The SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

The Financial Stability Board said it stood ready to coordinate additional help on capital requirements, upcoming regulatory deadlines and other standards.

Net income fell 46% in the first quarter as the company added nearly $5 billion to its loss reserves in anticipation of a wave of loan defaults.

With the coronavirus pandemic bringing economic activity to a virtual standstill, BofA, like Wells Fargo and JPMorgan Chase, is shoring up its reserves to brace for a likely recession.

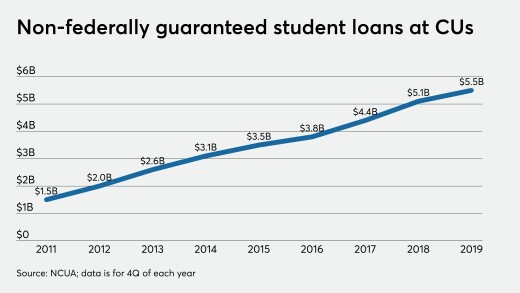

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

The benefits of virtual payment cards go beyond replacing physical cards and eliminating social contacts. Payment vendors that manage these virtual cards can also create branded cards and portals for companies, says Berkeley Payments' Jonathan Hamburg.

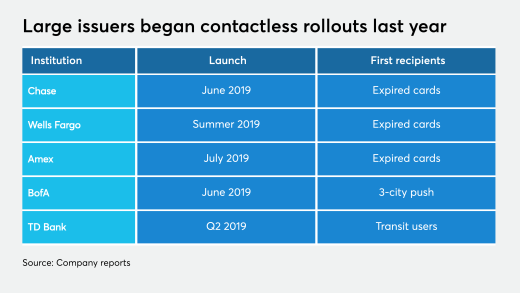

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

-

The SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

April 15 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

The Financial Stability Board said it stood ready to coordinate additional help on capital requirements, upcoming regulatory deadlines and other standards.

April 15 -

Net income fell 46% in the first quarter as the company added nearly $5 billion to its loss reserves in anticipation of a wave of loan defaults.

April 15 -

With the coronavirus pandemic bringing economic activity to a virtual standstill, BofA, like Wells Fargo and JPMorgan Chase, is shoring up its reserves to brace for a likely recession.

April 15 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

The benefits of virtual payment cards go beyond replacing physical cards and eliminating social contacts. Payment vendors that manage these virtual cards can also create branded cards and portals for companies, says Berkeley Payments' Jonathan Hamburg.

April 15 Berkeley Payment Solutions

Berkeley Payment Solutions -

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

April 15