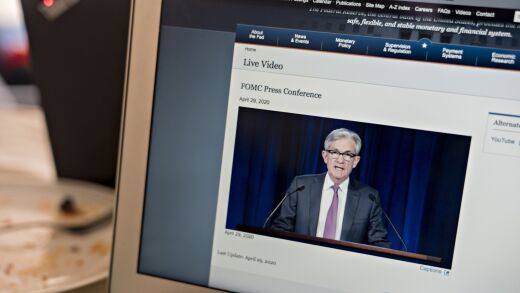

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

-

Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

April 30 -

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

April 30 -

Payments are slow, fees continue to increase, and merchants are increasingly feeling the pressure from holdbacks being imposed on them by acquirers. In the pandemic crisis, that's unacceptable, argues Nuapay's Nick Raper.

April 30 Nuapay

Nuapay -

There is nothing in U.S. federal laws or general payment processes that stops businesses from taking a consumer's money and using it for payroll or to finance a marketing campaign.

April 30 -

The industry dodged a bullet after the former vice president outlasted more progressive rivals for the Democratic presidential nomination. But some worry the presumptive nominee will have to consider calls for tougher regulation from his party's liberal wing.

April 29 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

April 29